China's state-controlled oil firm Sinopec has signed a strategic co-operation framework agreement with domestic automotive manufacturer Great Wall Holdings to develop hydrogen energy.

The two firms will carry out in-depth co-operation in the industrialisation, technology research and development and capital operation of hydrogen energy. The move is designed to promote a high-quality development in China's hydrogen industry.

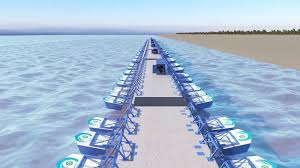

Sinopec is on target to build 1,000 hydrogen refuelling stations, 5,000 charging stations and power battery exchange stations and 7,000 distributed photovoltaic power stations by 2025, according to Sinopec president Zhang Yuzhuo.

Great Wall Holdings is the first Chinese auto producer to join the International Hydrogen Energy Committee. It has advanced hydrogen technology research and development capabilities, Zhang said. Great Wall sold 1.1mn pick-up trucks and SUVs in 2020, up by 4.7pc from 2019, crossing the 1mn mark for five consecutive years since 2016.

The co-operation between the two firms will provide more development opportunities for the domestic hydrogen market, promote the development and breakthrough of hydrogen energy technology and contribute to an early realisation of the country's "carbon neutrality" vision, Great Wall Holdings president Wei Jianjun said. Sinopec in April announced a plan to achieve carbon neutrality by 2050, 10 years ahead of the national target.

The firm also in April signed a strategic co-operation agreement with new energy vehicle (NEV) manufacturer Nio to build power battery exchange stations in the next few years. The firms' first power battery exchange station Chaoying started operations in Beijing on 15 April.

Sinopec has also teamed up with solar manufacturer Longi Green Energy Technology to develop green hydrogen projects. Green hydrogen is produced using renewable energy sources through the process of electrolysis by splitting water into hydrogen and oxygen.

China produced 750,000 NEVs, including fuel-cell vehicles in January-April this year, up by 257pc from a year earlier, according to China's Automotive Manufacturers Association. The development of hydrogen fuel-cell vehicles is expected to boost demand for some battery metals, particularly nickel, and a few rare earth metals such as lanthanum and cerium.