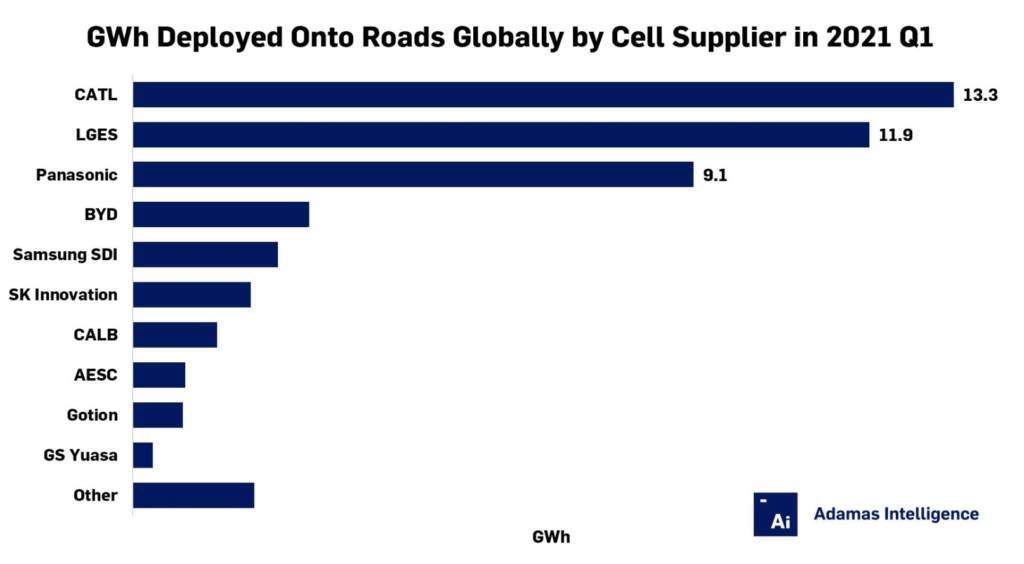

A new report by Adamas Intelligence reveals that Contemporary Amperex Technology (CATL) deployed 13.3 GWh of battery capacity onto roads in newly sold passenger EVs globally, a figure that is 12% more than the 11.9 GWh deployed by its closest competitor, LG Energy Solution.

CATL’s battery capacity deployment was also 46% more than the 9.1 GWh deployed by Panasonic.

Besides being the provider of lithium iron phosphate (LFP) batteries for Tesla’s China-made Model 3 cars with standard driving ranges, CATL systems are incorporated into Peugeot, Hyundai, Honda, BMW, Toyota, Volkswagen, and Volvo vehicles, among others.

To secure access to raw materials to back its battery production, back in April, the company took a stake in China Molybdenum Co’s Kisanfu copper-cobalt mine in the Democratic Republic of Congo, and it also has investments in Neo Lithium (TSXV: NLC.V), a Canadian miner developing the Tres Quebradas lithium project in Argentina.

According to Adamas, the recent positive results for the Chinese battery manufacturer are mostly based on the fact that it deployed 66% more capacity than LGES in January 2021, which gave it an early lead on the competition. In February and March, however, LGES beat CATL by GWh deployed onto roads globally.

“Through the first three months of 2021, CATL deployed 10.6 GWh of passenger EV battery capacity onto roads in newly sold passenger EVs in China, more than the next 32 cell suppliers combined,” the report reads.

In addition to the prior, the Ningde-based manufacturer deployed 0.7 GWh into newly sold buses and 0.2 GWh into heavy trucks and special purpose vehicles. Accounting for these larger vehicles, CATL deployed a total of 11.5 GWh only in China.

“Looking forward, we expect to see CATL maintain its dominance in China in the months ahead and expect to see up-and-comers CALB and Gotion cement themselves among China’s top-five before challenging Samsung SDI and SK Innovation for a top-five spot globally,” the review states.

In addition to these companies, it is also possible that EVE Energy sees some growth in the coming months, as recent reports reveal that the Huizhou-based company is in negotiations with Tesla to supply the American automaker’s Shanghai factory with LFP batteries by Q3 2021. The plan would be to incorporate them into the firm’s Model 3 and Model Y vehicles within the next six months.