BC-Saudi-Arabia-Is-Steering-Ever-More-Oil-to-China-Draining-the-US , Brian Wingfield

BC-Saudi-Arabia-Is-Steering-Ever-More-Oil-to-China-Draining-the-US , Brian Wingfield

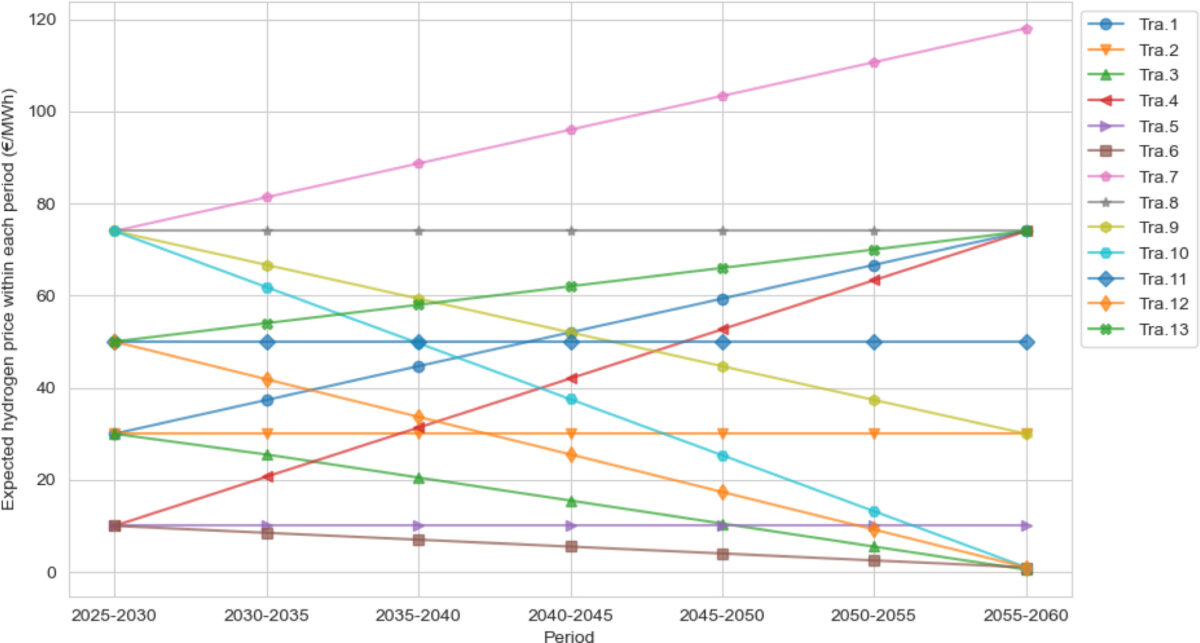

Signals from oil tankers last month suggest that Saudi Arabia is sending an ever-larger portion of its crude to China -- with the U.S. losing out.

Saudi Arabia’s observed exports to China soared to 1.74 million barrels a day in July, the highest since Bloomberg began tracking the tanker shipments in January 2017. At the same time, the kingdom’s shipments to the U.S. appear to have tumbled to 161,000 barrels a day, the lowest during that same period.

The divergence illustrates the current state of energy geopolitics. The Organization of Petroleum Exporting Countries -- of which Saudi Arabia is the largest producer -- and a group of allies last month agreed to extend production cuts. A big reason behind the curbs is soaring U.S. output, which is near record levels in weekly data. U.S. inventories have dropped in recent months as Saudi shipments to the country have declined.

At the same time, Saudi Arabia has grabbed a greater slice of China’s market as U.S. sanctions cripple exports from Iran, the kingdom’s regional rival. Saudi crude flows to markets east of the Suez Canal were about 5.1 million barrels a day last month, tracking data show, and the number is likely to rise as some ships indicate their final destinations. Saudi flows west of Suez appear to have dropped to about 1.1 million barrels a day in July.

“East is where their focus is,” said Amrita Sen, chief oil analyst at Energy Aspects Ltd. in London, noting that China has refineries with about 800,000 barrels of daily capacity starting up. “The West has been cut quite significantly.”

Overall, Saudi shipments haven’t changed dramatically in recent months -- the 6.7 million barrels a day in observed cargoes the kingdom exported in July is only about 200,000 daily barrels less than in June.

China’s Appetite

China imported a record amount of crude from Saudi Arabia in June, according to data from its General Administration of Customs. The country has a growing appetite for the feedstock, with the Hengli Petrochemical and Zhejiang Petrochemical megaprojects scheduled for this year. The Hengli plant in Dalian reached full capacity in May.

With China grabbing more Saudi crude, flows to India, Japan and South Korea also appear to have declined last month. Just three crude-laden ships sailed from Saudi Arabia for the U.S. in July -- one each for the East, West and Gulf Coasts -- though more could emerge in the coming days as tankers indicate their final destinations. U.S.-bound flows are down from 1.03 million barrels daily in July 2018.

Of the vessels that loaded crude in Saudi Arabia in July, ships holding some 13 million barrels haven’t yet revealed where they’re headed. Almost half of that amount is likely sailing east, tracking signals show.

BC-Saudi-Arabia-Is-Steering-Ever-More-Oil-to-China-Draining-the-US , Brian Wingfield

BC-Saudi-Arabia-Is-Steering-Ever-More-Oil-to-China-Draining-the-US , Brian Wingfield