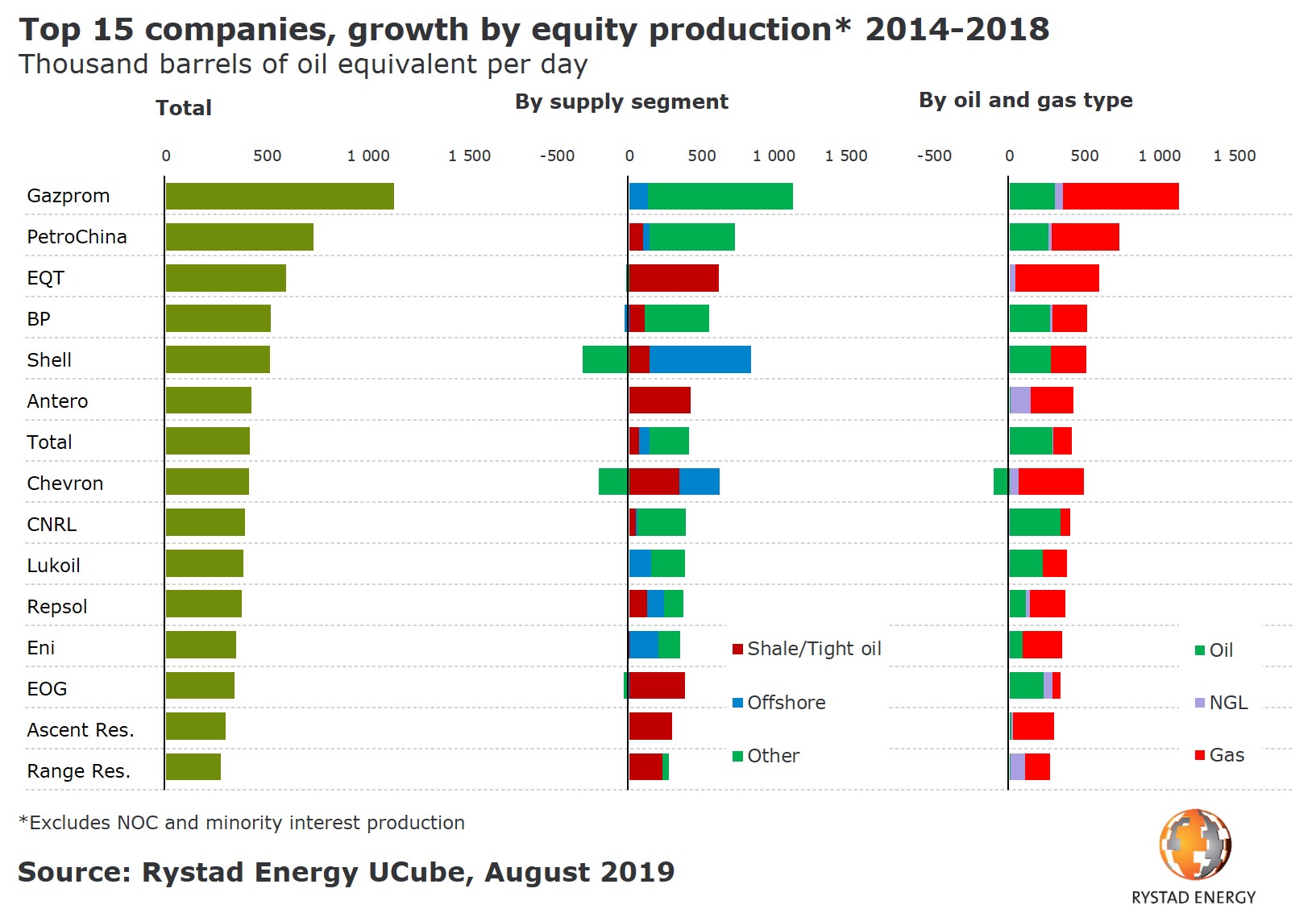

Rystad Energy has analyzed the production of all global E&P companies and ranked them according to their production growth from 2014 through 2018.

“Gazprom, the clear leader in production growth, is the only company with a total growth of more than 1 million barrels of oil equivalent per day (boepd) over the last five years. The growth comes primarily from conventional assets, with gas being the key contributor to the spectacular development,” says Espen Erlingsen, head of upstream research at Rystad Energy.

Production growth is a key performance indicator for E&P companies. This metric is commonly used by upstream players to demonstrate to investors that their portfolios are poised for growth as opposed to stagnated production.

Runner-up to Gazprom is PetroChina, with a total growth of around 730,000 boepd, also driven by conventional onshore gas production as well as splashes of shale gas growth. The third company to make the podium is shale-focused EQT, the largest producer of natural gas in the US, boasting equity production growth of close to 600,000 boepd, or 340% growth over the last five years.

“Behind the state behemoths in Russia and China, majors and shale companies are some of the fastest-growing companies over the last five years. Rystad Energy expects this rise in output among the majors and shale companies to continue,” Erlingsen said.

Among the majors, BP posted the largest production increase since 2014, seeing total production grow almost 500,000 boepd in the last five years. Much of the production uptick can be credited with the company’s operations in the Middle East, with significant production additions from the Rumaila field in Iraq, and in North America, where shale and US deepwater are driving most of the changes.

Five of the majors – BP, Shell, Total, Chevron and Eni – have made Rystad Energy’s list of the 15 fastest-growing E&P companies. Absent from the list are ExxonMobil and ConocoPhillips.

Equity production is strong not only among the majors, but also among five companies that are primarily focused on US shale and tight oil: EQT, Antero, EOG, Ascent Resources and Range Resources.

Our benchmark analysis evaluates the companies’ total production growth for the five-year period, looking at both organic growth (increased field-level production in assets the company already owns) and inorganic growth (increased production due to mergers or acquisitions). All calculations have been made using each company’s equity, or working interest, across its upstream assets. National oil companies, defined as national companies with activities only in their home country, are excluded.