While Australian coal remains off limits in China, the trade tensions have barely dented overall export figures from Australia's largest coal terminal, with producers finding other international markets.

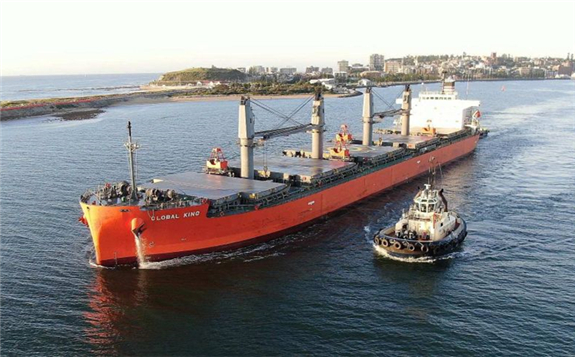

Coal exports from Newcastle showed only marginal decline last month, despite China's ban on Australian coal.(ABC Newcastle: Anthony Scully)

Coal exports from Newcastle showed only marginal decline last month, despite China's ban on Australian coal.(ABC Newcastle: Anthony Scully)

China usually accounts for 20 per cent of exports from the Port of Newcastle, and when coal ships stopped leaving for China in November, it raised the prospect of a shortfall in demand.

Yet, overall export figures for December show only a 3 per cent decline on the previous year.

A total of 14.9 million tonnes of coal were exported from the port last month, worth $1.7 billion, compared to 15.4 million tonnes in December 2019.

Rory Simington, senior analyst with Wood Mackenzie, said the international coal market had rebalanced itself "remarkably quickly" in the face of the trade war.

New markets emerge

There were reports of more than 50 Australian coal ships queuing at Chinese ports having been refused entry to offload their cargo.

But Mr Simington said new markets had opened for Australian producers, ironically as a result of China's surging power demand for heating through a bitterly cold northern winter.

"The Chinese coal market's in a bit of chaos at the moment because there's an extremely cold winter there and prices for domestic coal are extremely high," Mr Simington said.

"So they've gone to other places like Indonesia, Russia, South Africa and have pushed up prices in those destinations — that has provided opportunities for Australian coal into other destinations that it wouldn't normally compete into.

Mr Simington said new export orders to India, Pakistan, Turkey and even Spain had cushioned the shock for Australian coal producers.

In its December quarterly statement to the ASX, Whitehaven Coal explained that they were sourcing Australian coal through other countries:

China has supplemented its domestic coal production with higher cost coal from alternative origins such as Russia, Indonesia and South Africa.

In addition, late in 2020 China lifted its total import quota in response to strong domestic demand and an extremely cold winter.

China's restrictions have altered seaborne coal trade flows where, instead of being delivered to China, Australian coal is now finding customers in alternate destinations including India, Pakistan and the Middle East, and traded coal historically delivered into these markets is finding its way into China.

Demand boosted by pandemic

Annual figures for Port Waratah Coal Services (PWCS), which handles the bulk of coal loading in the Port of Newcastle, show its exports to China dropped from 18 per cent in 2019 to 8 per cent in 2020.

But overall there was only a 4 per cent decline, which PWCS chief executive Hennie de Plooy attributed to the pandemic.

"Certainly very little coal from here went into China sort of in the last four or five months of the year, but producers in the Hunter Valley were able to find replacement markets for basically all of the coal that didn't go to China," he said.

"I think the main impact was actually the pandemic, the demand really softened in the first half of the year around April-May, when a lot of the economies basically shut down and energy demand dropped.

"Economies restarted in the second half and demand picked up."

Overall, the Port of Newcastle exported a total of 158 million tonnes of coal in 2020, at a value of $18.5 billion, just 7 million tonnes less than relatively high export volumes in 2019.

New South Wales Minerals Council chief executive Stephen Galilee said it was good news for the industry.

"2020 was another strong year for NSW coal exports despite a range of challenges," he said in a statement.

"It … demonstrates the ability of the sector to adapt to changing opportunities and markets, with NSW coal exported to around 20 different countries during the year."

Higher coal prices could stay

In another win for the industry, thermal coal prices rose significantly at the end of 2020, up from a low of around $US50 a tonne, where many Australian coal producers are cash negative, to now above $US80 a tonne.

Mr Simington said the prices were being driven not only by China but also Japan and other Northern Hemisphere countries experiencing the cold winter.

"Obviously this peak winter demand will pass and things will probably ease off considerably around Chinese New Year, when it looks like the government there is asking people to close up early as a reaction to coronavirus issues," he said.

"So we're expecting to see quite a significant decline in China that could bring prices down — but having said that, my feeling is that Chinese domestic prices are going to support seaborne prices pretty significantly through much of, if not all, of 2021.

Mr Simington said there was "absolutely no sign" of the Chinese Government relenting on its Australian coal ban.

"I think the Chinese Government is showing that it's prepared to endure quite a bit of pain with coal prices where they are in China," he said.

This article is reproduced at www.abc.net.au