The gas industry portrays fossil hydrogen — also known as 'blue' hydrogen — as a climate friendly replacement for fossil fuels. But as Welsh crooner Mandy Rice-Davis might've said about gas lobbyists' claims for fossil hydrogen, they would say that, wouldn't they.

This is because large amounts of fossil gas are needed to produce fossil hydrogen, so promoting it as a 'climate solution' helps gas companies to stay in business, even though their business is destroying the climate and urgently needs phasing out.

When it's made from fossil gas, hydrogen dumps huge volumes of climate heating pollutants into the atmosphere. But no need to worry, say industry lobbyists, who claim that some of these emissions will be reduced by 'carbon capture' equipment.

Yet this is a failing technology that hasn't captured anything like the amount of carbon promised by industry, and it's unable to stop the climate-killing methane emissions that are also produced by fossil hydrogen.

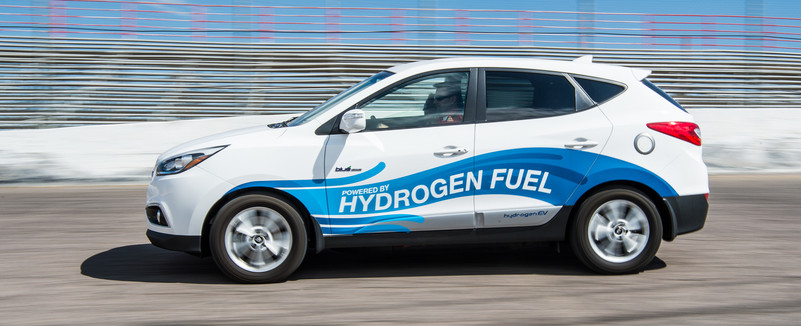

Hydrogen can also be made from renewable energy sources such as wind or solar. If it's produced in the right way, renewable hydrogen is virtually carbon free.

But because this type of hydrogen does nothing to keep fossil gas flowing through the energy system, it comes as no surprise that fossil fuel lobbyists are more focused on getting subsidies for gas-guzzling fossil hydrogen.

High prices

Following the war in Ukraine, the European Commission is working on a plan to end the EU's gas imports from Russia well before 2030. This was spurred by the knowledge that huge EU payments for Russia's fossil fuels are bank-rolling its military, a problem that civil society groups had been highlighting for many years.

Analysis from Rystad Energy, an industry research group, suggests that cutting Russian gas imports could also cause Europe to turn its back on fossil hydrogen.

Some 20 fossil hydrogen projects have been announced or are under development in Europe, according to Rystad's report. Companies with plans to produce fossil hydrogen in the region include Shell, BP, Equinor, Total, and Eni.

These projects would need reliable and affordable flows of fossil gas to produce hydrogen. But even before the Russia-Ukraine conflict, a global supply shortage had pushed gas prices to all-time highs in Europe, and caused an energy crisis that threatens to persist into 2023.

As gas is a key input for making fossil hydrogen, higher prices mean higher costs for producers. At the start of 2021, fossil hydrogen was sitting pretty, with low gas prices making it at least a third cheaper than renewable hydrogen, its main competitor.

At this time, renewable hydrogen wasn't expected to become cost competitive against fossil hydrogen until around 2030. But in October last year, rocketing gas prices had made fossil hydrogen almost twice as expensive as renewable hydrogen.

By the end of 2021, energy experts were wondering if fossil hydrogen had become a white elephant, with billion-dollar projects at risk of becoming redundant from losing their cost advantage over renewable hydrogen a lot quicker than anticipated.

Fast forward to early March 2022, and Rystad's analysis shows the cost of fossil hydrogen in Europe had reached over US$13 per kilo.

This is a monumental hike from US$2.2 per kilo earlier in 2021, which pushed the cost of fossil hydrogen in Europe more than three times higher than renewable hydrogen.

Life support

Yet even tougher times could lie ahead for fossil hydrogen, as Europe's plans to drastically cut Russian gas imports amid a supply shortage on world markets are set to propel gas prices even higher.

As the International Energy Agency puts it, gas buyers are "fishing in the same pool for supply", so by turning to alternative exporters when markets are tight, Europe would place immense upward pressure on already very high prices.

Most of the planned fossil hydrogen projects in Europe are close to the North Sea, and would likely use North Sea gas to produce hydrogen.

But as Rystad's report points out, in the context of global supply shortages, North Sea production could be diverted to the market to replace Russian gas, leaving Europe's fossil hydrogen projects at risk of being cancelled or significantly delayed.

Given the choice of using gas to keep Europe's lights on and factories running, or using it to produce a niche fuel that can be made more cheaply and sustainably with renewable energy, the former is surely a wiser option when faced with limited supplies of gas.

At the same time, Europe's push to find alternative sources of fossil gas should not be used to justify investments in new gas infrastructure.

Replacing Russian gas must be a temporary measure that ends once renewables and energy savings are deployed at greater scale, otherwise it will push us closer to climate destruction.

The fact that Europe has enough potential to meet its hydrogen needs via renewable hydrogen shows that if scrapped, planned fossil hydrogen projects in Europe wouldn't be greatly missed.

Furthermore, the European Commission has unveiled plans to double its already ambitious targets for the production of renewable hydrogen in Europe by 2030, as part of its response to Putin's attack on Ukraine.

This could further accelerate cost reductions for renewable hydrogen, although strong EU rules are needed to ensure this production is genuinely sustainable, and that the hydrogen isn't wasted in sectors where direct electrification from renewables is more efficient.

Reports of death exaggerated?

In the face of prohibitively high costs, waning competitiveness, the threat of stranded assets and the risks associated with Russian gas supplies, investing in fossil hydrogen would seem a fool's errand.

Yet Germany's vice-chancellor Robert Habeck, federal minister for the economy and climate, and co-leader of the German Greens, doesn't appear to share this view.

In March the vice-chancellor met Norway's prime minister Jonas Gahr Støre, who has been lobbying Germany to rapidly develop a hydrogen market supplied by large-scale imports of fossil hydrogen from Norway.

As Norway has vast gas reserves and a state oil company investing billions in fossil hydrogen, climate watchers are concerned that the country is vying to become a major exporter of the fuel.

In a joint statement from the meeting, vice-chancellor Habeck expressed his wish to realise "the fastest possible high-volume imports of hydrogen" from Norway, and "jointly plan the use of blue [fossil] hydrogen for a transition period."

Barely a week later, the German vice-chancellor was in the United Arab Emirates, signing several deals to secure hydrogen supplies from the country. According to a report in Euractiv, all of the contracts signed in Abu Dhabi appear related to fossil hydrogen, at least in their initial phase.

Clearly, vice-chancellor Habeck missed the memo that along with damaging the climate, fossil hydrogen might also be a busted flush.

By ramping up energy efficiency and 100% renewables, the EU could eliminate Russian gas imports by 2025, phase out gas altogether by 2035, and do so without making any further investments in fossil hydrogen.

For these reasons and more, the EU should ignore gas lobbyists' pleas for subsidies to boost fossil hydrogen.

Instead of keeping it on life support, lawmakers should pull the plug on this dirty fuel, and direct public resources to rapidly scaling up renewables and energy savings.