In 2019, we wrote an article raising the alarm that South Africa’s inertia in incentivising the adoption of electric vehicles could make it miss out on the incredible opportunities presented by the electric vehicle revolution. The motor vehicle assembly and motor vehicle component manufacturing industry is one of the key pillars of South Africa’s economy. South African–based assembly plants exported a record 387,092 vehicles in 2019 according to the Auto Green Paper released last week. The coronavirus-induced global economic slowdown resulted in sharp decline to 271,288 exported vehicles. This could be a temporary glitch caused by a global pandemic, but a much larger threat to this industry is already here and action is needed on an urgent basis. Apart from some hybrid Mercedes C-Class vehicles assembled in Port Elizabeth, the majority of vehicles exported from South Africa are ICE (internal combustion engine) vehicles.

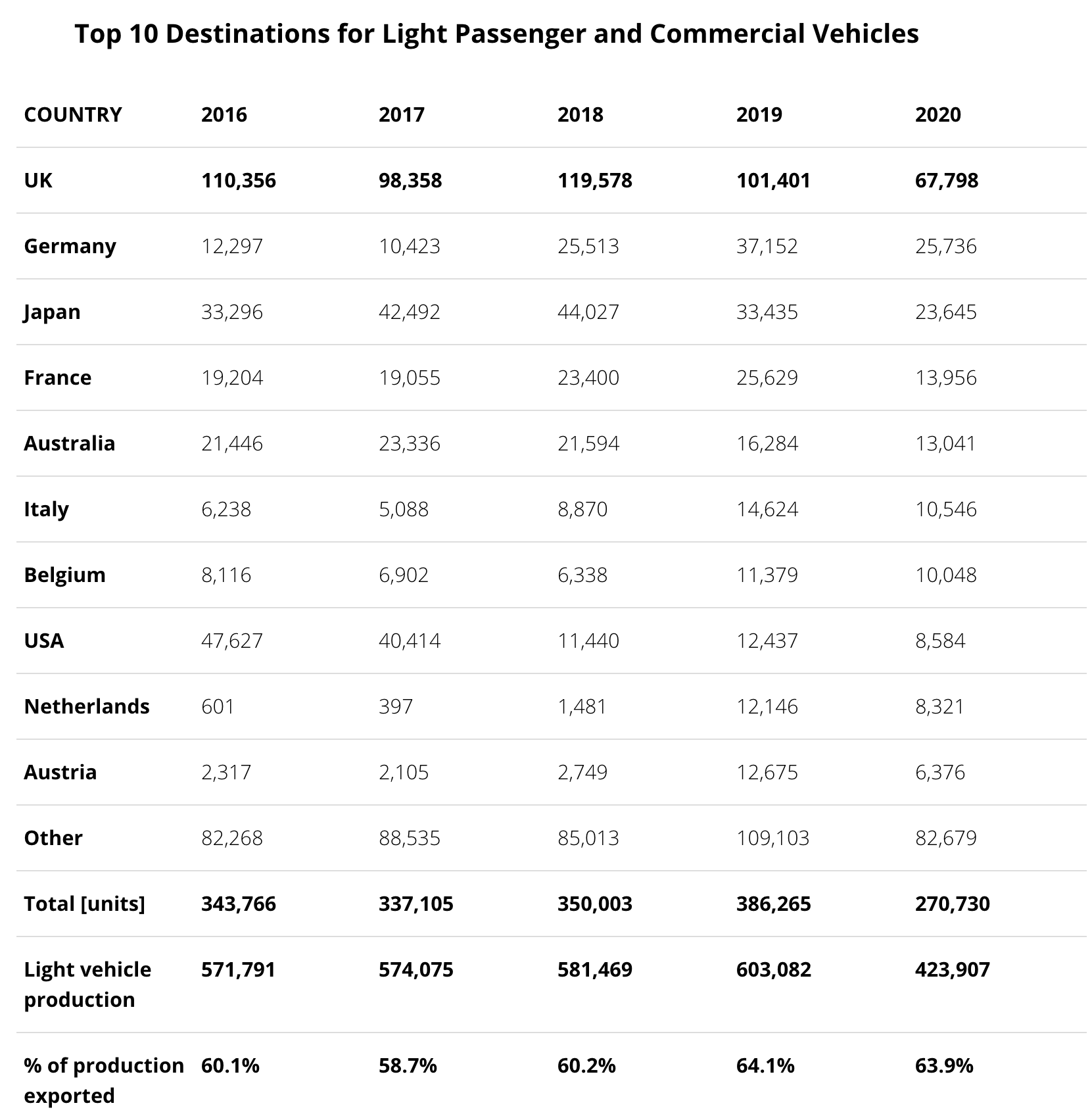

South Africa hosts assembly plants for BMW South Africa, Ford Motor Company of Southern Africa, Isuzu South Africa, Mercedes-Benz SA, Nissan South Africa, Toyota South Africa Motors, and Volkswagen Group South Africa. These factories and the associated downstream industries employ over 100,000 workers and contribute over 7% of GDP. In 2020, total automotive export revenue was R175.7 billion, and 58% of this revenue was from exports to the UK and the European Union. The UK has been the top destination for South African assembled vehicles, and it recently brought forward a ban on the sale of new ICE vehicles to 2030!

South Africa, therefore, only has 9 years to get its industry ready for this. It could actually have much less time than this if the transition to electric mobility happens a whole lot faster than most people think. The UK saw plugin electric vehicle market share at 13.25% in April 2021, with full electrics at a healthy 6.5% despite recent cuts in the government’s plugin car grant. With more fully electric models coming soon in this market along with policy supporting adoption of EVs by fleet operators and businesses, such as the Benefit In Kind tax (BIK) and a Salary Sacrifice schemes, the market share for ICE vehicles could fall much faster. Therefore, to protect and grow its share of vehicles exported to the UK, South Africa needs to expedite the shift to assembly and manufacturing of EVs and associated components.

South Africa’s Green Paper is not just focusing on battery electric vehicles. It also advocates for adoption of hydrogen fuel cell vehicles and a green hydrogen economy (topics we’ll ignore here). The Auto Green Paper aims to address key policy issues that will create and stimulate production of electric vehicles and associated components locally whilst looking at how to manage the delicate balance between completely knocked down kits for vehicles built in South Africa vs. imports of completely built up electric vehicles. The paper also discusses lowering duties or removing them completely for EV components. The Green Paper is still open for comments and submissions close in early June.