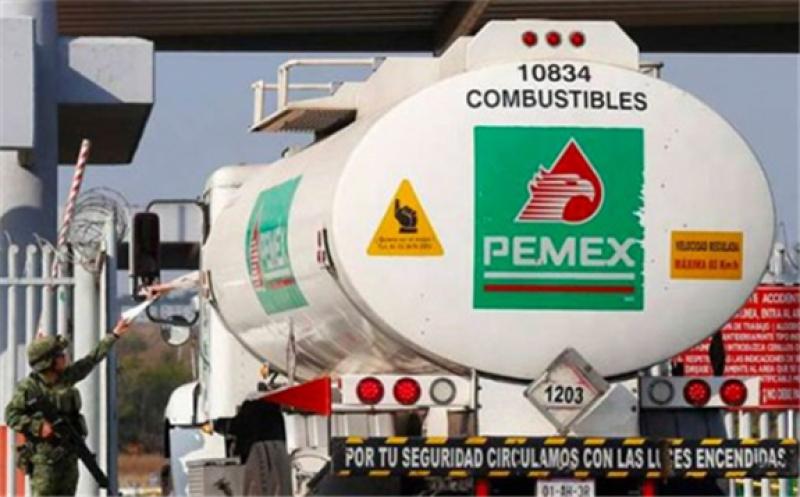

Mexico’s state oil firm Pemex is not planning a shift toward curbing carbon emissions or green energy, as Mexican President Andrés Manuel López Obrador continues to bet on oil exploration and a new domestic refinery to make the country energy independent and reverse the years-long decline in oil output.

López Obrador, a leftist populist, came to power with the promise to increase state support for Pemex and make the state-run major the pillar of a turnaround for the country’s declining oil production.

Petróleos Mexicanos, as Pemex is officially known, will continue to focus on oil exploration and production as well as a future $8-billion refinery, Dos Bocas, which is planned for López Obrador’s home state of Tabasco.

However, Pemex—a heavily indebted company—relies on issuing bonds to finance and refinance its maturities, and the financial situation at the Mexican state oil firm has further deteriorated since oil prices crashed earlier this year.

Many institutional investors hold a large part of Pemex’s bonds, and those investors are already demanding that the oil firm take action to curb emissions and help the fight against climate change.

If Pemex continues to ignore investor demands to start acting on emission reductions, it could find itself in a position that it would be more difficult to issue debt, investors say, many of them feeling that the oil firm doesn’t take their demands seriously.

“It will become increasingly challenging for international institutional investors to invest in their bond issuances if they don’t address their sustainability concerns - whether climate, oil spills due to oil theft and health and safety,” Marie-Sybille Connan, an analyst with asset manager Allianz Global Investors, told Reuters.

Pemex itself touts the unparalleled government support it has, which implicitly guarantees the company’s debt issues. But if lenders join the investors in the calls for climate action and withhold financing for the oil firm, Pemex could be forced to consider a climate action plan.