Exports of nuclear energy equipment and technology to meet the needs projected by the Intergovernmental Panel on Climate Change (IPCC) could be worth USD1.3-1.9 trillion to the USA over the period to 2050, a new report by consulting firm UxC has concluded.

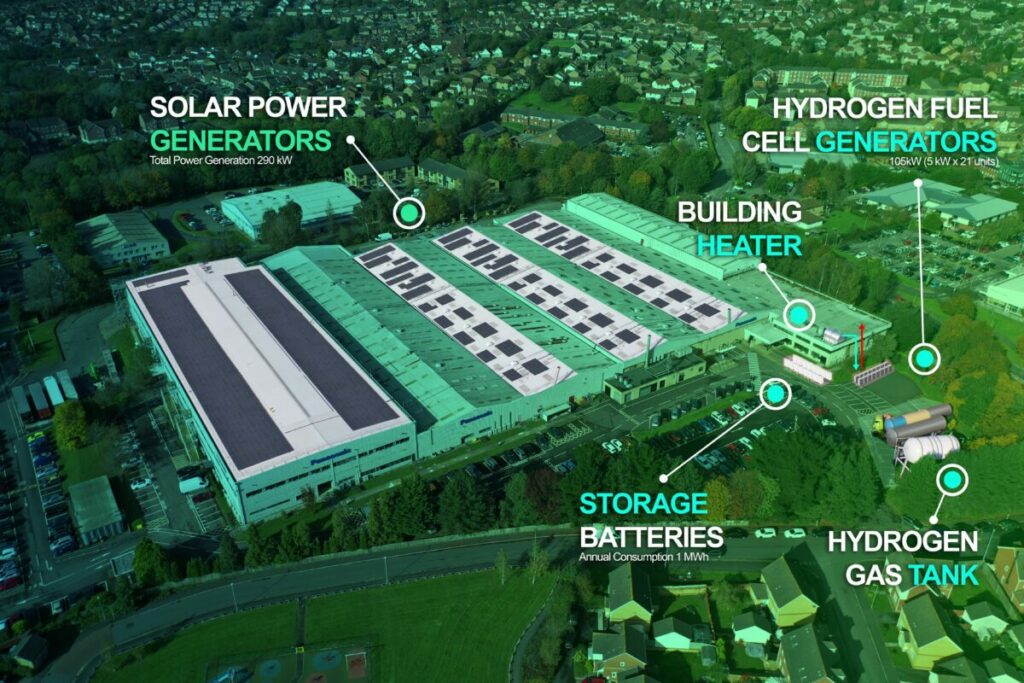

SMRs could be an export opportunity (Image: NuScale)

SMRs could be an export opportunity (Image: NuScale)

Global Nuclear Market Assessment Based on IPCC Global Warming of 1.5°C Report, was commissioned by US trade association the Nuclear Energy Institute (NEI), with a specific focus on global market opportunities that will arise as nuclear power plays an increasing role in contributing to global climate change mitigation strategies.

The 2018 IPCC report considers the impacts of global warming of 1.5 degrees above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development and efforts to eradicate poverty. UxC has analysed global and regional nuclear power outlooks over the period to 2050 based on the scenarios presented in that report, and used the IPCC's pathways to analyse the types of reactor technologies that could be deployed in various regions over the period to 2050 to keep global temperatures at no higher than 1.5°C above pre-industrial levels. It has also extrapolated the resulting potential global nuclear market size and discusses what this means in terms of export opportunities for US nuclear suppliers based on these projections.

The UxC report used the median scenario results as outlined in the IPCC's pathways to give a target nuclear capacity of 820-855GWe - with an average 840 GWe - by 2050. A total of "roughly" 640 GWe of new nuclear capacity must be built between 2020 and 2050 to achieve this target, it says.

Cumulative nuclear expenditures are estimated at USD8.6 trillion (in 2019 dollars) - a figure UxC says is "very reasonable considering that an independent cost estimate from the International Energy Agency (IEA) projects total costs to achieve a future global clean energy system will surpass USD67.7trillion".

In the near term, the outlook is primarily centred on extended operation and new construction of large, traditional reactor types, the report finds, but the longer-term future is likely to see a transition to a mix of emerging new technologies, including small modular reactors (SMRs), microreactors and other advanced designs. Nuclear will expand more rapidly in Asia, Eastern Europe, Africa, the Middle East and South America than in the USA or Western Europe. US suppliers will have numerous opportunities to expand their market presence including in construction projects for large reactors, SMRs and other reactors, maintaining and fuelling the global reactor fleet and decommissioning of ageing reactors, the UxC report found.

The USA has recently lifted its legacy prohibition on funding nuclear projects overseas. Ted Jones, NEI's senior director, National Security & International Programs, said the ability of US nuclear suppliers to compete in global markets is important both for the domestic economy, but also for US influence globally. "Supplying a reactor provides a long-term commercial relationship between countries, which leads to closer political ties as well," he said.

Today's market is dominated by Russia and China, Jones added. "To enable US companies to succeed, the US gvernment must enhance its export financing and ensure that new markets are open to US supply. And with the global need to decarbonise electricity and other sectors, it is clear that the US has tremendous export opportunities that could help meet growing global demand for carbon-free energy, while reasserting our leadership in nuclear technology," he said.

The UxC report is based on nuclear power capacity of 840 GWe by 2050 from the median of the 90 scenarios in the IPCC 1.5 report.

"The IPCC 1.5 report scenarios estimated a wide range of nuclear capacity to limit global warming to 1.5 degrees," King Lee, director of World Nuclear Association's Harmony Programme, said. "It is important to note that the 'middle-of-the-road' illustrative scenario - in which social, economic, and technological trends follow current patterns - sees the need for nuclear to increase by 6 times globally by 2050. The Association's Harmony programme has set a goal of nuclear generating 25% of electricity - that is, 1250 GWe of installed nuclear capacity - before 2050. To reach this goal will require 1000 GWe of new nuclear capacity to be installed worldwide by 2050."