India’s power sector regulator Central Electricity Regulatory Commission (CERC) has proposed new rules aimed at a complete overhaul of the power trading market in the country including changed net-worth criteria and trading margin that can be charged by companies.

The existing regulations defining the criteria for grant of trading license were notified in February 2009 while the trading margin norms were notified in 2010. The commission said in the draft regulations that since then, many developments have taken place in the power sector.

“New energy procurement and sale contracts like the day-ahead contracts through Power Exchanges and short-term contracts now form significant portion of the trading volumes. Cross border trade of electricity is expected to increase in the coming years,” the regulator said.

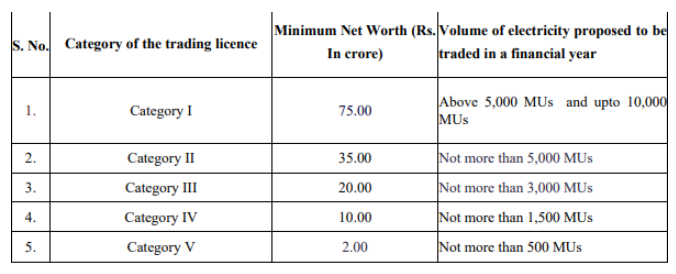

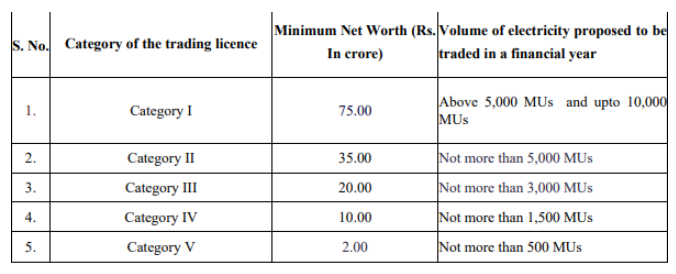

CERC has proposed raising the minimum net-worth requirement for category-I trading licensees, which account for 81 per cent of the total trade, from the existing Rs 50 crore to Rs 75 crore for a volume of trade between 5,000 million units (MUs) and 10,000 MUs. For trade exceeding 10,000 MUs in a year, additional Rs 20 crore net-worth would be required for every 3,000 MUs.

According to the commission, the net worth criteria of Rs 50 crore appeared sufficient in 2009 to cover the risks assumed by category-I trading licensees but as the Indian power sector has evolved in terms of size and nature of contracts it is necessary to review the capital adequacy requirements of the trading licensees.

TRADING MARGIN

The commission has also proposed revising the trading margin regulations by doing away with the existing two slab system based on sale price. “For short-term contracts and contracts through power exchanges, the trading licensee shall charge a minimum trading margin of zero (0.0) paise per kilowatt hour (kWh) and a maximum trading margin of seven (7.0) paise per kWh,” CERC said in its draft regulations.

Under the existing regulations, trading companies are allowed to charge a margin of less than 7 paise per unit for sale price above Rs 3 per unit, and a margin of less than 4 paise per unit where the sale price is less than Rs 3 per unit. The price of short-term transactions of electricity were found to be above Rs 3 per unit in most of the past 10 financial years.

India generates 1,300 billion units of electricity annually. Around a 10th of this is traded in the short-term market, through bilateral deals between discoms, trading entities and the two power exchanges – Indian Energy Exchange and Power Exchange India -- and deviation settlement mechanism (DSM). Excluding direct bilateral deals between discoms and DSM, the size of the short-term market was about Rs 30,427 crore in 2017-18, the latest year for which data is available.

Of the total short-term transactions, bilateral constitutes 46 per cent – 32 per cent through traders and term-ahead contracts on power exchanges and 13 per cent directly between distribution companies – followed by 31 per cent through day-ahead transactions on power exchanges and 22.5 per cent through DSM.

In January this year, top five trading licensees had a share of 73.01 per cent in the total volume traded by all the trading licensees. Among the top licensees, PTC India traded 26.71 per cent, Arunachal Pradesh Power Corp traded 17.13 per cent, Manikaran Power and Mittal processors traded 10 per cent each, followed by GMR Energy which traded 8.01 per cent and NTPC Vidyut Vyapar Nigam’s 7.50 per cent.

Among the other large traders were Tata Power Trading Company, Adani Enterprises, Jaiprakash Associates, JSW Power Trading Company, Knowledge Infrastructure Systems, RPG Power Trading Company, Essar Electric Power Development, Instinct Infra & Power and National Energy Trading & Services.

During its initial discussion with the stakeholders, CERC noticed multiple issues including non-compliance of capital adequacy requirements, challenges of payment security mechanisms and non-submission of regular monthly data by trading licensees. The draft regulations, therefore, deal with capital adequacy and liquidity requirements for the applicants, requirements for submission of information and penalties for non-compliance by the licensees, too.

According to the draft, trading licensees must ensure payment of dues to the sellers through an escrow arrangement and a revolving letter of credit (LoC). For long-term contracts, where an escrow arrangement or LoC is not provided, the licensee will not be allowed to charge any margin exceeding 1.0 paise per Kwh. The draft regulations also disallow trading licensees to engage in banking of electricity as no re-sale is involved.