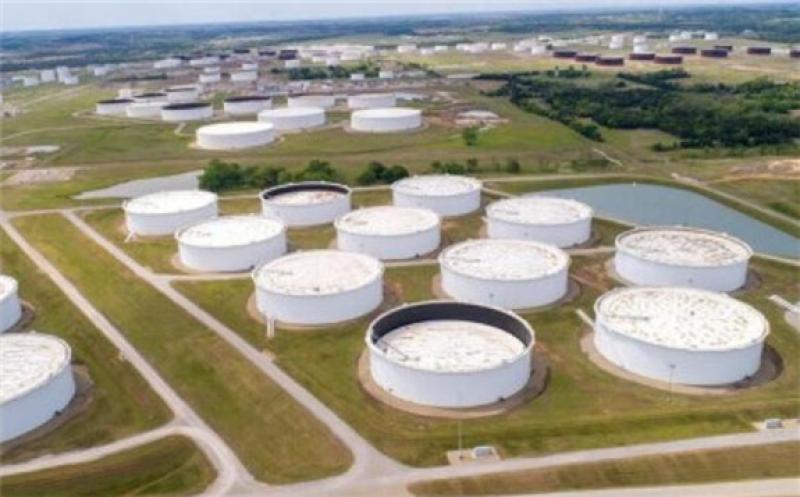

The OPEC+ production cuts and curtailments in the United States are set to help global inventories to continue drawing down for the rest of the year and most of next year, resulting in a relatively balanced market by the end of 2021, the U.S. Energy Information Administration (EIA) said on Wednesday.

The OPEC+ deal and the production drops elsewhere, most of all in North America, have brought global supply below the level of demand for the first time since the middle of 2019, the EIA estimated, noting that the supply deficit has helped bloated global inventories to decline since June.

“EIA expects inventories to continue declining in the second half of 2020 and during most of 2021, resulting in a relatively balanced market by the end of next year,” it said in its Short-Term Energy Outlook (STEO) for September.

In August, global liquid fuels production averaged 91.5 million bpd, down by 9.7 million bpd year over year, due to the OPEC+ cuts and U.S. curtailments.

U.S. crude oil production in August rose to 10.8 million bpd from a recent low of 10.0 million bpd in May as oil operators brought some wells back online in response to rising prices after the slump in Q2, as per EIA’s estimates.

While some experts, officials, and analysts say that global inventories are declining and will continue to draw down through the rest of the year, others have flagged faltering demand recovery and resurging COVID-19 cases as reasons for being careful about the outlook on inventory drawdowns in the coming months.

Vitol Group, the world’s largest independent oil trader, for example, expects global oil inventories to continue drawing down for the rest of the year.

But another major commodity trader, Trafigura, expects a "supply-heavy" market through the end of the year, with inventories building by the end of 2020 as the demand recovery stalls.