Malaysia's state-owned Petronas may be targeting a 20 January start to production at its Pegaga gas field offshore Sarawak, after the detection of high mercury levels at the field in September delayed the start to operations.

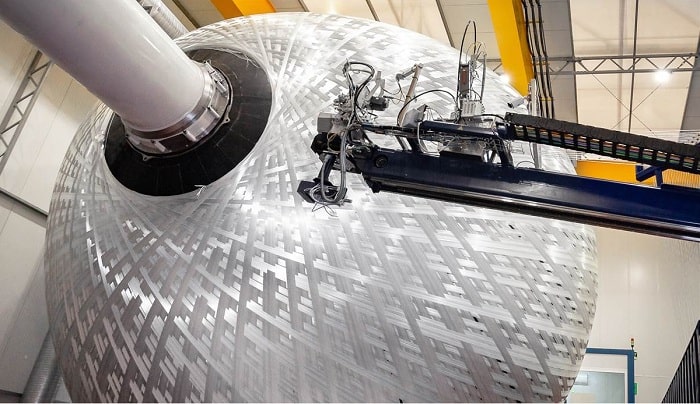

Petronas has set up an interim mercury unit (MRU) at the Pegaga field and will likely start commissioning the unit on 16 December, it told some term offtakers of the 30mn t/yr Bintulu plant early this week. This is in advance of earlier expectations that the MRU would be fixed in the middle of January. The Pegaga gas field supplies feedstock gas to the Bintulu liquefaction and export project.

Shell, which has a 20pc interest in the Pegaga project, said in March that it expected to see first production from the gas field by the fourth quarter of 2021.

But that was delayed when high mercury levels were discovered at the field in early September, prompting Petronas to approach term buyers to request for delays to or cancellations of November-January 2022 deliveries. It planned then to install an interim MRU in March 2022 and a permanent one in November 2022, market participants said.

But Petronas in the middle of November moved forward the scheduled installation of the interim structure to around end-December or January, market participants said. It in late November delayed the timeline to mid-January, they added.

High mercury content at gas fields may poison catalysts in downstream process units and damage downstream equipment through corrosion, potentially resulting in equipment failure, unscheduled outages, or even fires.

"[20 January] is just their target," a term buyer from the plant said about Petronas' latest timeline. Another term buyer said that Petronas had not informed all term buyers of the project's progress, and that "it wouldn't be surprising if they change the [expected first gas production] date".

Petronas told Argus on 1 December that the installation of the interim MRU at the Pegaga field was "progressing as planned" and that "the first gas is expected by Q1 2022", without specifying exact dates.

"The permanent mercury removal unit is targeted to be ready by 4Q 2022 as per the current plan," Petronas added.

Bintulu LNG has term supply agreements with northeast Asian buyers including Japan's Tokyo Gas, Osaka Gas, Toho Gas, Jera, Tohoku Electric, Japex, Saibu Gas, Shizuoka Gas, Hiroshima Gas and Eneos — formerly known as JX Nippon Oil and Energy — along with state-controlled China's CNOOC, Taiwan's CPC and South Korea's Kogas.

Petronas had most recently requested for the cancellation of around 7-8 cargoes/month for delivery in January and February, and around 5-6 cargoes/month for delivery in March-May, as a result of the issue at the Pegaga gas field. This was a reduction from its original expectation of the cancellation of over 10 cargoes meant for delivery in January, when the interim MRU was expected to be installed in March 2022, market participants said.

Several Japanese LNG buyers with term offtake from the plant entered the spot market to enquire for winter deliveries in November and December following Petronas' continued requests to cancel contractual deliveries, exercised under the downward quantity tolerance clause in its contracts.

Japanese gas distributor Saibu Gas sought what was likely its first spot requirement – a partial cargo for delivery in either December or January – through a tender that closed on 1 December. It sought the partial cargo to replace a cancelled delivery from the Bintulu project, market participants said. Saibu Gas typically relies on term supplies from Bintulu, gas retailer Tokyo Gas and Russia's 9.6mn t/yr Sakhalin to meet its LNG requirements.