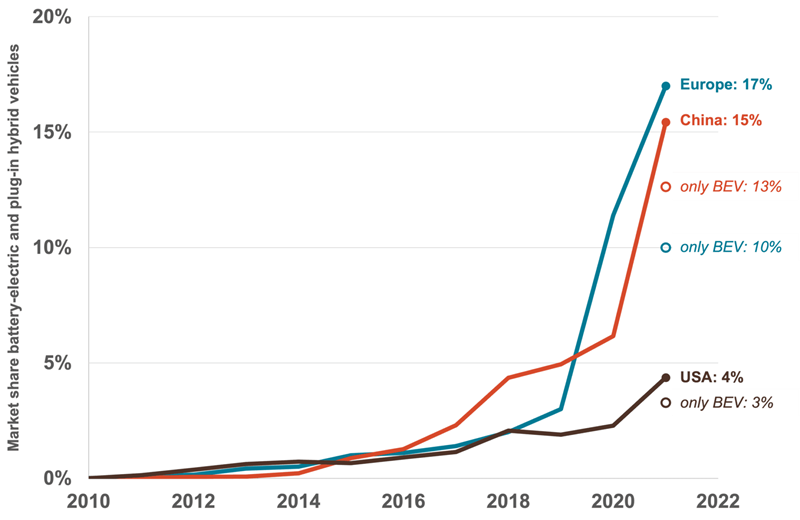

Not too long ago, back in 2015, the share of electric vehicles among new registrations was below 1% in all three markets. Then, in 2017 and 2018, China took the lead.

By 2019, electric vehicles accounted for 5% of all new passenger car registrations in China, while Europe and the United States were still stuck at 3% and 2%, respectively, as can be seen in the first figure below.

This electric vehicle growth in China was mainly driven by the national strategies for electric vehicle development, as well as three types of concrete policies: pilot programs, incentives, and regulations.

Next, it was on Europe to take the lead. The market share of electric vehicles in Europe quickly increased from 3% in 2019, to 11% in 2020, and to 17% in 2021.

The key driver behind this sudden jump was the second round of European CO2 targets for new cars taking effect. Meanwhile, the electric vehicle market share in China only saw a moderate increase from 5% to 6% in 2020 but then quickly reached 15% in 2021.

All these developments relate to market shares only. In terms of absolute sales, China clearly remains in the lead, with more than 3 million electric cars newly registered in 2021, compared to 1.9 million in Europe.

In the United States, electric vehicles are not yet as popular as in China and Europe. The market share almost doubled in 2021, going from about 2% in 2020 to 4% in 2021.

But still, neither absolute sales numbers (0.7 million in 2021) nor the percentage share in the U.S. are anywhere near the Chinese and European markets. This is likely the result of a combination of the Trump Administration rolling back the 2021–2026 U.S. light-duty vehicle efficiency standards as well as the absence of clear electrification targets.

The performance of Europe is a bit less impressive if only counting battery electric and fuel cell vehicles. The market share of those vehicle types was around 10% in 2021, and another 7% of new registrations in Europe were plug-in hybrid vehicles.

On average, plug-in hybrids emit about two to four times more CO2 than according to the official test values, because typical driving and charging patterns result in a much higher combustion engine usage than anticipated. In China and the United States, plug-in hybrids play less of a role than in Europe. In both markets, plug-in hybrids account only for about 1%–2% of new vehicle registrations.

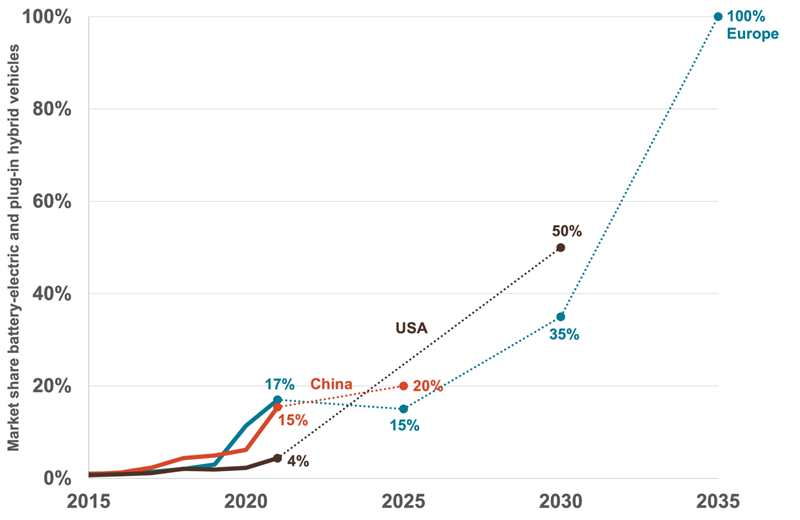

FIGURE 1. HISTORIC DEVELOPMENT OF THE SHARE OF BATTERY-ELECTRIC AND PLUG-IN HYBRID VEHICLE MODELS AMONG ALL NEW VEHICLE REGISTRATIONS AS WELL AS FUTURE TARGETS, FOR CHINA, EUROPE, AND THE UNITED STATES.

For future years, Europe has proposed the most ambitious targets of the three regions. In mid-2021, the European Commission came forward with a regulatory proposal to set a 100% target for fully electric vehicles by 2035.

In the meantime, current regulation foresees a 15% target for fully electric and plug-in hybrid vehicles by 2025 and a 35% target for 2030. However, as can be seen in the figure below, the 2025 target in particular lacks ambition given that it was already over-achieved in 2021.

For China, the current electric vehicle target contained in the 14th Five-year-plan Energy Saving and Emission Reduction Work Plan is 20% by 2025.

The main national regulatory approach is the new energy vehicle (NEV) mandate, which mandates manufacturers to produce NEVs to meet credit requirement while allowing manufacturers to use extra NEV credits to comply with their corporate average fuel consumption requirements.

In light of China’s significant electric vehicle growth in 2021, an updated vision with more ambitious targets, as well as a longer-term plan for full electrification, would help China to sustain its upward electrification trend.

In the United States, President Biden has proposed a target of 50% electric vehicle sales share by 2030. In December 2021, the revised light-duty vehicle greenhouse gas emission standards for model years 2023 and beyond, issued by the U.S. Environmental Protection Agency, will get the U.S. fleet back towards meeting the carbon emission reduction targets. That rulemaking estimates an electric vehicle penetration of 17% of the light-duty vehicle fleet by 2026.

FIGURE 2. DEVELOPMENT OF THE SHARE OF BATTERY-ELECTRIC AND PLUG-IN HYBRID VEHICLE MODELS AMONG ALL NEW VEHICLE REGISTRATIONS IN CHINA, EUROPE, AND THE UNITED STATES.*

No doubt, the global race towards electrification continues. And the speed is accelerating, quickly making previous targets seem outdated, particularly in Europe.

In upcoming months, it will be up to the European Parliament and the EU Member States to take the next step by confirming, and possibly further tightening, the 2035 phase-out target for combustion engine vehicles, as suggested by the European Commission, as well as adjusting the 2025 and 2030 interim targets so that they are more in line with current market trends and the longer-term trajectory.

In China and the United States policymakers will not hold still and are expected to closely monitor the political decisions in Europe while updating their own electric vehicles’ targets.

*Data for China and the United States is taken from Marklines. Data for Europe is taken from the European Environmental Agency (EEA) and Dataforce. Data for China and Europe only includes passenger cars, while data for the United States also includes light trucks.