After a nearly week-long delay, President Trump on Dec. 27 signed a legislative package that includes tax extenders, $900 billion in COVID-19 relief and government funding, averting a government shutdown and providing a new tax credit for residential wood heating. Congress passed the nearly 5,600-page bill on Dec. 21.

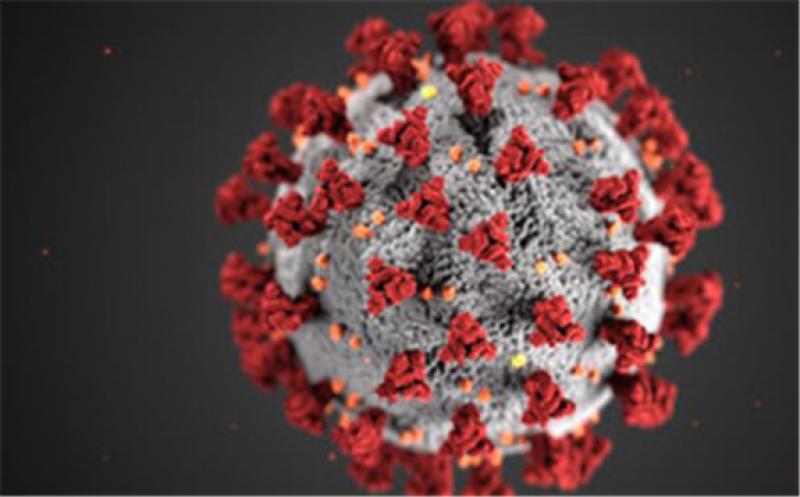

SOURCE: CDC

SOURCE: CDC

One component of the bill includes provisions of the Biomass Thermal Utilization Act and will enact a three-year investment tax credit (ITC) for high-efficiency home heating equipment that fires wood pellets, chips or cordwood. Charlie Niebling, a consultant for wood pellet producer Lignetics, has been working

to enact the BTU Act for more than a decade. He called the ITC for residential wood heaters a “gamechanger” for residential wood heating.

The legislative package also includes various tax credit extensions. The section 45 tax credit for renewable energy production from biomass, geothermal, landfill gas, municipal solid waste (MSW), certain hydro, marine and hydrokinetic facilities has been extended through 2021. The second generation biofuel producer credit and alterative fuel refueling property credit were also extended through 2021. In addition, the 45Q tax credit for carbon oxide sequestration has been extended for facilities that begin construction by the end of 2025.

Another component of the bill provides $11.2 billion in COVID-19 relief for agriculture. Language included in the legislation states that the USDA can use a portion of that funding to make payments to producers of advanced biofuel, biomass-based diesel, cellulosic biofuel, conventional biofuel, or renewable fuel that experienced market losses due to COVID-19. Although previous COVID-19 relief funding allowed similar discretion to aid biofuel producers, Agriculture Secretary Sonny Perdue has not allowed that to happen. Tom Vilsack, President-elect Joe Biden’s pick to fill the ag secretary post, is seen as more likely to provide aid to the hard-hit biofuels industry.

Other components of the legislative package include an extension and benefit phaseout for pandemic unemployment assistance. Pandemic unemployment assistance is extended to March 14 and allows individuals receiving benefits as of March 14 to continue through April 5 as long as the individual has not reached the maximum number of weeks. The bill also increases the number of weeks of benefits an individual may claim from 30 to 50. In addition, the legislation restores the federal pandemic unemployment compensation supplement to all state and federal unemployment benefits at $300 per week, starting after Dec. 26 and ending March. 14.

The legislation also includes a second round of Paycheck Protection Program loans, with a maximum amount of $2 million, for smaller and harder-hit businesses. Eligible entities must have no more than 300 employees, have used or will use the full amount of their PPP, and must demonstrate at least a 25 percent reduction in gross receipts in the first, second or third quarter of 2020 relative to the same period of 2019.

In addition, the bill includes a second round of direct payments to individuals in the form of a refundable tax credit in the among of $600 per eligible family member. The credit phases out for individuals earning more than $75,000 or married couples earning more than $150,000.

Additional information, including a full copy of the bill, is available on the House Committee on Appropriations website.