Australia has agreed to pay its last two oil refineries up to A$2.3 billion ($1.8 billion) through 2030 to keep the struggling plants open and protect the country's fuel security.

The package props up refineries owned by Ampol Ltd and Viva Energy Group and will save 1,250 jobs across their two plants, Prime Minister Scott Morrison said. Ampol's shares jumped nearly 10% and Viva's as much as 9% as investors applauded the big subsidies which will shield the companies from refining losses and help them upgrade their ageing plants. "This is a key plank of our plan to secure Australia's recovery from the pandemic, and to prepare against any future crises," Morrison said in a statement.

The package includes up to A$125 million each to Ampol and Viva to upgrade their refineries to produce ultra-low sulfur petrol. In return, the companies have agreed to start making the cleaner fuel by end-2024, catching up with the world's major markets three years earlier than planned.

Viva Chief Executive Scott Wyatt said securing the deal was a "huge relief". "It retains a material critical mass of refining capacity across the two sites and I think that allows us to continue to work closely with government on not just the future of refining but the whole energy transition," Wyatt told local media.

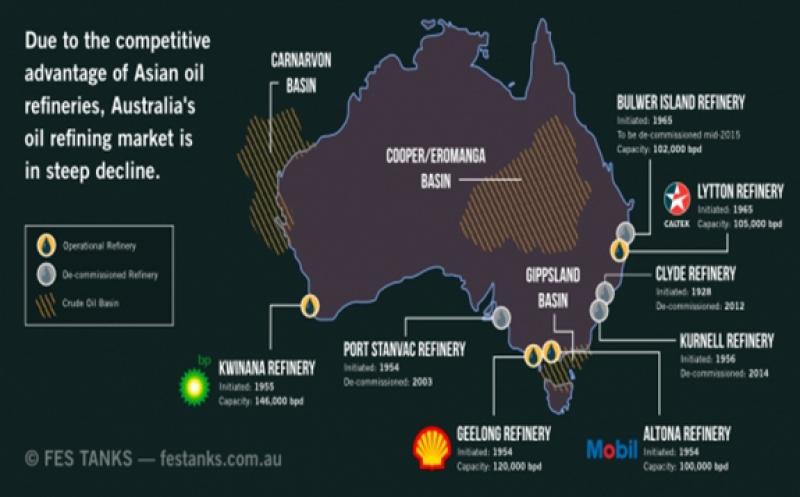

Australia's four refineries were just emerging from years of losses when the pandemic hit fuel demand last year, aggravating the pain of competing against Asia's mega refineries. Combined, the four had a capacity of 464,000 barrels per day, dwarfed by Asia's biggest refinery, the 1.24 million bpd Jamnagar plant in India. Pandemic-induced supply disruptions in other industries sparked fear over long-term fuel security in Australia and spurred the government to look for ways to rescue the industry. However BP plc has since shut its Kwinana plant in Western Australia and Exxon Mobil Corp is set to close its Altona plant in Victoria later this year.

Viva and Ampol have committed to keep their refineries open until at least 2027, with an option to receive support to 2030. Ampol Chief Executive Matt Halliday said the government's generosity was justified, because it ensured Australia would retain advanced manufacturing skills and assets that could eventually handle future fuels such as hydrogen. "We're playing our role to support them in terms of meeting their fuel security objectives, where they apply a broader lens," Halliday told reporters.

Both plants will be aided when refining margins drop below an agreed level and will not receive help during good times, Energy Minister Angus Taylor said. "The cap payment of 1.8 Australian cents per litre (around $2.20/bbl) provides a big lifeline during low refining margin periods, which is our most likely scenario for the next six years, given global refining overcapacity," said Sushant Gupta, research director at consultants Wood Mackenzie.

Analysts congratulated the companies on securing a "great deal"."You say thank you to Angus Taylor and Scott Morrison. As shareholders, we thank them too," Bank of America analyst David Errington told Viva executives on an analyst call.