The French Development Agency (AFD) is approving a $100 million loan for FirstRand Bank, the subsidiary of the FirstRand Group. The commercial bank will use the funds to finance climate change mitigation and adaptation projects.

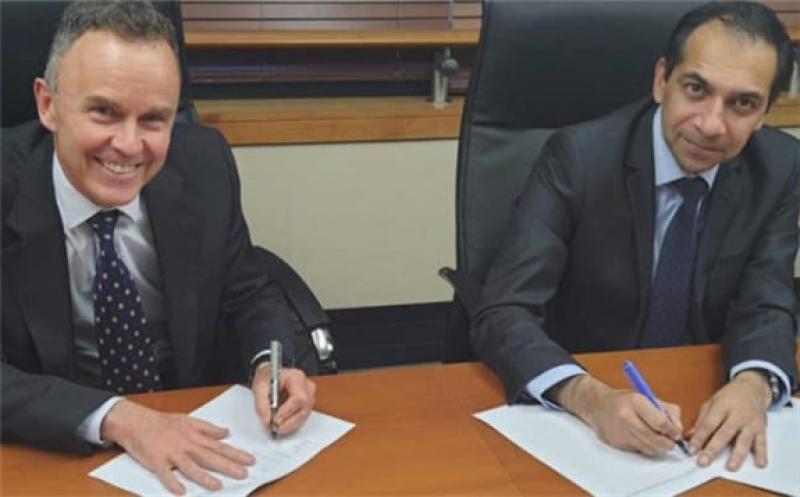

The memorandum of understanding for the $100 million loan was signed by Djalal Khimdjee, the deputy CEO of Proparco, the group’s subsidiary of the French Development Agency (AFD), and Andries du Toit, the group treasurer of FirstRand, one of the financial services providers licensed by the Reserve Bank of South Africa, the national banking regulator. The loan is being provided to FirstRand Bank to expand its climate finance operations.

The Johannesburg-based commercial bank will use the AFD loan to finance climate change mitigation and adaptation projects. The financing will benefit affordable housing projects, renewable energy, energy efficiency and agriculture. According to AFD, this operation will support South Africa’s ambitious Nationally Determined Contribution (NDC). This non-binding plan highlights the climate actions the South African government intends to take to meet the global targets set in the Paris Climate Agreement.

A TFSC initiative

The $100 million loan will also help strengthen the role of the South African private sector in the transition to a resilient, low-carbon economy. The operation also benefits from a technical assistance facility to support the implementation of the program and build FirstRand’s capacity in climate finance.

“This credit facility and accompanying technical assistance will allow us to accelerate our strategy to broaden and deepen our client offering in the SME (small and medium enterprise) and agriculture segments, while supporting our own and our clients’ climate change ambitions in an effective and efficient manner,” explains Andries du Toit.

AFD is making this transaction part of the Transforming Financial Systems for Climate (TFSC) program. This $750 million facility launched in 2018 with the Green Climate Fund (GCF) aims to support local financial institutions in scaling up climate impact finance in 17 countries, mainly in Africa. The program has a 20-year lifespan.