Russia’s Novatek and China’s Shenergy signed a new gas deal in February 2021, highlighting the primacy of energy ties in China–Russia relations. Under the provisions of the agreement, Novatek will ship around 3 million tonnes a year of liquefied natural gas (LNG) to Shenergy’s Shanghai terminals over the next 15 years.

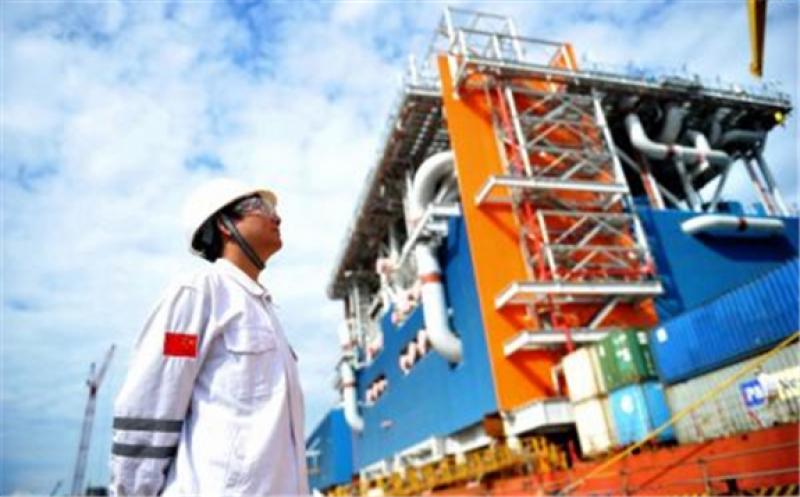

Gas will be sourced from Novatek’s gargantuan Arctic LNG-2 project on the Yamal peninsula, in which the Chinese state-owned China National Petroleum Corporation (CNPC) and China National Offshore Oil Corporation (CNOOC) participate as shareholders. With its first train coming online in 2023, Arctic LNG-2 is a trump card for the Kremlin in gas geopolitics and Russian Arctic development.

As most Arctic LNG-2 production is intended for the Asia Pacific, the project will tap into the enormous growth in regional gas consumption expected over coming decades. This will allow Moscow to vie for a share in the regional gas market with LNG superpowers such as Qatar and Australia.

Arctic LNG-2 will double Yamal LNG production, becoming a major cornerstone of Moscow’s Arctic Strategy up to 2035 and supporting the growth in transit through the Northern Sea Route. The project also provides a new diplomatic tool to sidestep isolation from Western financial institutions as it raises the interest of many state-backed institutions in both Asia and Europe.

The agreement will further develop Russia’s ‘pivot to Asia’, a strategic shift in the wake of the 2014 annexation of Crimea. According to Novatek Chairman Leonid Mikhelson, the agreement with Shenergy responds to Novatek’s diversification strategy toward the Asia Pacific aimed at ‘delivering affordable, secure and sustainable natural gas for many decades’.

In this sense, Arctic LNG-2 is key for Novatek in developing its Asian strategy. It will also strengthen the company’s stance as Russia’s LNG champion in the face of Gazprom, the Russian state-owned giant and Novatek’s main competitor on both foreign and domestic gas markets, and also legitimise the widespread support the Kremlin has given it over the last decade.

Like its Russian peers, Novatek has cut capital expenditure and announced a possible delay in implementing its Arctic projects due to COVID-19. The company remains ready to pursue bold logistics and marketing strategies to reap the benefits of a sooner-than-expected year-round Arctic navigation. In order to achieve this goal, Moscow would need additional infrastructure investments and transport capabilities throughout the entire Arctic region. In line with the company’s strategy, Novatek is planning to raise approximately US$11 billion by the end of the first half of 2021 from international investors to finalise the Arctic LNG-2.

The COVID-19 pandemic has not slowed China’s thirst for gas. President Xi Jinping has put forth ambitious climate goals, pledging to achieve carbon neutrality by 2060 and personally endorsing a long-term coal-to-gas transition as a response to domestic air pollution and environmental degradation. By the first half of the 2020s, China will likely become the world’s largest LNG importer, consuming an extra 100–130 billion cubic meters of gas.

Beijing has also introduced unparalleled market-oriented reforms in China’s energy system. Increasing liberalisation of domestic gas prices, third-party access and competition are accelerating the reboot of the gas industry, with scope to expand domestic production, stimulate investments and optimise China’s gains from the commoditisation of gas.

Beijing has also reclaimed coordination of the country’s gas policy and strategy from national oil companies (NOCs) by institutionalising a new midstream company called PipeChina. This encourages foreign and domestic entities including Shenergy, a municipal state utility, to invest in China’s gasification, bolstering competition. These second-tier gas importers have been ramping up a new wave of LNG deals and in 2020 were securing the majority of new China’s LNG import contracts, pursuing their challenge to NOCs’ domestic predominance. Shenergy delivers more than 90 per cent of Shanghai’s gas consumption, and the agreement with Novatek will assist the expansion of gas in the local energy mix.

China’s energy system had undergone tremendous stress amid extreme weather conditions during the winter of 2020. A mix of economic stimulus, a government cap on domestic prices and a colder than usual autumn and winter have forced Beijing to significantly increase imports, including from the Sino–Russian gas pipeline Power of Siberia. As China accelerates its coal-to-gas transition, the country is likely to face new strategic challenges from its growing foreign gas dependency.

Once considered a weak link, economic cooperation between China and Russia has shown a relentless capacity to withstand political and financial turmoil, with raw materials and oil becoming the driving force behind bilateral trade. The scale of the Novatek–Shenergy agreement may pale in comparison to recent Gazprom–Novatek and CNPC–CNOOC contracts, but the deal goes beyond gas security.

Both Xi and Russian President Vladimir Putin have doubled down on promises to double trade to US$200 billion by 2024. In the longer-term, natural gas could help expand the commercial partnership by attracting investments in infrastructure. As Russia and China reform their domestic gas sectors, the Novatek–Shenergy deal could help synchronise the two countries’ agendas, displaying a growth in mutual confidence.

Given the intertwining of energy transition and gas geopolitical dynamics, the deepening of energy ties could bring unforeseen changes to China–Russia relations. This requires a delicate balancing of state and market interests to preserve the required stability of the Beijing–Moscow strategic partnership.