Initial proposals were presented to the EC on March 23 and 24 and are now under review and consultation, with the EC set to publish its first draft of the act between October and December. EU member states can still object to these proposals through the summer.

While the classification would not stop lithium usage, it is highly likely that it would have an impact on at least four stages in the EU lithium battery supply chain: lithium mining; processing; cathode production; and recycling. Several administrative issues, risk management and restrictions could hit each of these fledgling industries in Europe, which would drive up costs.

“Should the European Commission take this decision, it may undermine the EU’s energy security and net zero goals, in addition to increasing costs for the domestic EV market. The EU is a global regulatory powerhouse, so any decision to classify lithium as Category 1A toxicant in the world’s largest single market will be keenly studied by regulators elsewhere. Industry hates regulatory uncertainty, so the longer it takes for a ruling, the more it will delay existing and significant investment decisions. This is more than a technicality; the impact could be far-ranging and wide,” says James Ley, Senior Vice President, Analysis

Implications for EV production

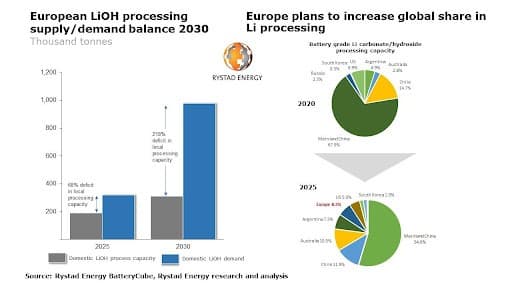

A drawn-out permitting process for new mining operations in Europe has already been highlighted at recent industry events as one of the main barriers to new mining projects ramping up quickly. Both lithium carbonate and hydroxide are critical to the battery raw material supply chain, with the bulk of new EV battery chemistries containing lithium. This potential ruling comes at a time when the EU is itself scrambling to build and establish local lithium supply chains. The permitting issue has repeatedly been highlighted at recent industry events as one of the main barriers to new mining projects ramping up quickly in the EU.

There is also further risk of potential projects losing local community support for building lithium mines and processing operations. Additional concerns could arise if the pending decision ends up slowing down the injection of further and much-needed new investment into the EU lithium mining and processing industries. Rystad Energy is aware of at least one new proposed lithium hydroxide processing operation that is now withholding its investment decision pending the outcome of the EC’s final resolution.

Industry seeks clarity

The lithium industry is urging the EC to reassess the RAC’s initial opinion. They also argue that the three lithium salts cannot be considered in the same light and that there is significant doubt as to the applicability of the read-across to lithium hydroxide due to its corrosive properties. An inappropriate classification of lithium salts would create business uncertainty, which would have numerous implications for future investment.

Other countries outside the EU may reach a different conclusion on the classification, gaining a competitive advantage. The UK, for example, will propose its own classification by 30 June – meaning processing investments proposed for an EU member could instead be shifted to the UK, depending on the ruling taken in London.