A recent study published by the Australian Renewable Energy Agency estimated Australian hydrogen exports could add $1.7 billion (USD$1.2 billion) per year to the economy by 2030, with China, Singapore, Japan and the Republic of Korea identified as major prospective markets for Australian hydrogen by 2025. Japan especially, is already being regarded as a potential major customer with the country aiming to derive 40% of all its energy from hydrogen by 2050. The hope is that Australia can utilise the existing natural gas infrastructure and conventional transport methods to accelerate the hydrogen export industry. Considering Australia's success at exporting natural gas and its status as a global energy exporter, the country is well-positioned for such a move.

For those who plan to take advantage of that position, it's important to understand how any hydrogen production facility will be subject to various environmental regulations at both a Federal and State level. In this article we review the existing regulatory framework and key considerations for hydrogen energy production projects, and what major projects are currently underway or in the pipeline.

Hydrogen as part of the energy mix

Hydrogen is a carrier of energy; it is not a fuel source in itself. Typically produced through the process of electrolysis where water molecules are split into hydrogen and oxygen, hydrogen can be condensed into a liquid fuel source which can generate conventional electricity or power vehicles in a similar way to diesel. At the point of consumption, the only by-products are water and electricity making it an attractive fuel alternative. "Green" or renewable hydrogen is produced using the same methods but the production process is powered by renewable energy such as solar, wind or biomass. Once produced, hydrogen can be blended into existing gas and power networks or exported much like natural gas. The global market for hydrogen is growing due to the increased demand for efficient, large-scale renewable energy and the market is forecast to become a trillion dollar economy by 2050. A major driver of this market growth is expected to be hydrogen-powered fuel cell electric vehicles in densely populated countries such as Japan, China, the Republic of Korea and areas of Europe. Spurred on by these significant export opportunities and the vast domestic potential, the Australian hydrogen industry continues to gain momentum with numerous companies backed by state and foreign governments developing pilot projects to investigate commercial applications.

In August 2018, the CSIRO released the National Hydrogen Roadmap providing a blueprint for the development of a hydrogen industry in Australia. The report found strategic investments along the value chain from both the private and public sector will help scale Australia's hydrogen industry and recommended utilising Australia's abundant natural resources (specifically solar, wind, fossil fuels and available land) to establish a hydrogen export supply chain. Additionally, Australia's Chief Scientist, Dr Alan Finkel AO, is leading the COAG Energy Council Hydrogen Working Group tasked with developing a National Hydrogen Strategy. In July 2019, the Hydrogen Working Group released nine issues papers that delve into specific topics to help develop the strategy such as producing hydrogen at scale, attracting investment, hydrogen for transport and industrial use and developing an hydrogen export industry.

How does hydrogen trigger regulatory considerations?

Generally, environmental protection legislation will regulate an activity that causes, or is likely to cause, environmental harm. Hydrogen energy can either be generated through thermochemical technologies (including steam methane reforming and coal gasification) or electrochemical technologies (such as polymer electrolyte membrane or alkaline electrolysis). Production of hydrogen energy from these technologies carries numerous possible environmental and safety risks associated with:

the manner in which fuel sources and materials are used and stored;

the location and operation of plant and equipment as well as connection and interaction with power sources;

the waste generated from production activities (eg. carbon dioxide produced as a by-product from thermochemical technologies);

the storage of hydrogen, either via compression, liquefaction or chemical carriers; and the transport of hydrogen by truck, rail, ship or pipeline.

Due consideration must be given to these risks to ensure environmental and safety hazards are avoided or minimised. For example, some hydrogen production technologies involve chemical reactions occurring in controlled environments at high temperatures and pressures which can increase explosion risk and may lead to major hazard facility classifications. Similarly, the storage of hydrogen in underground salt caverns, line packing in gas pipelines and the use of ammonia also create potentially significant environmental and safety risks that may require regulation.

Current regulatory framework for hydrogen

Currently, no targeted regulation for hydrogen production facilities exists in Australia. There is an existing framework of technical regulations (eg. for transport of gaseous materials) that provide broad coverage regarding the use of hydrogen and related technologies. Any hydrogen production facility will be governed by existing energy, water, gas and environmental regulations. However, given the increasing attention given to hydrogen by political parties and the renewable energy industry, regulatory reform is likely to occur in the near future. Considering this, and depending on the intended end-use application of the hydrogen produced by a facility, it is important to understand the current regulatory frameworks applying to: the export of hydrogen and related substances here in Australia and the destination country; and, participation in the domestic gas market. While they are yet to be any introduced in Australia, hydrogen-specific standards are being developed internationally through organisations such as the International Organisation for Standardisation and the International Electro-technical Commission. These standards remain voluntary unless codified as Australian law. However, it is important to consider these technical standards when developing a hydrogen project as equivalent specifications between Australia and potential export markets can simplify processes and help to reduce costs.

Environmental laws

Early in the development process, proponents should consider:

if the facility will engage any activity that may have a "significant impact" on a "matter of environmental significance" and whether the project requires approval under the Environment Protection and Biodiversity Conservation Act 1999 (Cth);

whether any licences are required under Federal and State legislation, eg. an environment protection licence; and

if reporting to the National Pollutant Inventory is required and any relevant reporting obligations which may apply.

Storage and transport regulations

On-site storage of hydrogen post-production and subsequent transport off-site is governed by multiple laws, regulations and codes at both the federal and state levels. Substances other than hydrogen may be present during the production process and these may also be subject to such regulatory requirements. Key considerations regarding compliance, licensing and reporting obligations include:

the presence of any "dangerous goods or substances" at a facility as prescribed under the Australian Dangerous Goods Code;

which licences are required (if any) to store or transport any relevant dangerous goods or substances; and

any technical standards which may apply to storage and transportation depending on the type and volume of any dangerous goods or substances, eg. permissible types and specifications for storage conditions or tanks.

Water for hydrogen electrolysis

The production of "green" hydrogen requires water for the electrolysis process. A key challenge of production is sourcing and securing a sufficient volume of quality water. Relevant considerations include:

any licensing or approval requirements for connecting to the relevant water network in the state or territory where the facility is located; and

if using seawater, the relevant state licensing requirements regarding the operation of a desalination facility (including limitations on water temperature increases at the point of discharge, and brine management and disposal).

Project approval requirements

As the current hydrogen projects are pilot projects, the approvals requirements have been regulated on a case-by-case basis by the relevant authorities under feasibility study, demonstration or pilot project regimes, enabling smaller-scale proof-of-concept testing without the need for lengthy formal assessment and approval processes. If the technology is proven, it is most likely that regulations will be amended to introduce a new category of energy specific projects and approval guidelines will be developed (as has happened for wind and solar projects).

Regardless of the regulatory approval pathway, given the likely significant environmental and safety risks it is likely that these projects will be subject to comprehensive environmental assessments and public consultation regimes.

Moving forward with your hydrogen project in Australia

Overall, hydrogen energy is a rapidly growing industry which the regulatory environment is pushing to catch up with. Although there are numerous pilot programs operating in Australia there is currently is no regulatory framework or established approval pathway. The proposed Asian Renewable Energy Hub may provide an indication on how regulatory authorities will assess large-scale renewable energy projects in future. However, the intended end-use application of the hydrogen produced will likely have the most impact on potential regulation and approval. Proponents should therefore give due consideration to existing international standards on hydrogen as a guideline to potential Australian regulations and consult with the relevant consent authority (eg. the Department) when drafting a proposal.

Current and proposed major projects for hydrogen production

New South Wales

Jemena Gas Networks (NSW) Ltd is implementing a renewable hydrogen pilot project on its gas network to demonstrate large-scale hydrogen storage and distribution by existing gas pipeline infrastructure. The project will convert solar and wind power into hydrogen gas via electrolysis (500kW electrolyser). If the trial to power 250 homes and a hydrogen vehicle re-fuelling station is successful, we understand that the company will look to expand it across its NSW network.

Australian Capital Territory

Evoenergy and Canberra Institute of Technology (CIT) opened a test station in December 2018 at CIT's facility in Fyshwick on Canberra's outskirts. It is designed to test the use of pure hydrogen in existing gas infrastructure with the results informing the future implementation of hydrogen in the ACT and Australia. Aims to also train students in new hydrogen technologies and work practices. The station will be launched progressively in three phases over 12 months.

Victoria

Hydrogen Energy Supply Chain (backed by Kawasaki Heavy Industries, J-Power, Iwatani Corporation, Marubeni with support of the Japanese government) is a world-first trial project in the Latrobe Valley to use brown coal to make hydrogen. The trial plant, located within AGL's Loy Yang complex to allow access to brown coal, will use 160 tonnes of brown coal to generate three tonnes of hydrogen. The trial has been approved by the Victorian EPA and the demonstration plant will be operational for 12 months, beginning mid-2020 with construction to start in 2019. The trial will test the science behind the concept and measure it against the emissions from the process. The results will also be used to determine the commercial viability of the project and to potentially expand operations to a commercial scale, subject to regulatory approvals.

South Australia

Hydrogen Utility (H2U) has announced a 30MW water electrolysis plant located near Port Lincoln, to produce renewable ammonia and approximately 300 tonnes of hydrogen per year. The project is intended to provide balancing services to the national electricity system and fast frequency response support to new solar plants on the Eyre Peninsula.

Neoen is proposing a 50MW Hydrogen Super Hub solar and wind hydrogen plant in the 305MW Crystal Brook Energy Park, near Port Pirie, which will produce approx. 7,000 tonnes of hydrogen per year.

Australian Gas Infrastructure Group (AGIG) is investing in a renewable hydrogen demonstration at the Tonsley Innovation District. Using renewably-sourced electricity via a 1.25MW electrolyser, the plant will produce hydrogen which will be injected into the local gas distribution network. AGIG is also investing in the establishment of a National Hydrogen Centre of Excellence in the district.

Western Australia

NW Interconnected Power Pty Ltd is proposing to develop the "Asian Renewable Energy Hub" in the Pilbara. The proposal aims to construct and operate a large-scale wind and solar renewable energy project. Production is expected to reach approximately 55TWh per year with the electricity produced either exported to Indonesia and Singapore via undersea high voltage direct current transmission lines or converted into exportable hydrogen related products. The project would incorporate up to 1,743 turbines and 2,000MW of solar PV within an overall development envelope of 662,400 hectares. Up to 3,000MW has be earmarked for large energy users in the Pilbara region.

ATCO has announced a project for a commercial scale micro-grid construction at its operation centre in Jandakot to convert solar power into hydrogen fuel for backup power to the site and to blend with the reticulated natural gas network.

Yara Australia has designed a pilot project to produce renewable ammonia for export based on hydrogen from solar electrolysis, using the company's existing ammonia production and export infrastructure in the Pilbara.

Queensland

Northern Oil Refinery (joint venture between Southern Oil Refining and J.J. Richard & Sons) is developing a pilot biofuels refinery in Gladstone which includes the first hydrogen fuel cell in Queensland. The project aims to create hydrogen from waste biomass (e.g. old tyres, weeds) for use in the refinery processes and to generate electricity in a fuel cell to power the refinery.

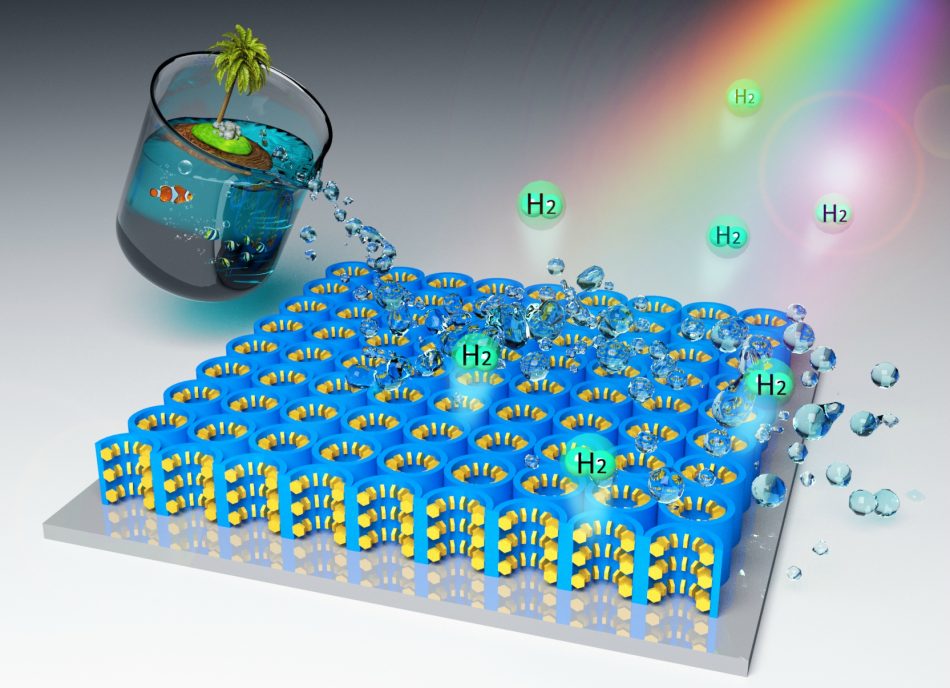

Queensland University of Technology and JXTG (a Japanese company) conducted a proof of concept test in March 2019 to produce and export "green" hydrogen derived from treated non-drinking water from Australia to Japan. Produced using renewable energy from a range of natural materials, the "green" hydrogen was created by adding water and acid to the chemical toluene in a solar-powered electrochemical process. The toluene was converted into methyl cyclohexane (MCH) which has the appearance and consistency of oil, meaning it can be shipped using existing conventional methods. Once in Japan, the MCH was converted back to toluene and the hydrogen extracted for use. The toluene remains available for re-use in the transportation cycle.

International

One international project of note is a hydrogen panel developed by a research team from KU Leuven University in Belgium. The hydrogen panel, similar in appearance to a solar panel, can convert sunlight and water vapour into hydrogen gas with an efficiency of 15%. The panel integrates solar energy capture and hydrogen production in one device and produces a yearly average of 250 litres of hydrogen gas per day from the moisture in the air. It has a rated output of 210 watts and the hydrogen produced is carbon neutral. The researchers claim the panel is more efficient than conventional methods of producing hydrogen gas and that there is sufficient air moisture in deserts for the panel to function. The panel is currently in the patent application process and is undergoing small-scale testing in homes in Belgium. Although commercial production is a long way off, if successful, the potential applications for the panel in Australia as well as globally are significant.