CBA last week announced a $20 million investment in Amber, as part of the unconventional energy retailer’s Series B funding round — boosting Amber’s goal of connecting one million customers with best-price renewables through access to wholesale energy market information.

“Amber’s partnership with CBA is a big step towards our goal of helping a million customers save money while shifting Australia to 100% renewables,” said Dan Adams, Co-founder and CEO of Amber, who added that the funding will accelerate the company’s reach and product development.

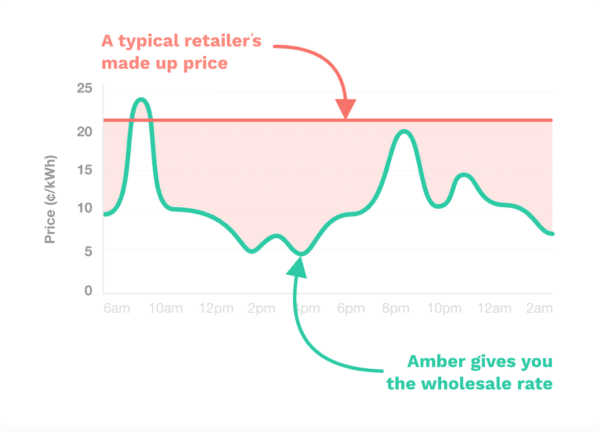

Amber offers customers a subscription of $15 a month to its app, which provides access to real-time wholesale energy prices and the percentage of renewable energy flowing through the National Electricity Market (NEM) at any given moment; this enables them to adjust their consumption to take advantage of times of cheap renewable generation, rather than paying a flat fee they’ve negotiated with a conventional retailer for their energy.

All energy market transactions are handled by Amber, which passes on the wholesale electricity prices — including network charges, metering costs, environmental costs and carbon offsets — exactly, transparently, as they are incurred by Amber as the retailer.

Amber subscribers can also opt in to be paid for solar exports to the grid, at the wholesale rate the market is offering at the time of export, and the company provides forecasts of energy price spikes (so consumers can shift non-essential energy use to other times), and likely low periods (so they know when to set all electrical loads humming).

Making the low cost of renewables real for consumers

“We need to give people an incentive and the technology to use cheaper renewable power when it’s available,” says Adams, and at the same time increase demand for construction of new renewable energy projects.

More than an investment, the CBA partnership will, over time, facilitate Amber offering its service to CBA customers; and Amber is set to collaborate with CBA which provides low-cost finance to bank customers who want to buy battery storage for their solar systems, smart electric vehicle (EV) chargers and other intelligently enabled electrical devices.

Through its partnership with Amber, CBA will “help our customers see how their energy costs are calculated, help them save money on their energy bills and help them use renewable sources of energy”, says Commonwealth Bank Group Executive, Angus Sullivan.

Amber is currently building and trialling its new SmartShift technology with 1000 customers; SmartShift will optimise the use of smart devices and automate load shifting into renewable-energy windows of opportunity in the NEM.

Buying into rooftop solar

Earlier this year, CBA announced the Commbank Green Loan facility, which aims to help customers invest in renewables.

The loans of up to $20,000, at a 0.99% fixed interest rate, are set up to be repaid over 10 years, and incur no upfront fees, or monthly service or early repayment charges.

“We recognise the important role we play in supporting Australia’s transition to a low carbon economy,” said Sullivan.

CBA was also the first Australian corporate to join the global RE100 program, committing to being powered 100% by renewables by 2030, a goal it achieved 10 years ahead of schedule on 1 January 2020.

With its million-customer goal within reach, Adams says that volume of members would enable the Amber collective to “shift enough demand to replace an entire coal-fired power station with wind and solar farms”.