Major capacity additions in Asia’s non-hydropower renewables sector will facilitate the region’s ability to supply electricity amid rising power consumption needs, which look set to outpace all other regions as economies continue to expand after the easing of COVID-19 restrictions, according to a Fitch Solutions’ report.

The research firm found that the continent was pivoting toward renewables such as solar and wind for power generation over the use of hydropower and coal that has typically dominated Asian markets, although coal will still play a significant part in the region’s energy mix for years to come.

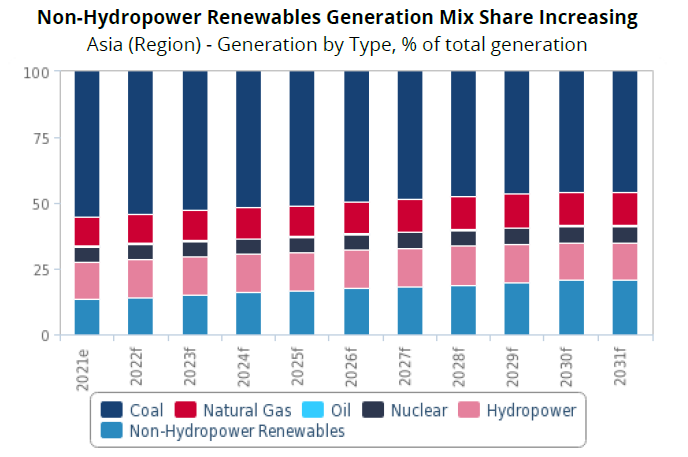

“This surge in net capacity additions of non-hydropower renewables will be able to facilitate a robust growth in electricity generation,” said Fitch Solutions, adding that this played into its forecast that non-hydropower renewables’ share of the generation mix will increase by about 7.3%, from 13.3% at end-2021 to 20.6% in 2031.

“This increase in non-hydropower renewables generation will be about 2,060TWh at an annual average growth of 8.4% from 2022 to 2031,” said the report.

The report pointed to a number of examples of Asian countries prioritising non-hydro renewables, such as markets in the Mekong region expanding into solar and wind over hydropower, Thailand investing heavily in floating solar projects – which are on the rise globally – and Vietnam offering strong state support for renewables development.

The growth in non-hydro renewables is expected to supply Asia’s growing power needs, with the continent projected to make up more than half of global power demand. “We estimate Asia’s share of global power consumption to be 50.7% and will increase to 55.0% by 2031,” said Fitch Solutions. “This corresponds to an increase of 4,501TWh at an annual average growth of 3.1% from 2022 to 2031.”

Nonetheless, Asia will continue to rely on its well-established coal power sector on top of its growing non-hydropower renewables sector to supply power to its economies as they increase activity following the pandemic-induced slowdown.

Coal-fired power generation remains Asia’s dominant power type, estimated at 56% of the region’s generation mix as of end-2021, according to Fitch Solutions. “This is largely due to the region’s well-developed coal sector, with major power markets like China and India that will still require years to wane their heavy dependence on coal.”

In other Asian news from Fitch Solutions, the Philippines looks set to significantly ramp up its solar deployment in line with a rapidly-expanding project pipeline and growing regulatory support.