Strict production discipline by OPEC and its partners is the #1 reason why oil prices have managed to stage a remarkable recovery and stay relatively high after plunging to historical lows in 2020. Early this month, oil prices reacted positively after OPEC and its non-OPEC partners, aka OPEC+, reached a favorable agreement to start gradually curbing production cuts beginning in May. Starting next month, OPEC+ will allow an additional 350,000 barrels per day to join the markets, with another 350,000 coming in June and June and 450,000 barrels per day slated for July. Currently, OPEC is holding back just over 7 million barrels per day, with Saudi Arabia voluntarily cutting an additional 1 million barrels per day.

Indeed, the OPEC kingpin has since taken on voluntary cuts of 1 million barrels per day from the beginning of February.

That marks a sharp turnaround from the Kingdom’s stance just a year ago when Riyadh and Moscow failed to agree to deep supply cutbacks in a bid to cope with falling oil demand leading to a supply glut and oil prices descending into negative territory for the first time in history.

And it certainly appears like overkill bearing in mind that Saudi Arabia has some of the lowest production costs anywhere in the world.

However, Saudi Arabia could be eyeing an even bigger prize with its generous cuts.

Diversifying the economy

Whereas Saudi Arabia, the region’s largest economy of the GCC (Gulf Cooperation Council) boasts the largest economy and the lowest production costs of any Arab nation, the harsh reality is that the country needs significantly higher oil prices than the current WTI price of $59.50 per barrel to balance its books.

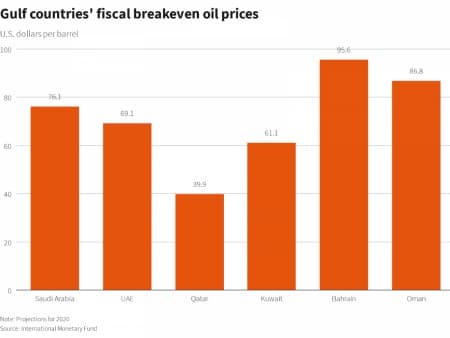

Indeed, Saudi Arabia’s fiscal breakeven price of $76.10 per barrel means that it remains heavily in the red, with only Qatar being able to record a surplus thanks to its low breakeven point of $39.90 per barrel.

Budget deficit

Saudi Arabia desperately needs higher oil prices not only to balance its books but also to lower its dependence on crude.

That goal is even more critical now that Saudi Arabia is pushing a 7.2 trillion-dollar plan to diversify its economy, essentially requiring state companies to cut dividends they pay the government in order to boost spending.

For a company like Saudi Aramco--whose $75 billion dividends last year were the highest for state revenues--any reduction in dividends would need to be compensated by higher oil prices to boost transfers to the sovereign through taxes and royalties instead.

Saudi Arabia has a target to boost domestic spending to 27 trillion riyals ($7.2 trillion) by 2030 as the world’s biggest oil exporter seeks to tame a huge deficit caused by lower oil revenues and weak demand due to the pandemic.

To achieve its goal, Saudi Arabia needs to curb supply over the coming years in a bid to boost oil prices.

The fiscal benefits of higher oil prices can easily outweigh the impact of lower oil production on the economy.

Whereas Saudi companies participating in the new programme have the liberty to decide how to fund their investments, the most likely avenues are dividends, soft loans, debt, and other financial instruments.

Further, Saudi Arabia desperately needs to boost investments coming into the country (FDI) by nearly 100x, from $5.5 billion last year to FDI flows of over $500 billion over the next decade.

Betting on clean energy

On the energy front, Saudi Arabia is clearly committed to moving from crude to cleaner energy sources.

The Saudi government has announced plans to build a $5 billion green hydrogen plant that will power the planned megacity of Neom when it opens in 2025. Dubbed Helios Green Fuels, the hydrogen plant will use solar and wind energy to generate 4GW of clean energy that will be used to produce hydrogen.

But here’s the main kicker: Helios could soon produce hydrogen that’s cheaper than oil.

Bloomberg New Energy Finance (BNEF) estimates that Helios’ costs could reach $1.50 per kilogram by 2030, way cheaper than the average cost of green hydrogen at $5 per kilogram and even cheaper than gray hydrogen made from cracking natural gas. Saudi Arabia enjoys a serious competitive advantage in the green hydrogen business thanks to its perpetual sunshine, wind, and vast tracts of unused land.

In fact, Saudi Aramco has told investors that it has abandoned immediate plans to develop its LNG sector in favor of hydrogen. Aramco has said that the Kingdom’s immediate plan is to produce enough natural gas for domestic use to stop burning oil in its power plants and convert the remainder into hydrogen. Blue hydrogen is made from natural gas either by Steam Methane Reforming (SMR) or AutoThermal Reforming (ATR), with the CO2 generated captured and then stored. As the greenhouse gasses are captured, this mitigates the environmental impacts on the planet.

Saudi Arabia clearly has its eyes on a future whereby the economy will stop relying too heavily on oil. Whether or not it will remain committed enough to achieve its long-term goal is another question.