Battery system integrators must navigate a broad array of technologies and varying market drivers when putting systems together. Andy Colthorpe speaks to Powin Energy and Sungrow about the engineering challenges involved in building lithium-ion battery storage.

We spoke to four leading developers of solar-plus-storage and standalone energy storage projects based in North America about what it takes to get projects over the line, their experiences in the field – and what sort of technologies are making their efforts possible.

This time around, we’ve spoken in depth with two of the system integrator/ manufacturers that supply that segment of the energy storage market as well as projects in other key markets including the UK, mainland Europe and Australia.

Danny Lu, vice president at Oregon, USA-headquartered Powin Energy and Dr Zhuang Cai, R&D director at Hefei, China-headquartered Sungrow, share their insights on what it means to build lithium-ion battery storage systems at scale.

A 21st Century industry

Powin Energy is a pure-play battery energy storage system (BESS) manufacturer and system integrator, having pivoted away from its role as a developer in 2017, while Sungrow will be better known to readers as one of the world’s biggest solar inverter makers.

“Sungrow has focused on power electronics for more than 20 years. Our president (Can Renxian) was a university professor and saw a large potential for renewable energy,” Cai says.

Sungrow has to date supplied more than 100GW of PV inverters. Since first announcing a joint venture (JV) with South Korean battery maker Samsung SDI to create and supply energy storage systems in China with an investment of around US$20 million, the storage JV has accelerated its activities rapidly. By 2016, when it went global, investment in the JV stood at a reported US$170 million. According to Sungrow the JV has already installed more than 900 battery systems, at various scales and for varying applications. The company’s background in solar was instrumental in allowing for the move into energy storage, Cai says.

“From a technical perspective, we utilised the same platform: we started with PV inverters, [in energy storage], we focus on power conversion technology (PCS). The PCS equipment evolved by the same platform as the inverters,” Cai says, with solar project work providing a strong level of understanding of how to go from “inverter to converter technology”.

The biggest difference, of course, is that solar inverters only convert in one step, from DC to AC, whereas energy storage is bi-directional, drawing power from the grid as well as injecting electrons into it. While this “very specific characteristic” allows for energy storage to perform various roles in providing flexibility to the electricity network, it presents fresh engineering challenges.

“A PV inverter [works in] a single direction and the PCS is bi-directional. So, because the PCS is bi-directional, energy storage can be an ‘energy buffer’. It’s not a generation unit, it is also not load consumption: it can play different roles in different applications. This is the reason we achieve a lot of applications such as frequency regulation, price arbitrage, peak shaving, and PV-plus-storage scenarios,” Cai says.

“Different applications will also have different control strategies, so we have to design the dispatch strategy into the PV part and also the storage part to combine the two parts together to achieve different functions.”

For Powin Energy too, its connections with the solar industry and resulting partnerships with international big names have helped put the company on the energy storage map. Formerly Powin Corporation, Powin began its R&D into large-scale storage in 2011 and then netted investment from the owners of PV company Suntech, Shun Feng Clean Energy (SFCE) in 2013 and 2014.

“The SFCE was really kind of our Series A funding,” Powin Energy VP Danny Lu says. “They were one of our first strategic shareholders and they provided us with growth capital, working capital, in a time when we were trying to finish up the R&D of our battery management system (BMS). So we really utilised those funds to commercialise our product and to get it to a point where we could deliver on utility-scale projects.”

From there, Powin made an early stage project win, after the infamous 2015 Aliso Canyon gas leak in California led to the expedited awarding of energy storage contracts to help utility Southern California Edison meet capacity needs. Danny Lu says SFCE’s funding meant Powin Energy was able to secure and build its awarded 2MW/9MWh facility in Irvine, California.

Although it wasn’t the largest project among those awards, Lu says the whole timeframe for executing the Irvine project, from starting the development to interconnection, was about six months. To date, Powin Energy has now delivered or installed around 250MWh of BESS and expects to exceed 1GWh of installations and deliveries by 2021, according to projections from earlier this year.

Partnerships and adaptation of technology

The building of partnerships across international lines remains key for Powin’s strategy. While SFCE retains a stake, it has taken a backseat and Lu says Powin also has a deal with GCL, agreed in November 2019, to expand sales reach into the utility-scale markets of Southeast Asia, South Korea and Australia.

There’s also Powin Energy’s tie-in with one of the world’s biggest lithium-ion battery producers, Contemporary Amperex Technology Limited (CATL). Powin and CATL have a 1.85GW master supply agreement over three years. Lu says that has given Powin both locked-in pricing of cells and locked-in availability up to 2022.

Powin has just launched a new range of stacks including long-duration (four-plus hours of storage) products with a 20-year lifetime, based on prismatic large-format lithium-ion cells supplied by CATL. Powin Energy claims it has around 600MWh of contracted orders for the new Stack225, Stack230 and Stack230P products during 2020 and 2021.

Part of that is to do with CATL’s design of 280 amp-hour battery cells specifically for stationary storage systems, while another is the manufacturer’s selection of lithium iron phosphate battery chemistry. Much has been written about the pros and cons of lithium iron phosphate (LFP) versus nickel manganese cobalt (NMC) for use in energy storage systems.

While there is a perception that LFP is ‘safer’ than NMC, having a higher tolerance for thermal runaway, Sungrow-Samsung SDI nonetheless use Samsung SDI battery cells that have passed the stringent UL9540 test certification for the safe installation of stationary energy storage systems – the Korean manufacturer was the first in the industry to pass the test, in fact. Sungrow “has invested a lot already” to ensure system safety, according to the R&D chief.

“For example, we have the DC combiner between the batteries and also the PCS. So, inside the combiner we have the breakers and fuses inside, in case of short circuit [of the] current,” Cai says, adding that “other specific designs were made” for the Sungrow-Samsung SDI systems to also pass the UL9540 tests.

“We have to test the ground impedance from different points in the equipment and also design thermal management. Also, we design our own software: for example, if you have some communication failing, it doesn’t matter, because we can reduce the rated power of the PCS automatically, in order to avoid charging and discharging with very high rates.”

In terms of strategy, Cai says that the company is flexible to working with different battery chemistries and has in the past done projects using lead acid and redox flow batteries too. Both LFP and NMC

are likely to take big shares of the energy storage market going forward, Cai says.

Sungrow recently worked with both Samsung SDI and CATL as cell suppliers on one of its own ‘milestone’ system integration projects: the 100MW/100MWh Minety project in Britain, which is split across two 50MW sites in close proximity to one another. The project got underway in late 2019 and could be expanded by another 50MW. According to Cai, the level of complexity behind such projects is deep. Work on it required engagement with several stakeholders including transmission operator National Grid and distribution operator Eclipse Power Networks, and it’s been invested in by China Huaneng Group, and Chinese government-backed fund CNIC.

Powin Energy’s recently launched product line features CATL’s ‘made-for-stationary-storage’ LFP battery cells. Image: Powin Energy.

Powin Energy’s recently launched product line features CATL’s ‘made-for-stationary-storage’ LFP battery cells. Image: Powin Energy. BMS and EMS

There is a lot more to consider than the choice of battery chemistry when it comes to building large-scale energy storage. Sungrow’s Cai says that in utility-scale energy storage, there are many challenges in getting the dispatch and control of the assets to meet customer expectations. Sungrow sources energy management systems (EMS) from third parties and in order to do so needs to negotiate with grid operators what the specific requirements will be for each application, such as the required response time.

Asset operators, meanwhile, will “have their own dispatch strategies in order to achieve very stable revenue streams”, Cai says, which can present “a lot of challenges”, and for this reason Sungrow prefers to design customised containers according to the customers’ requirements. “We don’t have a very standardised, container solution with 3MWh or 4MWh [for example],” he explains.

Powin Energy as a system manufacturer, meanwhile, has its own battery management system (BMS). Lu says that chief technology officer Virgil Beaston has been very focused on designing a BMS scalable to utility-scale projects that are growing to be hundreds of megawatt-hours or even in the gigawatt-hour range for a single system. Beaston’s BMS design includes “all of the standard safety features, alarms and shut-offs”, Lu says, as well as cell-level controls and cell-level monitoring.

“We utilise a balancing circuit that utilises auxiliary power from the grid to be able to charge energy into a single cell, to balance that battery up. When you are performing a full 100% discharge, if your lowest cell is a slightly lower voltage than all your other cells, when that one cell reaches its bottom threshold, it will stop the whole system from discharging further,” Lu explains.

“What that delta is between your low-charge cell and your other cells will be the amount of capacity that is stranded within your system that you can’t discharge further, without damaging other battery cells within the system. During these discharge events we try to pump grid power into the system. We pinpoint the individual cells through our monitoring system that might have a slightly lower voltage... then we utilise that grid power

to pinpoint those individual cells, pump auxiliary AC power that we transfer to DC into the individual cells to keep them online longer, before they drop the whole system offline.”

Powin Energy’s BMS allows the company to be flexible on which cells go into its systems, Lu says. “Right now we’re pretty settled on LFP but if there’s another chemistry that comes out in the next few years that has better performance, lower costing, longer life than LFP we can easily change the layout in dimensions of our battery module to accommodate a new cell and tweak the range of our BMS to accommodate those cells’ characteristics”.

Geographies and applications

Of course, what you want your system to do and how you size it depend on which market the battery storage is going to be deployed in. Different geographies have different regulatory regimes, different levels of solar penetration on the grid and so these different markets have greatly different asks. As an overall trend, it’s certainly true that as costs come down and solar and wind penetration go up, longer duration systems are being deployed, but

it would be a generalisation to say that this is the case everywhere. Dr Zhuang Cai of Sungrow says that he believes that longer duration “will be popular in the near future”, owing to the dynamics described, but there’s still a significant appetite for shorter duration storage too.

“Batteries are [still] a very expensive thing. If you want to do frequency regulation, you have to calculate the business models to check if you can earn money or not. Because of the higher cost of the batteries, sometimes investors don’t want to invest a lot of money for long periods of payback, so this brings an opportunity for shorter duration batteries. Last year we achieved one project in Germany for frequency regulation with half an hour duration of storage.”

Meanwhile, for Sungrow, in general terms the different applications and therefore types of system asked for by customers can be divided into different regions. There is rising demand for solar-plus-storage from North American customers, ordering a lot of DC-coupled systems at present. In Europe, the market is more focused on AC-coupled, short-duration battery systems. The growing Southeast Asia market in countries such as Thailand and the Philippines on the other hand, is more about microgrid solutions.

Although Powin has made some forays into Europe and started up its partnerships in Australia and in Asia, Lu says around 90% of its business is in North America. As alluded to earlier, this began with the California boom of 2016 and 2017. Lu says that Ontario’s commercial and industrial (C&I) market, where behind-the-meter systems that more closely resemble utility-scale projects in terms of size are frequently deployed for peak shaving, has been important too. Ontario got kick-started by the independent system operator procuring front-of-meter storage for its system reliability needs, but latterly has focused on C&I projects of over 1MW.

“The Ontario market has developed into more of a C&I market – but very large C&I projects for the Global Adjustment Charge (GAC), which is the demand charge that all industrial power users of over 1MW get charged every year... all the industrial energy users get charged a very significant per-megawatt demand charge.

“It’s actually a very low cycle use case but it offers big savings to the customer if you time it right and you hit the right states at the right times. We’ve deployed over 100MW of projects in the GAC market, and we have a significant pipeline of about 70MWh of projects that we’ll be deploying this year to that market.”

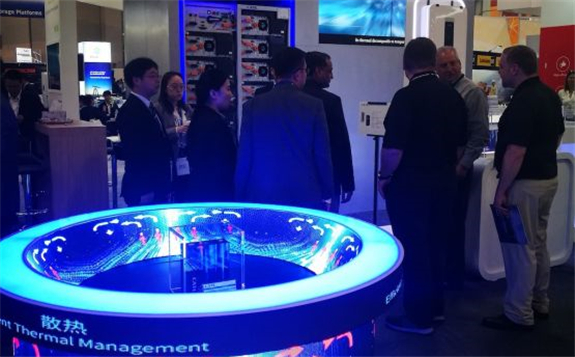

China’s CATL, one of the biggest makers of lithium iron phosphate cells in the world, has worked with both Powin and Sungrow recently. Image: Andy Colthorpe/Solar Media.

China’s CATL, one of the biggest makers of lithium iron phosphate cells in the world, has worked with both Powin and Sungrow recently. Image: Andy Colthorpe/Solar Media.

The customer is always right

Looking ahead, both Sungrow and Powin Energy see opportunities all over the world. For Powin, there have been around 100MWh of recent projects for solar-plus-storage and wind-plus-storage, while the next major US opportunity is in Texas where the company has already deployed over 100MWh of projects.

“There’s a lot of developers targeting the fast response frequency regulation market in Texas,” Lu says, as well as “humungous requests for proposals (RFPs) ranging from one to two-hour systems all over Texas”.

The big shift for Powin, Lu says, is that Texas and other nascent markets present almost purely merchant opportunities. Cai meanwhile says that Sungrow has already seen a lot of business potential for energy storage and believes it can “achieve a huge amount of projects in the 2020s”.

“Recently we are also focusing on North America, Europe and Australia. Maybe the next booming market will be Australia. We have a lot of operations with engineering, procurement and construction (EPC) companies, even from the domestic market from China. We see a lot of potential in energy storage systems and we believe the energy storage business will be booming in the next two years.”