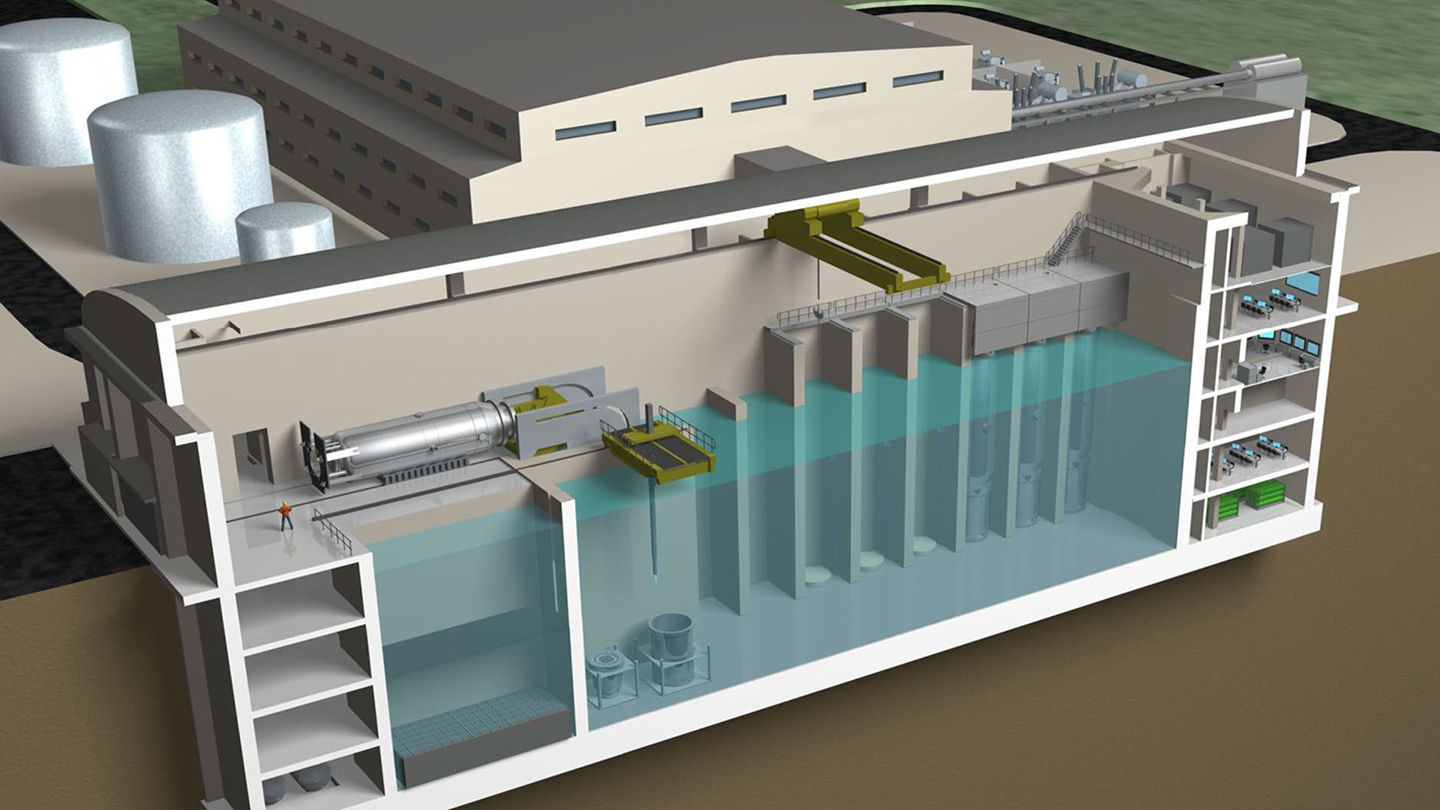

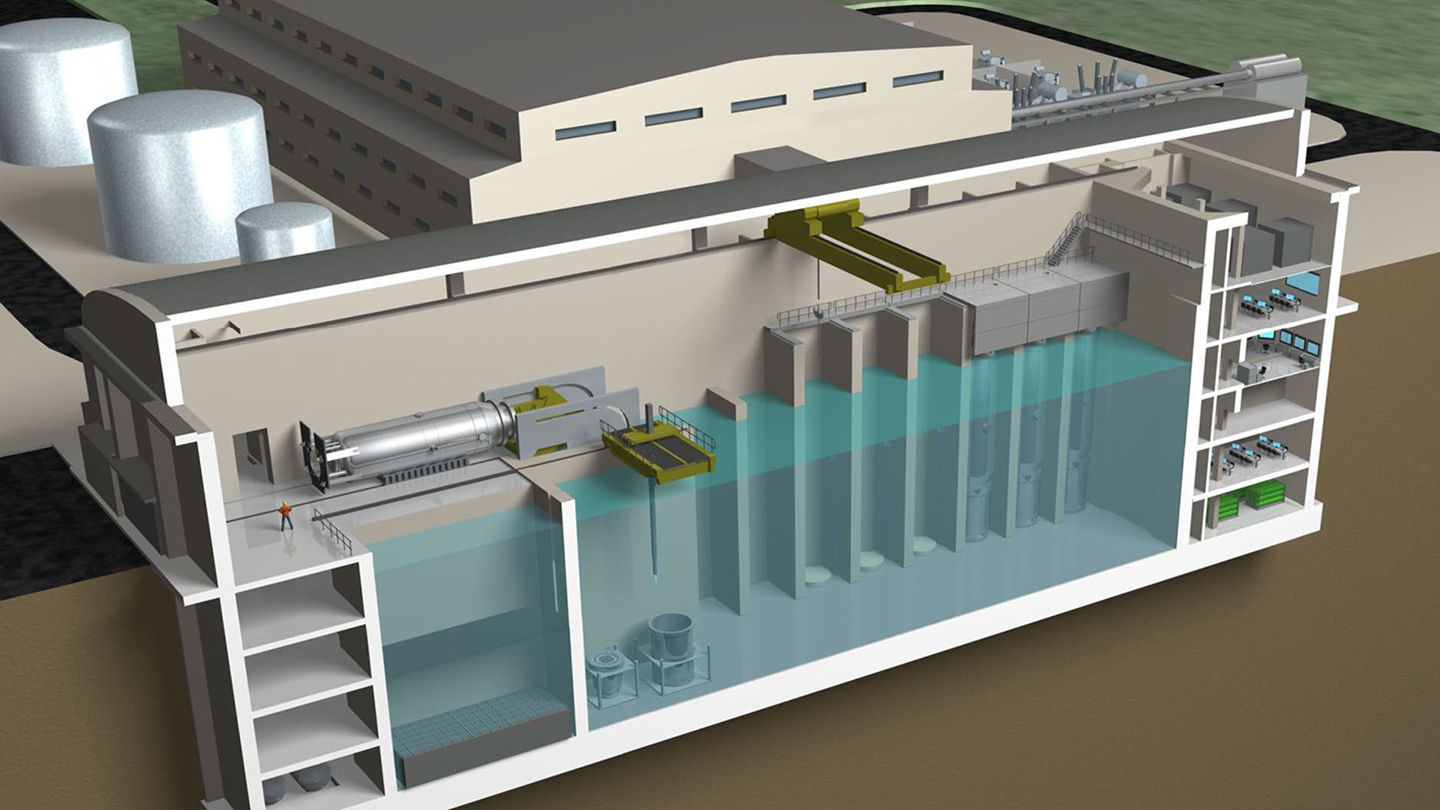

SMR plant cutaway (Courtesy: NuScale).

SMR plant cutaway (Courtesy: NuScale).

NuScale calls IEEFA’s report “factually inaccurate.”

“Too late, too expensive, too risky and too uncertain” is how a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) described NuScale’s proposed small modular reactor (SMR) project.

The analysis, released by the institute February 17, primarily focuses on the SMR project the Oregon-based company is building for Utah Associated Municipal Power Systems (UAMPS) at a U.S. Department of Energy (DOE) site in Idaho. However, the institute noted it was outlining cost risks, construction timelines, and competitive alternatives for all buyers in the SMR market.

In 2020, NuScale received U.S. Nuclear Regulatory Commission (NRC) approval on its SMR design, the first design approval for a small commercial nuclear reactor. SMRs have a smaller footprint, capacity and anticipated cost than traditional high-capacity nuclear power plants.

NuScale is among several companies developing SMRs, with the intent of reigniting the country’s nuclear power sector. The company touts its reactors as “smarter, cleaner, safer and cost competitive.”

The SMRs are light-water reactors, which represent most of the reactors now in operation. But modular reactors are designed to use less water than traditional ones and have a passive safety system enabling them to shut down automatically, should something go wrong.

The federal government has invested in the development of SMRs, and the NuScale site is no exception. In October 2020, UAMPS received a nearly $1.4 billion, 10-year award from the DOE to help fund the project.

However, in its report, IEEFA said there are “uncertain implications for the units’ cost, performance and reliability,” and that NuScale makes overly optimistic claims in each of these categories.

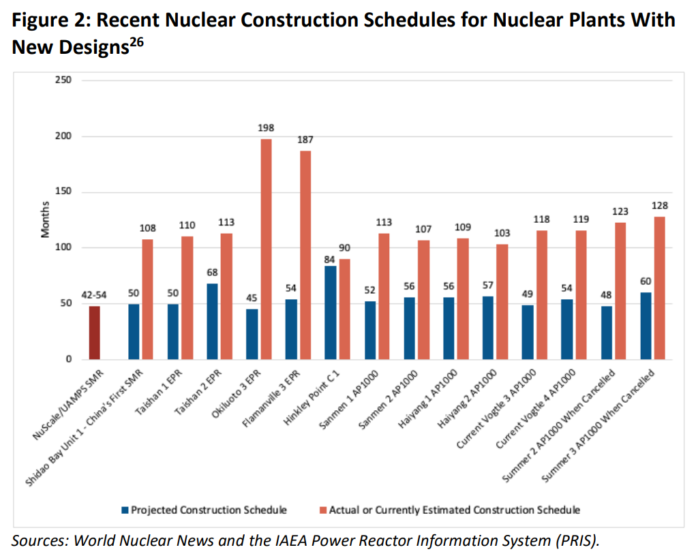

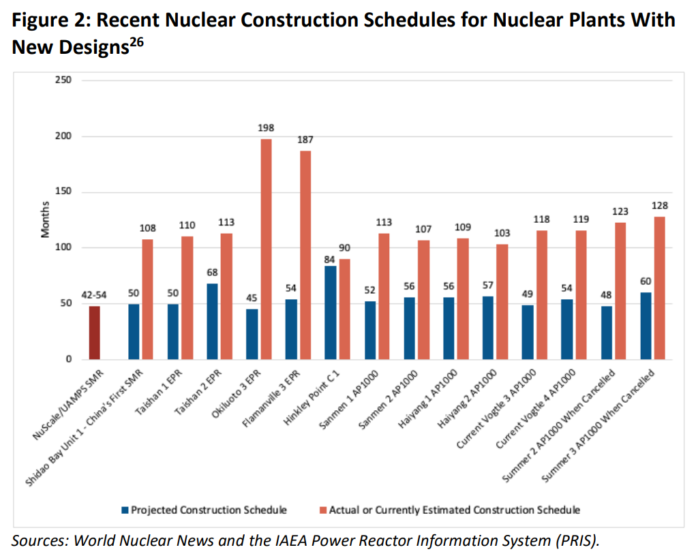

NuScale said its plant has a construction period of “less than 36 months from the first safety concrete through mechanical completion,” according to reports on the company’s website. But the institute said based on recent nuclear industry experience, plants with new reactor designs have taken more than twice as long to build as the owners projected at construction start, resulting in “delays of four years or longer before the start of commercial operations.”

(Source: IEEFA report).

(Source: IEEFA report).

IEEFA also noted NuScale’s project design has changed repeatedly throughout the development process. In July 2021 UAMPS said it would be downsizing the project from 12 to six modules, with 462 MW of power. NuScale recently projected the project’s first module, once expected to deliver in 2016, would come online in 2029, with all six modules online by 2030.

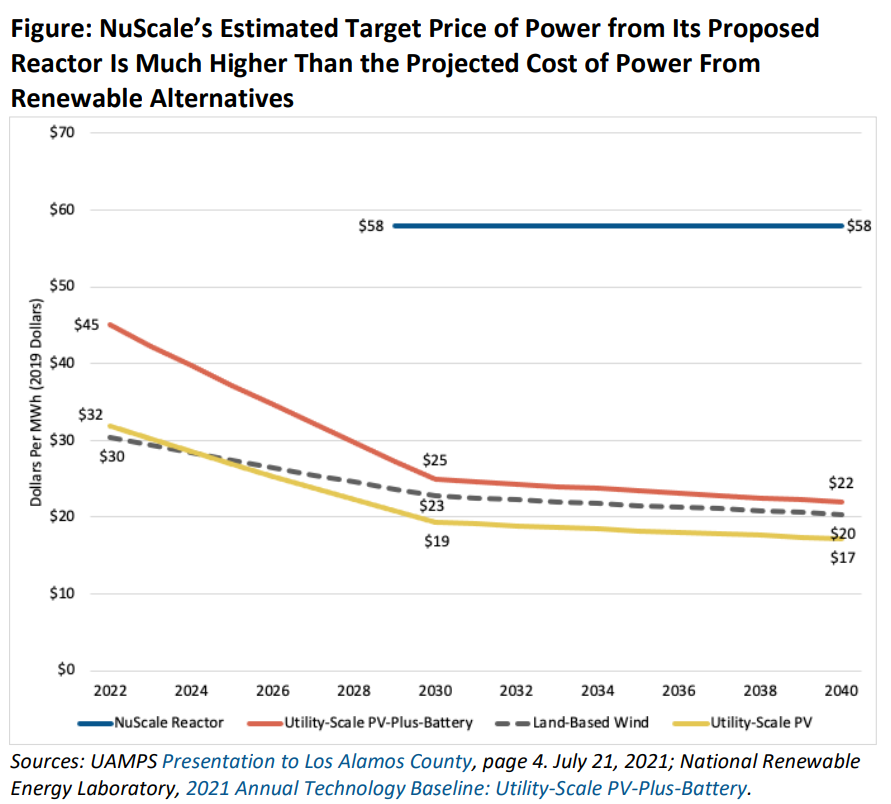

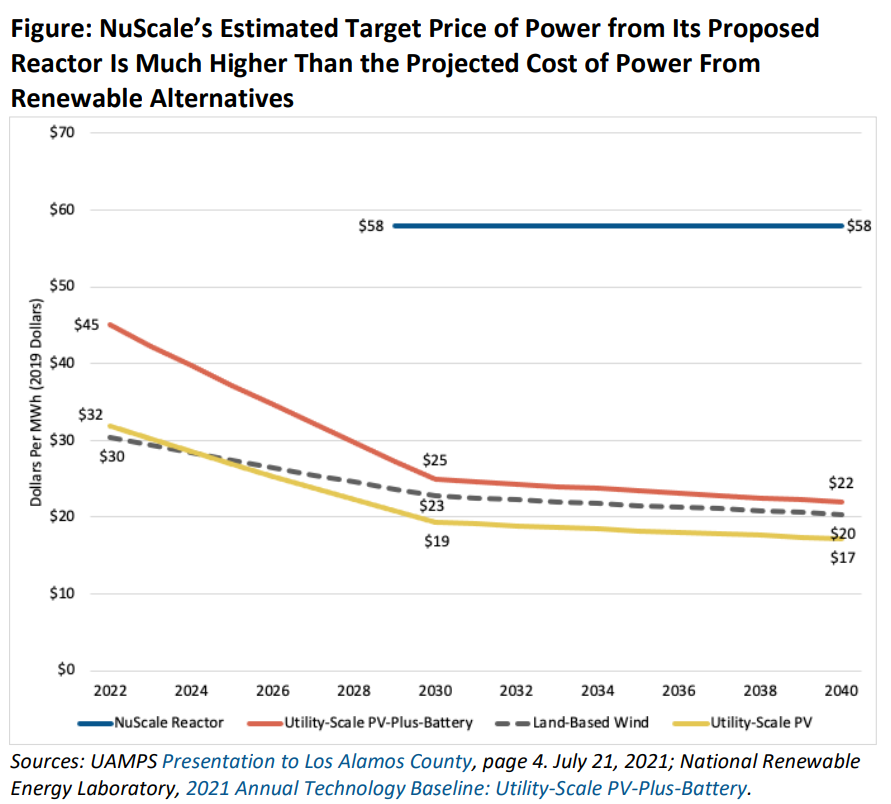

The institute also doubted NuScale’s ability to keep construction costs in check, thereby meeting a target power price of less than $60/MWh, set in mid-2021.

The nonprofit noted costs for all recent nuclear projects have vastly exceeded original estimates. It cited cost overruns at the embattled Plant Vogtle in Georgia, the project “most like NuScale in terms of modular development” where costs “now are 140% higher than the original forecast.”

“This first-of-a-kind reactor poses serious financial risks for members of [UAMPS], currently the lead buyer, and other municipalities and utilities that sign up for a share of the project’s power,” IEEFA researchers wrote.

(Source: IEEFA report).

(Source: IEEFA report).

The report also cited the new wind, solar and energy storage that have been added to the grid in the last decade, along with significant additional renewable capacity and storage expected to come online by 2030. IEEFA added new techniques for operating these renewable and storage resources, along with energy efficiency, load management and broad efforts to better integrate the western grid would undermine NuScale’s affordability and reliability claims.

“This new capacity is going to put significant downward pressure on prices, undercutting the need for expensive round-the-clock power,” the institute said.

In responding to the IEEFA report, NuScale told Power Engineering it didn’t have the opportunity to respond to the institute’s analysis prior to its publication.

“It’s unfortunate when a report is entered into the public discourse when it is factually inaccurate and inherently flawed in its assumptions and conclusions,” said Diane Hughes, Vice President, Marketing & Communication for NuScale. “This report provides a wholly uninformed view of the value of advanced nuclear energy technology in meeting our energy needs and climate goals.”

She added: “The report also mischaracterizes NuScale’s costs, does not accurately reflect or examine schedule timeframes and even fails to understand the output of a NuScale VOYGR facility.”

VOYGR is the official name of NuScale’s small modular reactor.

“We remain committed to having an informed discussion with any organization that is focused on providing a reliable, safe, affordable, and operationally flexible carbon-free energy future,” said Hughes.

In December 2021 the company and Spring Valley Acquisition Corp., a publicly traded special purpose acquisition company, reached a merger agreement with an estimated enterprise value of $1.9 billion.

Upon completion of the transaction, Fluor projects to control around 60% of the combined company, based on the PIPE investment commitments and the current equity and in-the-money equity equivalents of NuScale Power and Spring Valley.

Existing NuScale shareholders, including majority owner Fluor, will retain their equity in NuScale and roll it into the combined company. Fluor will also continue to provide NuScale with engineering services, project management, administrative and supply chain support. Additional investors in NuScale include Doosan Heavy Industries and Construction, Samsung C&T Corp., JGC Holdings Corp., IHI Corp., Enercon Services, Inc., GS Energy, Sarens and Sargent & Lundy.

In April 2021, Japanese project firm JGC Holdings Corp. announced it was investing $40 million in NuScale Power.