ANZ Bank has unveiled plans to adopt a net zero emissions test for loans, and to set a 2030 exit date for all direct investment in thermal coal mines and power stations. Starting immediately, the bank will not take on any new business customers with thermal coal exposure amounting to more than 10 per cent of total revenue. By 2030 ANZ will only directly lend to renewables and natural gas projects, despite the latter’s role in driving climate change.

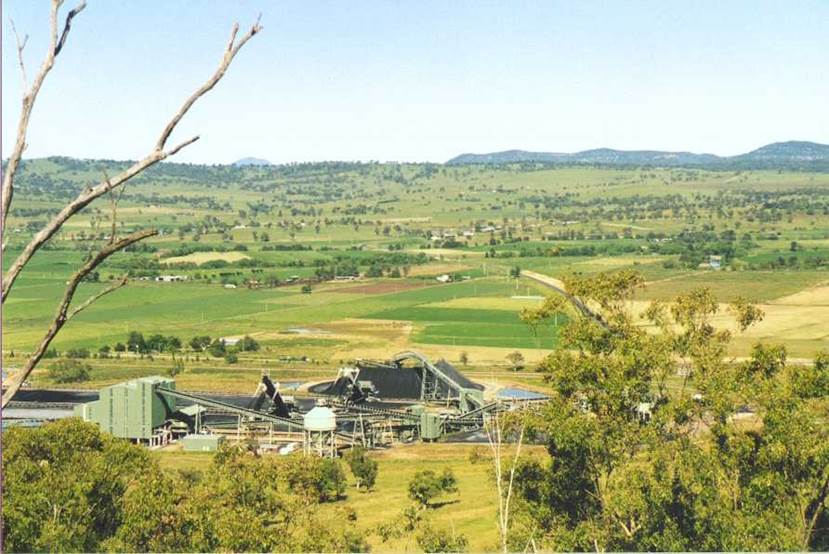

Image Source: ANZ Bank Coal Funding

Image Source: ANZ Bank Coal Funding

ANZ is the last of Australia’s big four banks to set a date for exiting direct thermal coal investments, although it will continue to support metallurgical coal used for steel production. The bank will also adopt low-carbon deadlines for the agriculture, food and beverage, building, energy and transport sectors in a 10-year plan