Tesla is still aiming for annual energy storage deployments of 1,500GWh by 2030, which would require an average CAGR of 90% over the decade; something it achieve in the first quarter of this year.

The target was outlined in the previous impact report (2020) and repeated in its latest report for 2021. It is 375 times higher than last year’s deployment figure of 4GWh.

The target is certainly ambitious given it is nearly ten times what BloombergNEF reckons the entire global energy storage market by annual deployments will be by that point; 58GW/178GWh.

Tesla would need to maintain its current growth trajectory to reach its target, which implies a 93.4% CAGR from 2021 to 2030. The company’s storage deployments increased by 90% in the first quarter of this year, despite supply chain constraints.

By the end of the decade, it also aims to be selling 20 million EVs, which is more than 20x its 2021 figure of 940,000.

The Austin-headquartered company sells its home energy storage solution, the 13.5kWh Powerwall, as a product, which complements its solar roof and EV charging solutions. Its utility-scale energy storage solutions are the Power Pack and Megapack, the latter of which starts at 3MWh per unit.

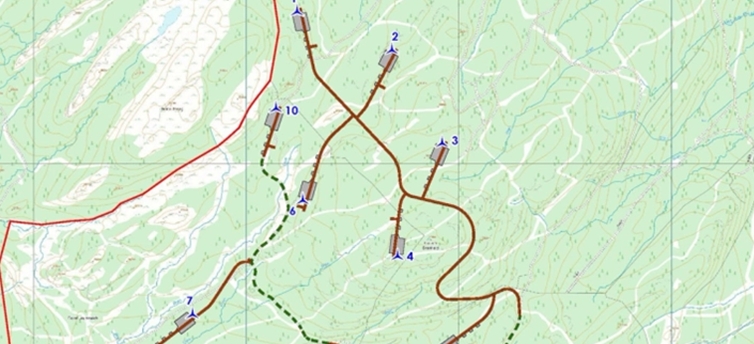

It was recently revealed that it will supply Power Packs to sister company SpaceX for an expansion of the on-site energy sources at its Starbase launch facility in Texas, while its Megapack unit was used in a recently-commissioned 730MWh battery energy storage system (BESS) at Moss Landing.

That 4GWh figure achieved in energy storage last year gave it a market share of over 15% of the global market last year of 25GWh, Tesla said, citing S&P Global figures. BloombergNEF’s slightly lower estimate for the 2021 market gives Tesla a higher market share, of 18.2%.