Qatar Petroleum’s recently set a new record for the largest LNG export project ever. By 2026, the country will once again become the world's largest supplier of liquefied natural gas by overtaking Australia. The signing of the contract was delayed for a year due to economic uncertainty as a direct consequence of the Covid-19 pandemic. With the mega-expansion, the market could be oversupplied for years and the feasibility of other projects that are awaiting their investment decision could be in jeopardy.

For years Qatar Petroleum was the de-facto leader of the global LNG industry. The self-imposed moratorium was intended to ensure competitiveness in the long-term by preventing oversupply. Currently, Qatar produces 77 million tons per annum (mtpa). With the first phase expansion, the country will increase its capacity to 110 mtpa by 2026. By 2026 this should rise to 126 mtpa after completion of the second phase.

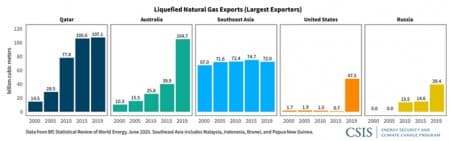

Qatar’s decision to lift the moratorium is a direct consequence of increased competition by primarily Australia and the U.S. Also, Russia has entered the fray with major plans of its own. The added supply went at the expense of Qatar Petroleum which was losing market share. According to Giles Farrer, research director at Wood Mackenzie, “Qatar is pursuing market share. This FID (final investment decision) is likely to increase pressure on other pre-FID LNG suppliers, who may find Qatar secured a foothold in new markets.”

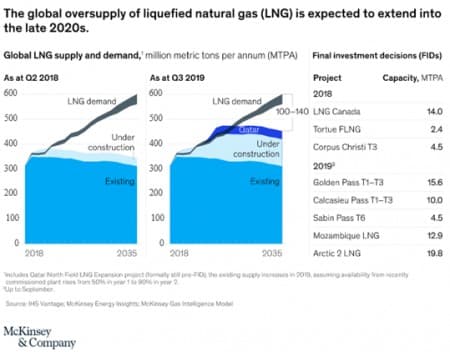

Global demand is expected to increase to between 560 mtpa and 600 mtpa by 2035 up from 315 mtpa in 2018. The expectation is that an additional 100 mtpa to 140 mtpa of new capacity will be required until 2035. Currently, an unprecedented amount of 100 projects with a production capacity of 1,100 mtpa are awaiting FID. According to McKinsey, these projects require a break-even price of $7 per million British thermal units (MMBTU) to maintain competitiveness.

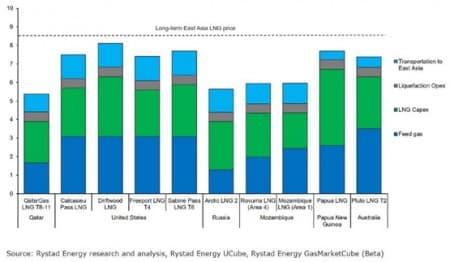

In this regard, Qatar's LNG industry has a strong advantage due to low production costs compared to the competition. The cheap feed gas from the world's single largest natural gas field, South Pars/North Dome, significantly improves Qatar Petroleum's competitiveness despite the excruciating heat of the Middle East. Russia's arctic climate, however, makes it possible to keep liquefactions costs low. Coupled with cheap feed gas, Novatek's facilities are also highly competitive.

This means that many of the envisioned projects won’t make it to the finish line under the current expected demand growth. However, there are reasons to believe that demand could increase more than currently expected. First, the growth of renewables in all regions of the world increases the need for flexibility to balance the grid. Currently, natural gas is a good contender due to its wide availability and relatively low CO2 emissions.

Second, carbon ceilings decrease the long-term competitiveness of coal in favor of gas that emits approximately 50 percent less CO2. China, the world's largest emitter of greenhouse gasses, saw the launch of its carbon trading market just a few weeks ago. This could boost demand for LNG in favor of coal in the Asian country.

Lastly, with rapid industrialization developing countries are facing an environmental crisis comparable to China not so long ago. Therefore, it is reasonable to expect that demand for cleaner gas could offset more pollutant fuels such as coal which is dominant in the energy mix of many countries.

However, it remains unclear how fast demand will grow. The absence of an organization dedicated to natural gas comparable to OPEC and a swing-producer comparable to Saudi Arabia makes the LNG market highly volatile. Also, the high upfront costs and long-development time make investments risky. By the time a project is completed, the market could have transformed.

Therefore, expect many of those 100 pre-FID projects to fail in reaching the finish line in the next decade.

This article is reproduced at oilprice.com