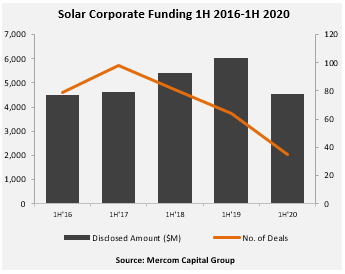

Investments in solar energy projects by corporates reached $4,5 billion during the first half of 2020, according to a new report released by consulting firm Mercom Capital Group.

The 1H and Q2 2020 Solar Funding and M&A Report highlights a 25% drop year-over-year from 2019’s $6 billion invested during the same period.

A total of 23 venture capital investors participated in solar funding during the first six months of 2020.

Global venture capital funding (venture capital, private equity, and corporate venture capital) in the solar sector was 74% lower with $210 million compared to $799 million during the same period last year.

Report findings include:

Solar public market financing reached $758 million in six deals.

Public market financing totaled $737 million in five deals in Q2 2020 up from $22 million in one deal made during the first quarter of 2020.

Fifteen debt financing deals ($3,6 billion) were closed, a 16% decline from the $4.2 billion made in 27 deals in the first quarter of 2019.

There were four solar securitisation deals totaling $1.06 billion in 1H 2020.

$1.2 billion in funding was made in residential and commercial solar energy projects during the first half of 2020 and there were 25 solar corporate merger and acquisitions compared to just 37 during the first half of 2019.

Solar project acquisition activity was up in 1H 2020 with 14.7GW compared to 11.6 GW in 1H 2019.

Up to 3GW of solar projects were acquired in Q2 2020. Oil and gas majors were the major acquirers of solar assets in 1H 2020.

The total solar energy capacity acquired has reached over 140GW since 2010.

Raj Prabhu, CEO of Mercom Capital Group, said: “Financial activity in the first half of the year reflects the realities on the ground. Even though solar stocks have performed well, and corporate funding in Q2 looked slightly better because of several securitisation deals, global economies and solar activity are still far from being back to where they should be. Project acquisition activity, typically a sign of health in the sector, declined significantly in Q2.”