Meyer Burger Technology has officially set in motion plans to become a dedicated manufacturer of heterojunction (HJT) solar modules in Europe and the US and exclusively use its technology in-house, forgoing its PV equipment supplier and JV business models.

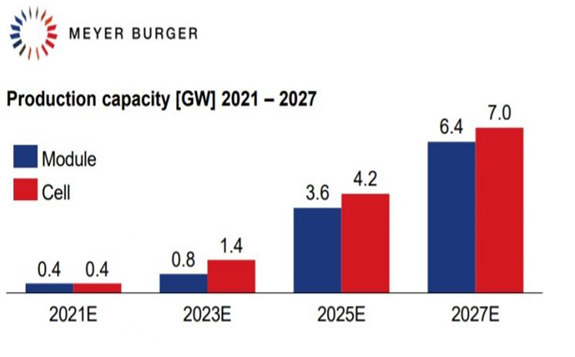

The company said it was planning to raise CHF 165 million to start HJT cell and module assembly in the first half of 2021, with an initial annual production capacity of 400MW. Meyer Burger will be targeting the European and US residential markets with the high-efficiency modules, for which it said it has already secured letters of intent from potential customers operating in these two areas.

The second phase of capacity expansion is planned for the beginning of 2022, via a further capital injection of around CHF 180 million (US$189 million). The company plans to increase HJT cell capacity to 1.4GW and to double module assembly to 800MW.

Further phases of expansion are planned that would take annual cell production capacity to at least 4.2GW by 2025 and potentially 7GW in 2027, though these higher caapcity levels would be dependent on market demand.

Meyer Burger also noted that, at some point in the multi-gigawatt capacity levels, other additional module assembly plants would be established in Europe and North America that would be supplied with HJT solar cells from a single central production facility.

At that as yet undetermined time, Meyer Burger said it expected to gradually increase its market share in the utility-scale segment.

Driving force

Meyer Burger has struggled to return to profitability in recent years and has undergone multiple restructuring phases and asset sales. The highly competitive PV manufacturing equipment market and the major shift of production to Asia has meant lean times for many suppliers outside of Asia.

With restless investors, Meyer Burger noted that the reason for the fundamental change of business direction was the “realization that the Company has not been able to generate profits from its technological leadership in recent years,” further stating that; “by selling its production equipment, however, Meyer Burger relinquished control of its technology and largely left the realization of the added value creation to its customers.”

Franz Richter, Chairman of the Board of Directors of Meyer Burger Technology said, "The change of our business strategy from equipment supplier to a vertically integrated cell and module manufacturer is the right and logical next step to secure an appropriate share of the value pool that our globally leading technology generates.”

With the two initial capacity expansion phases announced, Meyer Burger said it expected to “achieve annual sales of CHF400 – CHF 450 million and an EBITDA margin of 25% - 30% within three years.”

The company had net sales of CHF 262.0 million in 2019 and a net loss of CHF 39.7 million.

Franz Richter, Chairman of the Board of Directors of Meyer Burger Technology said, "The change of our business strategy from equipment supplier to a vertically integrated cell and module manufacturer is the right and logical next step to secure an appropriate share of the value pool that our globally leading technology generates.”

With the two initial capacity expansion phases announced, Meyer Burger said it expected to “achieve annual sales of CHF400 – CHF 450 million and an EBITDA margin of 25% - 30% within three years.”

Fallout

The decision to completely transform its historical business model means that former customers of its HJT equipment, such as REC Group, which has 600MW of operating HJT production in Singapore, will not gain access to further equipment to expand capacity or technological development initiated by Meyer Burger as part of ongoing talks for both companies to share profits in REC Group’s next expansion phase.

Meyer Burger noted that it was “not able to agree a mutually beneficial co-operation with REC Group within the given time, as the conditions of the Memorandum of Understanding (MoU) between the parties were eventually not met by REC Group to date. As a result, the Board of Directors of Meyer Burger has decided to no longer pursue this strategic option.”

PV Tech reported back in March 2020 that Meyer Burger noted the REC Group expansion would be in the gigawatt range and a profit-sharing agreement was on the cards.

Although not mentioned in Meyer Burger’s latest statement, HJT cell and module manufacturer, the Russia-based Hevel Group, had also been a customer of the company, using some of its equipment and technology to switch from amorphous thin film modules and expand production into being a dedicated HJT player in recent years.

There was also no mention by Meyer Burger of its investment in Oxford PV and their ongoing plans to enter volume production of perovskite tandem HJ solar cells in Germany. This additionally applies to Turkey-based renewables firm EkoRE, which had broken ground on the world’s first vertically integrated heterojunction (HJT) module factory in Turkey, with an expected initial nameplate capacity of 1GW, and which was also a major customer of Meyer Burger, having struck a deal on the technology roadmap for HJT.

Competitive landscape

PV Tech recently highlighted major capacity expansion announcements, mainly in China, regarding new HJT manufacturing plants, some expected to be customers of Meyer Burger. Typically, silicon solar cell (500MW) expansion or new plant announcements have given way (in 2018 and 2019) to nameplate capacity plans of 5,000MW and above. Indeed, 10,000MW expansion plans have been noted in PV Tech’s 2019 capacity expansion report.

In respect to new HJT manufacturing plans announced just in the month of July 2019, the total was over 7,500MW, including plans by Jiangsu Akcome Science & Technology Co to build a 5,000MW HJT plant in Changxing, Zhejiang province, China, with Risen Energy also announcing plans for a 2,500MW HJT plant in Ninghai, Hejiang province, China.

In the first quarter of 2020, HJT activity from major mid-term expansions by the likes of GCL-SI, Aiko Solar and Tongwei included HJT production lines in future expansion phases that span multiple years.

Many of these and other announced plans start with small-scale production, similar to the new plans from Meyer Burger. However, production costs remain high and limit market penetration to primarily the residential markets in Europe, US and Japan.

Although not saturated by HJT modules, the many new entrants will target these markets as a matter of course. Indeed, REC Group, with its 600MW of HJT production, is already a key player.

Although Meyer Burger said it had commissioned expert opinion from the Fraunhofer Institute for Solar Energy Systems (Fraunhofer ISE) that had confirmed that the company had a global technological lead in HJT of at least three years over its potential competitors, scale at speed and a robust technology and cost reduction roadmap will be defining milestones for Meyer Burger.