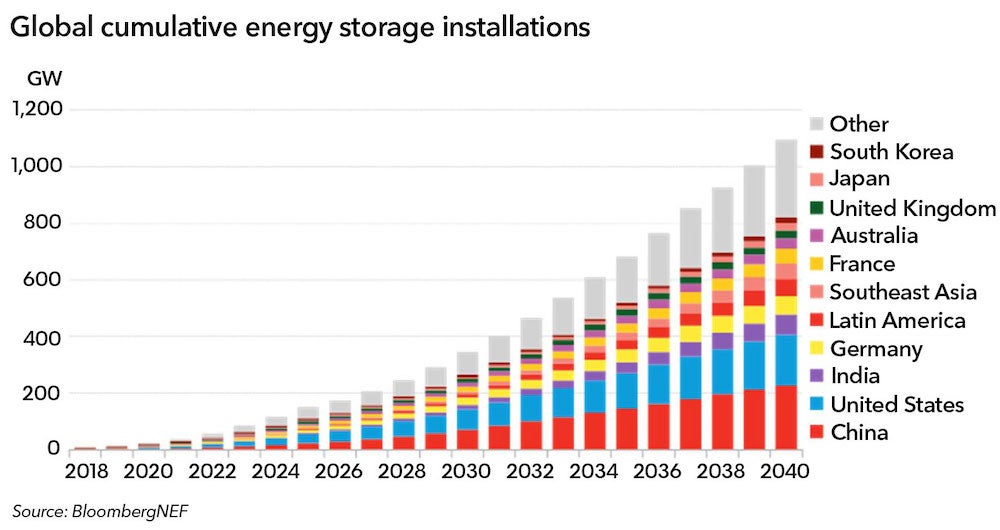

By way of comparison, just last November BNEF was anticipating 942 gigawatts by 2040, though the underlying result is the same: “Cheap batteries mean that wind and solar will increasingly be able to run when the wind isn’t blowing and the sun isn’t shining.”

Whatever Happened To The Lithium Shortage?

There’s plenty more energy storage news outside of the new BNEF report. It focuses onlithium-ion battery technology and it doesn’t even count pumped hydro, which is by far the major form of utility scale energy storage currently available in the US and other markets.

Alternative battery materials and alternative systems like thermal energy storage and renewable hydrogen are also coming on strong, but for now let’s focus on that thing about lithium.

There was supposed to be a shortage of lithium, but the world’s top lithium producer, Australia, has been on a mine-opening tear. The second place producer, Chile, is also planning to ramp up output.

Lithium recovery from brine and recycled batteries will also be contributing to the pot.

All of this activity has already contributed to a drop in the global price of lithium in recent months, and the bottom is a long way down. BNEF foresees that the surge in energy storage installations will be fueled by a 50% drop in the cost per kilowatt-hour of Li-ion batteries by 2030, partly due to the advent of low cost lithium.

Who’s Gonna Pay For All This Energy Storage?

There being no such thing as a free lunch, BNEF notes that it will cost many benjamins for the Li-ion energy storage market to reach its 122-fold potential by 2040.

BNEF puts the figure at a US$622 billion investment over the next 20 years. That’s chump change! Just look at the US Congressional Budget Office estimate for national defense in the fiscal year 2020. It is looking at a total of US$727,569 million for just one year if you throw in the Energy Department’s nuclear programs and the Maritime Administration.

For that matter, the US Department of Defense is already one of clean tech’s best customers. The Pentagon is keenly aware that climate change is a national security threat of the first degree, and that distributed energy resources — namely, microgrids featuring renewable energy plus storage — are the key to insulating US military facilities from wider grid disruptions.

Lithium-Ion Is Not The Only Fish In The Energy Storage Sea

An increase in lithium production is just one factor driving down the cost of lithium. Another key factor involves improvements in lithium-ion battery technology, leading to greater range and longer lifespan.

Alternative materials can also help relieve upward pressure on lithium prices. Researchers are in hot pursuit of zinc batteries and “glass” batteries, among many other options.

Pumped hydro energy storage could also help tamp down lithium prices while making room for more wind and solar in the grid. Major new pumped hydro facilities could face environmental challenges, but there are still opportunities to ramp up pumped hydro capacity by upgrading existing facilities.

Yet another thing to keep an eye on is thermal energy storage, and we’re not just talking about concentrating solar power systems. The US Department of Energy is eyeballing long-duration energy storage systems of 10 hours or more deployingalternative technologies.

Speaking of DOE, there’s that whole thing about renewable hydrogen but that’s a whole ‘nother can of worms. CleanTechnica is reaching out to BNEF for its insights on renewable hydrogen energy storage, so stay tuned for more on that.