<img alt="Kangping Chen, JinkoSolar's chief executive officer said, " technology="" remains="" central="" to="" strengthening="" our="" competitive="" edge="" in="" the="" market.="" we="" recently="" launched="" a="" new="" tiger="" pro="" series="" module="" with="" maximum="" power="" output="" of="" 580w.="" pandemic="" has="" actually="" accelerated="" adoption="" high-efficiency="" premium="" products="" by="" downstream="" partners="" which="" is="" allowing="" industry="" transition="" into="" 500w="" ultra-high="" efficiency="" era="" earlier="" than="" expected.="" image:="" jinkosolar"="" data-cke-saved-src="https://www.world-energy.org/uploadfile/2020/0616/20200616111317920.jpg" src="https://www.world-energy.org/uploadfile/2020/0616/20200616111317920.jpg">

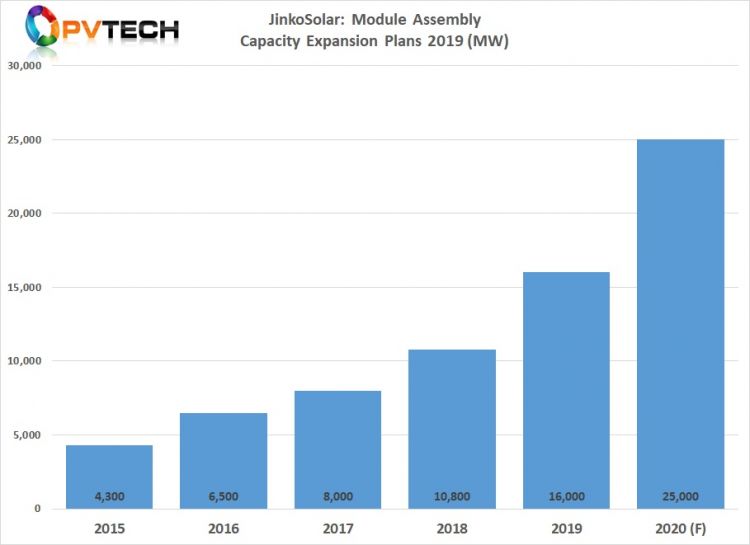

Leading ‘Solar Module Super League’ (SMSL) member JinkoSolar has reiterated solar module shipment guidance for 2020 to be in the 18-20GW range, while stating that its monocrystalline-based module capacity would reach the 25GW milestone by the end of the year.

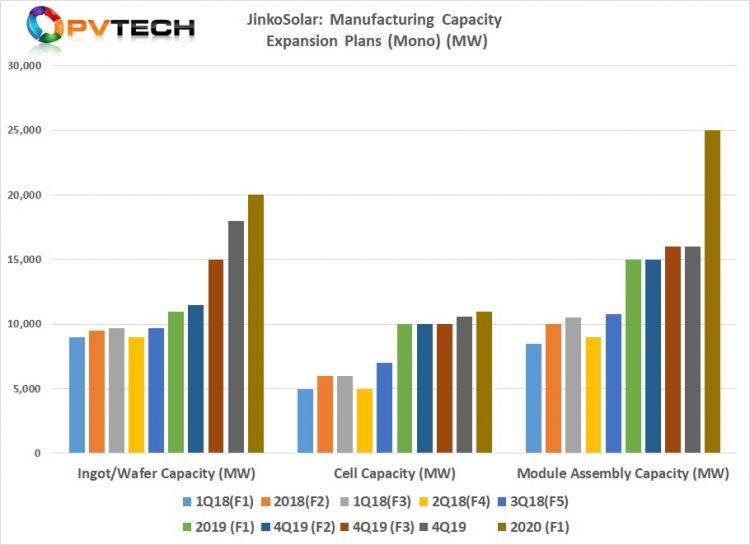

The SMSL member also noted that mono wafer production capacity had been ramped to 18GW in April 2020, compared to 16GW of annual production at the end of 2019.

However, mono-PERC cell-based capacity is only planned to expand by 400MW in 2020 to 11GW, while n-type mono cell capacity will remain unchanged at 800MW in 2020.

JinkoSolar would seem to have increased it focus on an asset-lite solar cell strategy, increasing dependence on key third-party merchant cell producers such as Aiko Solar and Tongwei, which supports a low capital expenditure approach. The manufacturer guided 2020 capex to be around US$350 million, compared to estimates of arond US$500 million in 2019.

Kangping Chen, JinkoSolar's chief executive officer said, "Technology remains central to strengthening our competitive edge in the market. We recently launched a new Tiger Pro series module with a maximum power output of 580W. The pandemic has actually accelerated the adoption of high-efficiency premium products by downstream partners which is allowing the industry to transition into the 500W ultra-high efficiency era earlier than expected. We continue to lead the industry by developing and launching innovative premium products, leveraging our highly-skilled R&D team, industry-leading research platform and expanding capacity to bring mass-produced cutting-edge products to market."

The SMSL member also noted that it expected the COVID-19 pandemic to lead to a significant decrease in global solar demand, causing a decrease in the market price of solar modules.