Qatar will invest £85m in a Rolls-Royce led programme to build a new generation of smaller nuclear reactors, as part of the UK’s push to meet its 2050 net zero carbon targets.

The investment by the Gulf state’s sovereign wealth fund is a significant boost to the programme, which is aiming to develop a UK-designed small nuclear reactor to be built in factories and then assembled on site, reducing the risks and huge costs of construction of big nuclear power plants.

UK ministers announced last month that they would commit £210m of grant funding to the Rolls-Royce led programme after the aero-engine maker said it had received £145m of investment from two private sector backers. Rolls-Royce is putting in £50m.

Under the terms of the latest agreement, Qatar will invest £85m in the consortium, Rolls-Royce Small Modular Reactor, for a 10 per cent stake.

US energy company Exelon Generation and BNF Resources, an investment vehicle backed by members of France’s wealthy Perrodo family, will own 20 per cent. Rolls-Royce, which has developed the SMR business for the past six years, will own the remaining 70 per cent.

The Qatari backing will help the consortium fund its design through the first two stages of the UK’s rigorous regulatory process for assessing nuclear reactors, which is expected to take about four years. Rolls-Royce is hoping to build the first SMR early in the next decade.

Rolls-Royce’s design has a generation capacity of 470MW, which is small compared with Hinkley Point C, a 3.2GW two-reactor nuclear plant under construction in Somerset in south-west England. But its capacity is not far off some of Britain’s earliest nuclear power stations.

The government has committed to supporting both smaller and large-scale nuclear plants as part of plans to create jobs and help meet future electricity demand, which is expected to double by 2050. Other countries including the US and France are developing SMRs.

However, sceptics argue that Rolls-Royce’s small nuclear reactor is not yet proved and will come too late to make a significant contribution to the UK’s recently announced target to make electricity generation net zero on carbon emissions by 2035.

Mansoor bin Ebrahim Al-Mahmoud, chief executive officer of the Qatar Investment Authority said the fund was “investing in the energy transition and funding the technologies that enable low carbon electricity generation”.

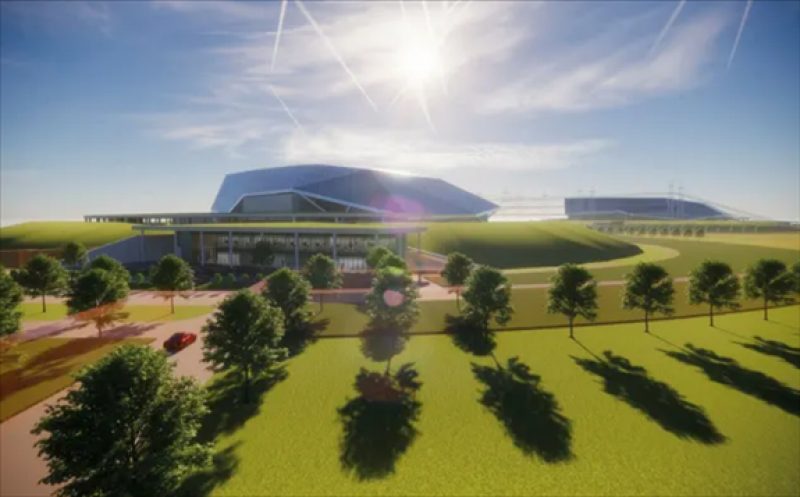

Qatar’s investment comes after it announced last month that it would partner Rolls-Royce to build a UK science and engineering campus to develop green technology start-ups.

The gas-rich Gulf state already has a relationship with Rolls-Royce: Qatar Airways is one of the biggest customers for its Trent jet engines.

For Rolls-Royce, the partnership and the small nuclear reactor project are among a number of initiatives it is pursuing to convince investors that it could benefit from global efforts to combat climate change.