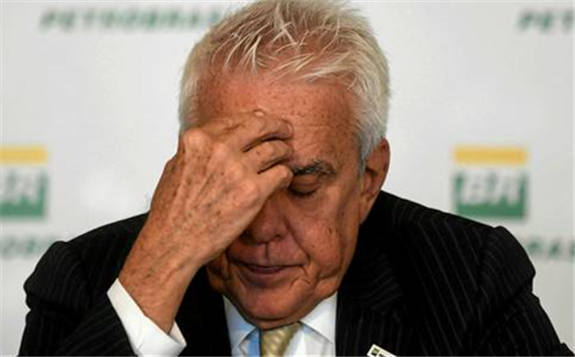

Brazil's state-controlled oil company Petrobras will scrap plans to invest in renewable energy projects, but says it will continue research and development projects in the field, according to chief executive Roberto Castello Branco.

“About renewables, we are investing in research and we will just not invest in operational assets because it is something that requires competencies different from the oil & gas business," he said at a press conference about the company's second-quarter results.

“If we decide to enter the game [of the renewable energy sector] we want to enter to win, we will not rush in without thinking just because other oil majors are doing so. We don’t want to lose money,” he told a press conference publicising the company's second-quarter results.

Last December, shortly before Castello Branco was appointed by far-right president Jair Bolsonaro, Petrobras unveiled a long-term strategic plan for 2019-23 that included $417m of renewables investment. That same month, the company signed a memorandum of understanding (MoU) with French oil giant Total to jointly develop 500MW of onshore wind and PV in Brazil over five years. Petrobras had also signed an MoU with Norwegian oil company Equinor last September to jointly develop offshore wind projects in Brazilian waters.

When asked if these MoUs would continue, Castello Branco brushed them off as “mostly research and development”.

He also cast doubts about renewable-energy investments by other oil majors.

“There is a lot of marketing and only a few real actions," he said. "There are people announcing that they are committed to ‘better energies’ and what have you, but if you look at the European companies, the ones that are leading announcements in renewables, the projections for the participation of renewables in their revenues in 2030 is of 1%, 1.5% tops."

Castello Branco, a University of Chicago-trained economist, former central bank director and boss of Rio de Janeiro-based free-market think-tank IBMEC, was appointed to run Petrobras in January. His main mission is to divest from activities not related to upstream oil & gas operations — ie, exploration and production. The sale of domestic and international assets such as gas transport and stakes in productive oil fields has so far raised R$34.5bn ($9bn) and was one of the main reasons for the company’s record net profit of R$18bn in the second quarter.

Castello Branco's decision not to invest in renewables adds to recent declarations and actions by Bolsonaro government against investments that would help control global warming — and follows the firing of the head of the country's space research institute (INPE) after Bolsonaro himself said that INPE's report of a recent surge in Amazon forest deforestation was a lie.

After seven months as CEO, Castello Branco has revised the company’s 2019 capex down from R$16bn to R$11bn. Of the $4.9bn invested so far this year, 83% has been in upstream activities and only 3% in “other activities”, which includes power and renewables.

But the company’s US$84bn long-term strategic plan for the 2019-23 period has yet to be revised.

Petrobras has interests in power generation, with 9.6GW of mostly fossil fuel and natural gas capacity, but it also has 104MW of operating wind power capacity, a 1MW experimental PV plant, and interests in biofuels.

Meanwhile, BP, Equinor and Total continue to invest in solar and onshore wind assets in Brazil.

Petrobras' total divestment plan is estimated at US$15bn, of which US$13bn is expected to be concluded this year.