AXA IM Alts joins GreenStruxure’s impact investment partners Huck Capital and Inclusive Capital Partners, alongside strategic investor and technology partner Schneider Electric. In May GreenStruxure secured a $500mn commitment from ClearGen, a subsidiary of private equity giant Blackstone.

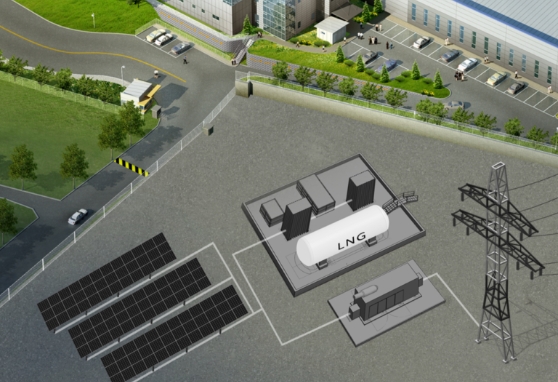

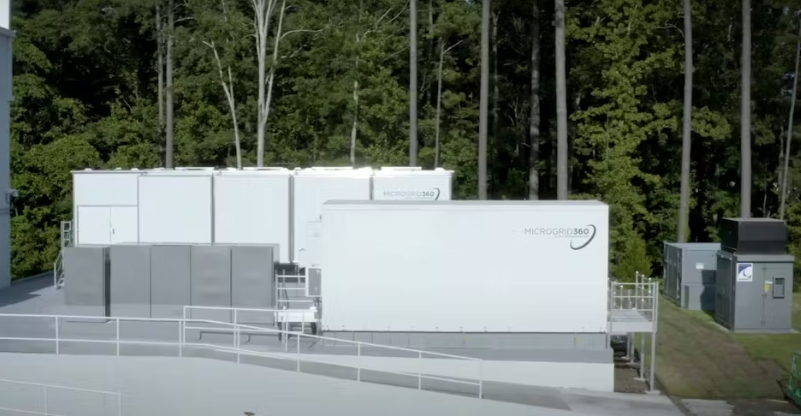

GreenStruxure designs, builds, operates and maintains on-site renewable energy microgrids for commercial and industrial buildings in the US.

It aims to simplify and accelerate market adoption of renewable energy microgrids, offering an innovative outcome-based alternative for building owners and operators who want sustainable, cost-effective, resilient, onsite energy delivered to them hassle-free as a service with no upfront capital expenses or operational risks.

The equity by AXA IM Alts will support GreenStruxure to continue its development in a sector in urgent need of decarbonisation, facilitating a step change for energy usage in hard-to-abate industries.

Building on 20 years of impact investing experience, AXA IM Alts seeks to address some of the biggest sustainability challenges globally, and climate change is at the forefront of the global sustainability agenda.

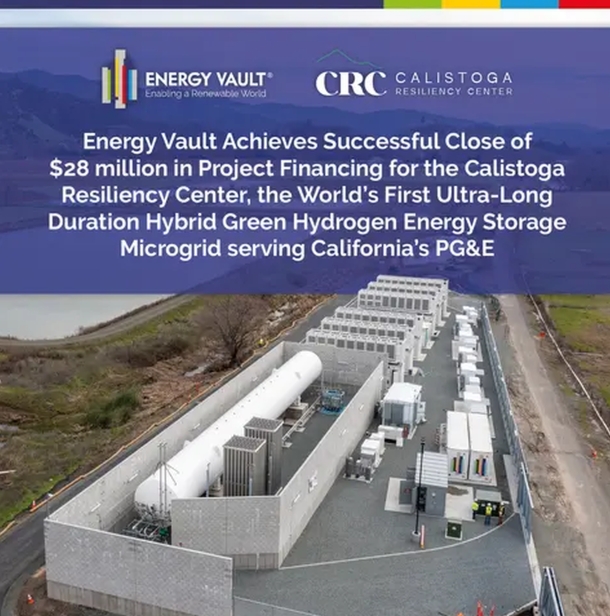

Jonathan Dean, Head of Impact Investing at AXA IM Alts, said GreenStruxure is a first mover in the Energy-as-a-Service microgrid space, which is providing sustainable, more resilient and stable energy solutions.

"GreenStruxure provides a clear opportunity to displace fossil fuel-based grid energy," he said. "This investment reinforces our continued commitment to climate action, namely our impact goals of evolving resource efficiency and providing sustainable solutions to the global market."

Demand for on-site renewable energy assets is growing rapidly as consumers are faced with rising energy costs, a desire to improve the sustainability of their operations, and service outages caused by extreme weather and natural disasters.

Financial benefits of heat-and-power microgrids

Using estimates from the Fourth National Climate Assessment for increases in extreme weather events and coastal infrastructure damage driven by climate change, McKinsey estimates that by 2050, the cost of damages and lost revenues would rise by 23% ($300mn), or approximately two to three additional years with major hurricane damage.

These projected increases are conservative, based on estimates of regional increases in extreme weather or storm damage due to sea-level rise. Combined, these estimates give a baseline of $1.7bn in economic damage for each utility by 2050.

Decentralising electricity generation is one of its key recommendations. "Locating smaller, utility-scale facilities closer to population centres can reduce reliance on long transmission lines that are vulnerable to damage during storms," it states. "It also means that if one facility goes down, others still keep going."

After Hurricane Irene knocked out power to many Connecticut residents in 2011, the state began encouraging the formation of microgrids to improve resiliency. Subsequently, the town of Fairfield launched a microgrid for its critical infrastructure services, including its police department, fire department, communications center, and homeless shelter.

While no storm has knocked out power to the main grid since installation, the town estimates the combined heat-and-power microgrid has saved the town an estimated $60,000 a year in electric expenses and $10,000 in heating expenses during normal operations - an example in which improving resiliency can be cost-effective.