Hannon Armstrong Sustainable Infrastructure Capital Inc (NYSE:HASI) has committed to invest about USD 663 million (EUR 544m) in a large renewable energy portfolio developed by Clearway Energy Group.

The climate solutions investor has already funded some USD 200 million and anticipates providing the remaining portion over the next two years. In return, the company will get a preferred equity interest in several holding companies owning the cash equity interests in individual operating projects, it explained. The investment reached financial close on December 21.

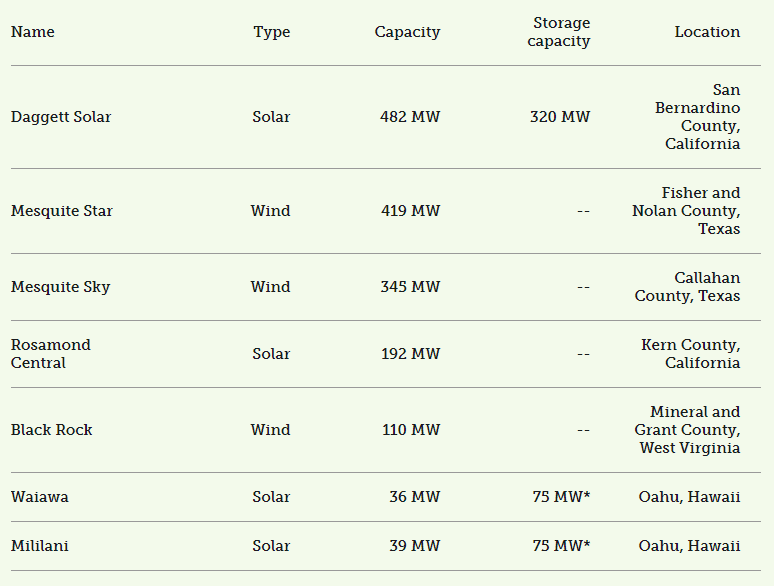

The portfolio in question amounts to 1.6 GW and includes 874 MW of onshore wind, 192 MW of utility-scale solar and 557 MW of utility-scale solar coupled with 395 MW of co-located energy storage. These assets are located in California, Hawaii, Texas and West Virginia.

More details are available in the table below.

*The Waiawa and Mililani solar parks share a combined 75 MW of co-located storage.

The assets within the portfolio have a weighted average contract life of more than 14 years. Their cash flows are contracted with a diversified group of predominantly investment-grade corporate, utility, university and municipal offtakers, according to the announcement.

While the portfolio is developed by Clearway Energy Group, its publicly traded affiliate Clearway Energy Inc (NYSE:CWEN) has the remaining ownership of cash equity interests.