A year after President Joe Biden signed an executive order calling for a review of American supply chains, the Department of Energy released what it called its first-ever comprehensive assessment of the U.S. clean energy supply chain.

The coronavirus pandemic amplified pressure on the clean energy supply chain, which was already facing constraints caused by limited rare minerals and foreign dominance of manufacturing. Now, bolstering the domestic clean energy supply chain is one of the most critical steps for the U.S. to have a chance at meeting its goal of net-zero emissions by 2050.

The report outlines detailed strategies that the Biden administration hopes will "secure America's position as a clean energy superpower."

Broadly speaking, DOE identified seven goals to improve the U.S. clean energy supply chain:

1. Increase domestic raw material availability

2. Expand domestic manufacturing capabilities

3. Invest and support the formation of diverse and reliable foreign supply chains to meet global climate ambitions

4. Increase the adoption and deployment of clean energy

5. Improve end-of-life waste management

6. Attract and support a skilled U.S. workforce for the clean energy transition

7. Augment supply chain knowledge and decisionmaking

Through executive action, DOE determined that the Biden administration should support innovative and sustainable means of critical mineral extraction and refining, expand loan and grant funding opportunities to encourage domestic manufacturing, and leverage federal purchasing power to "provide a sustainable demand signal" for domestic manufacturing.

Congressional action is needed, however, to provide tax incentives for clean energy manufacturing and deployment, appropriate funding to DOE to support domestic critical material supply, and provide funds for regional and state-level workforce development partnerships.

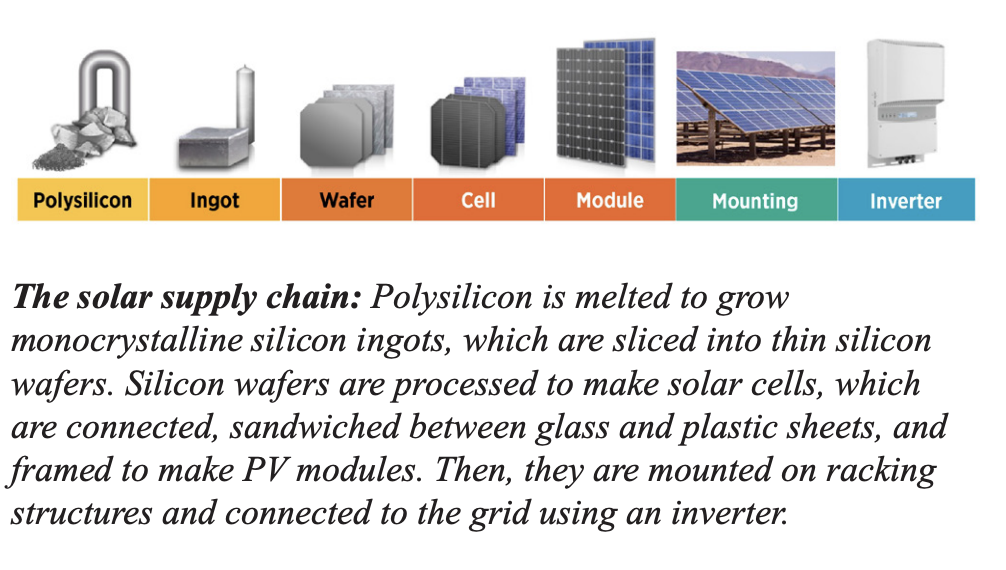

Solar PV

The solar PV supply chain remains heavily reliant on China, but opportunities exist to embolden domestic manufacturing, DOE said.

A recent report from the Ultra Low Carbon Solar Association found that Chinese producers hold 83% of global capacity for polysilicon production, 96% for wafers, 79% for cells, and 70% for modules.

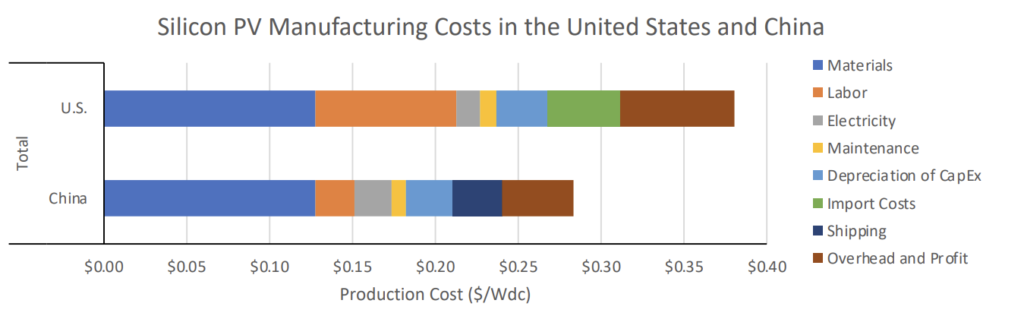

The DOE report said incentives could offset the higher cost of solar PV manufacturing in the U.S., which can be 30-40% higher. A prime example of those cost pressures, LG recently announced that it will exit the solar industry entirely, resulting in the closure of its Huntsville, Alabama manufacturing facility, because of "uncertainties" in the market.

DOE recommended that the U.S. expand thin-film module production, which isn't reliant on China for input materials. The agency suggested that cell production and establishing the first international standards for inverters also present opportunities to improve the domestic supply chain.

The U.S. solar PV supply chain will, above all else, need significant financial support from the federal government, the report notes. With the right support, the U.S. could take strategic actions on workforce development, manufacturing, human rights, and trade.

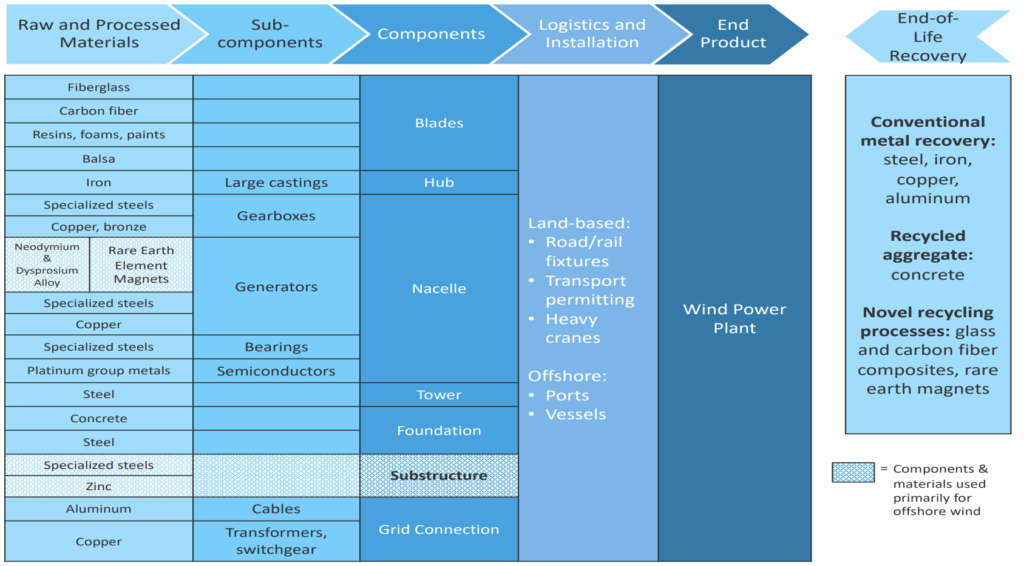

Wind

Meeting U.S. onshore and offshore wind goals will "require significant expansion of domestic supply chains, according to DOE. The Biden administration has a goal of developing 30 GW of offshore wind by 2030.

The DOE report called for the acceleration and expansion of the domestic offshore and onshore wind supply chains through tax incentives that support manufacturing and deployment. Domestic content in onshore wind turbine blades has declined in recent years, the agency noted.

Financial support will also be needed to spur offshore wind port and vessel infrastructure, both of which are in their infancy. The federal government can also help by prioritizing financing of offshore wind ports and vessels through the Department of Transportation Maritime Administration programs and the DOE Loan Programs Office.

Energy storage

The expansion of energy storage capacity is critical to the U.S. supporting the electric grid with, primarily, renewable energy sources like wind and solar.

The U.S. energy storage supply chain remains vulnerable, though, because three or fewer countries control more than half of the mine production needed for lithium-ion batteries. Demand for batteries by the electric vehicle industry is also straining supply chains.

The U.S. energy storage supply chain, specifically for lithium-ion batteries, is at a "significant disadvantage" when compared to China, and the rest of Asia and Europe, in some cases.

DOE recommended that the U.S. focus on the development of sustainable upstream, midstream, and recycling facilities to support grid storage, as well as the development of an industry for end-of-life batteries to be used for grid storage. The report also recommended development and deployment of diverse long duration energy storage applications.

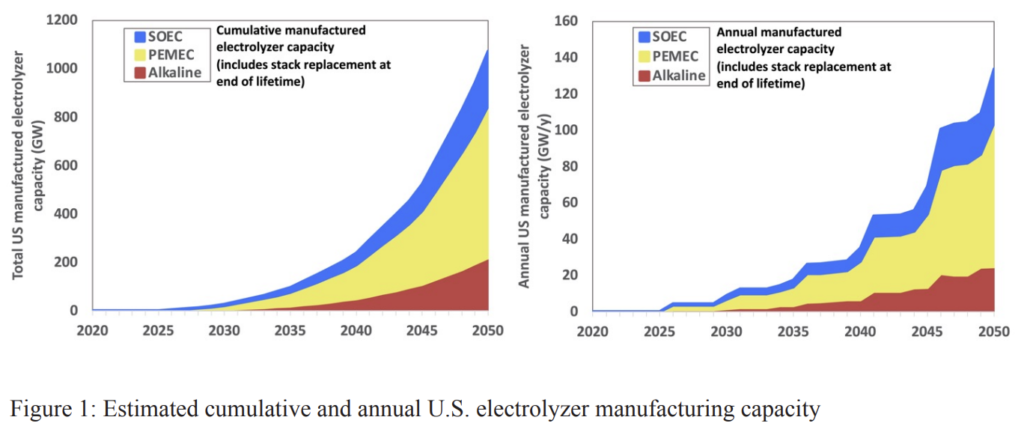

Hydrogen

Hydrogen presents opportunities for the U.S. to decarbonize heavy industry, shipping, and the electric rid. Producing zero or low-carbon hydrogen, however, remains a challenge due to, in part, the limited availability of electrolyzers and high cost of production.

The U.S. hydrogen market is currently 10 MMT/yr and 65-100 MMT/yr globally, according to DOE. Green hydrogen remains, still, an insignificant slice of production, as electrolyzer capacity today is only 170 MW.

However, looking ahead to 2050, DOE expects the market for green hydrogen to grow to 100 MMT/yr with 1,000 GW of electrolyzer capacity.

DOE determined that government policy is necessary to scale green hydrogen production, even though the U.S. currently has the necessary manufacturing capabilities and materials.

Hydropower (and pumped storage)

The Hydropower Supply Chain Deep Dive Assessment seeks to identify potential bottlenecks, challenges, and opportunities, particularly if the U.S. demand for hydropower components grows significantly to meet decarbonization targets. It found that while the existing U.S. supply chain is mature and effectively supports the nation’s large hydropower fleet, anticipated new construction and the need to complete refurbishments, upgrades, and relicensing activities point to the need to scale up domestic supply chain activities.

Growth in U.S. demand for hydropower components and related services may arise from a combination of increased refurbishments and upgrades — partly connected to the wave of Federal Energy Regulatory Commission relicensing activity expected to take place during the 2020s — and construction of the new hydropower capacity needed to achieve clean energy goals. However, the U.S. hydropower supply chain faces vulnerabilities related to securing large components with long lead times, managing global disruptions and maintaining a well-trained workforce.

Modernization of the existing hydropower fleet, along with new construction, could drive the expansion of domestic manufacturing, restoring, and foreign direct investment in the U.S. hydropower supply chain. Reshoring manufacturing of critical components — or those that are difficult or impossible to source domestically (such as large steel castings, forgings and windings for generators) — should be a high priority to improve supply chain resilience and meet increased U.S. demand for domestically produced hydropower components.

Electric grid

Expansion of the U.S. electric grid's transmission infrastructure is crucial to accommodate the rapid uptake of renewable energy sources.

Bottlenecks in component suppliers for large power transformers (LPT) has limited manufacturing, DOE said. The agency also noted a significant bottleneck for the High-Voltage Direct Current (HVDC) transmission supply chain caused by fragmented Regional transmission Organizations and investor cost-recovery uncertainty.

DOE recommends the engagement of government and private sector entities to expand research and development of LPTs and expand government funding opportunities for manufacturing. The agency said the government should also incentivize domestic production of energy components, such as HVDC.