Stock image

Stock image

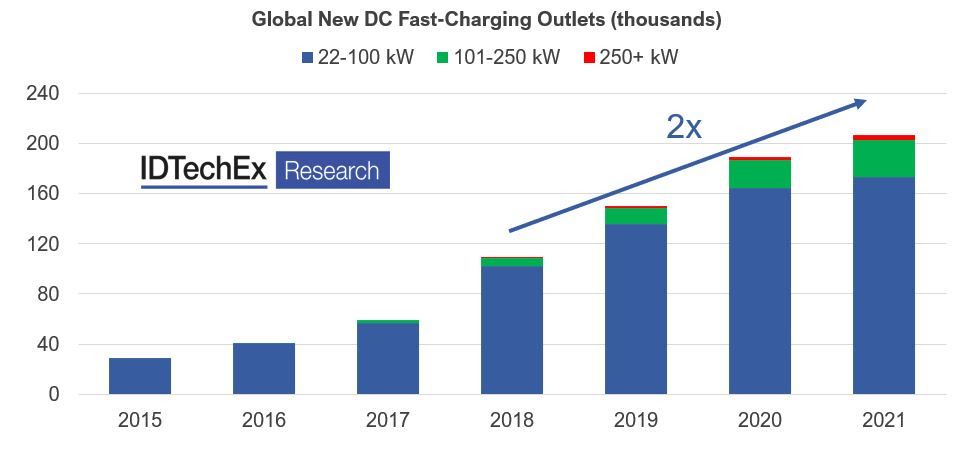

A new report by IDTechEx estimates that there will be 18.7 million units in electric vehicle fleets including electric vans, trucks, and buses on the road by 2032, which explains the current ramp-up of charging infrastructure.

According to the market researcher, a holistic approach is being taken where fast chargers, destination chargers, and home chargers all play an important role in supporting the different electric segments.

“The industry is seeing increased investments, collaboration, and innovation that will hopefully help today’s parking lots become tomorrow’s charging stations,” the report reads.

As an example, IDTechEx mentions Daimler Trucks’ commitment to initiating and accelerating the necessary build-up of charging infrastructure for commercial vehicles, something the company plans to accomplish by establishing joint ventures that will help set up a public charging network for battery-electric heavy-duty long-haul trucks and coaches.

“In Europe, they are investing a whopping €500 million together with their largest truck-making competitors Traton and Volvo Group,” the dossier points out. “They plan to install and operate at least 1,700 charging points which are speculated to be in the 250+ kW all the way up to the megawatt charging levels. This charging network not only shows collaboration between three competitors, but the network will also be open and accessible to all commercial vehicles in Europe, regardless of brand.”

The report also mentions that in North America, Daimler has secured €580 million in investments from NextEra Energy Resources and BlackRock to establish a megawatt-charger network that also includes hydrogen refuelling stations.

“BlackRock has also previously invested €700 million in Ionity and is showing support for a rapid expansion of the necessary charging network to be able to contribute to reaching climate targets,” the report reads. “The first megawatt chargers for Tesla’s Semi were also installed recently and attracted a lot of attention for their sheer size, being 7 feet tall.”

In the market analyst’s view, these investments present an opportunity for charging companies that will be capitalizing on different revenue streams such as hardware, installation, maintenance, and operation of these chargers.

For IDTechEx’s experts, chargepoint operators would like to benefit from increased utilization at their sites and minimal downtime. This is why larger networks are either buying out smaller charging networks and rebranding them as their own or enabling roaming agreements that allow users of one network to use another.

“This method of expansion is commonly seen in the EV charging market – merger and acquisition activity is high. This benefits the EV user as well since they are not exclusively reliant on one network but instead have a choice. By enabling roaming agreements, the billing models are simplified too – the customer can simply pay as they go rather than relying on a subscription-only model,” the report states.

In addition to new business models, there is a move towards a universal adapter with automated conductive charging via robots being one of the most recent proposals to eliminate confusion or concerns around charging connectors and handling heavy cables.

“Companies are working on combining the convenience of wireless charging with the power delivery and efficiency of conductive charging,” IDTechEx’s analysis reads. “Easelink’s Matrix Charging system and Continental’s charging robot are pioneering this technology. They both offer a fully automatic charging solution by retrofitting one unit in the underbody of the vehicle and another on the parking spot. As soon as the car is parked, the two components connect automatically and charging at up to 22 kW begins – without the driver ever stepping out or handling the charging cable.”

For the market research firm, such wireless systems are likely to play a key role in the future, given the current rise in autonomy and electrification of fleets.