The major benefit to using on-site generation or private wire to produce low-carbon energy is the opportunity for protection from high and volatile wholesale prices and avoidance of the network charges for importing energy from the public network. It can also help larger companies meet their legal climate obligations.1

An npower business solutions survey of large companies from manufacturing, transport, and public sector found that 77% of respondents had already invested in solar and 38% of respondents had installed combined heat and power (CHP). Alongside solar and CHP, wind and battery storage are the other leading assets for on-site low-carbon generation and storage. Different on-site generation methods wield different returns and which asset a company uses will be both site dependent and affected by whether the most value is in avoiding importing electricity at peak times or whether demand is flexible.2

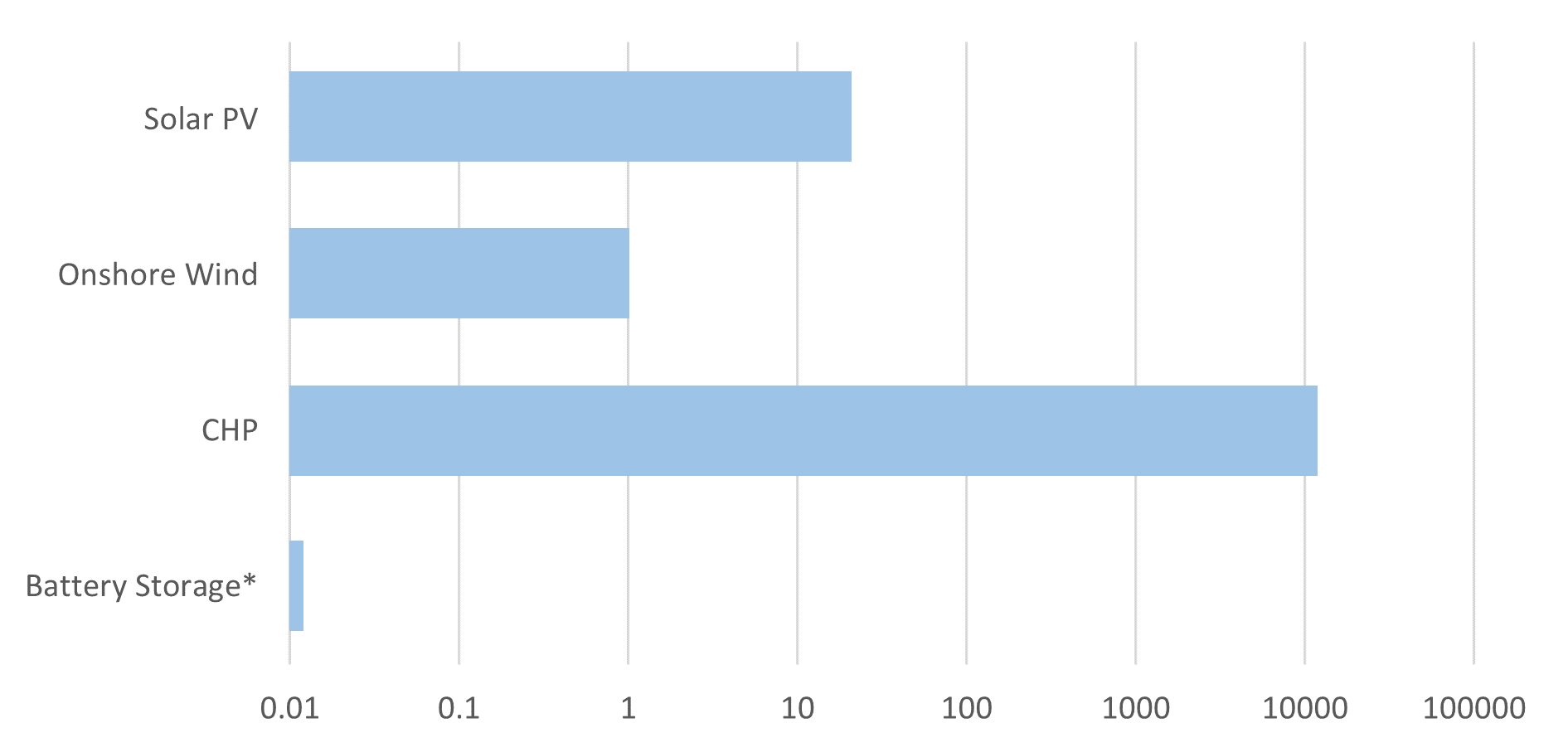

Figure 1: Power densities (W/m2) for the most common low-carbon on-site generation and storage assets. *For battery storage the value is an energy density (Wh/m2) as storage assets have a more significant relationship between space and energy rather than power.

Source: Cornwall Insight

Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight said:

“Incredibly volatile energy prices, mean businesses will be increasingly open to new ways to secure their energy supply and lower prices. A business moving to generate their own energy is not for the faint hearted, and businesses will have to review the practicality of this plan, including whether they have adequate space, and the necessary upfront funds, which could be significant. However, if it is feasible, on-site energy generation or private wire agreements will let businesses take back control of their energy, safeguarding them from fluctuating wholesale prices and helping them to avoid expensive network costs.

“Not only will on-site generation or private wire arrangements save corporations money, but the move to renewable sources of energy will also help many with their climate legal obligations. As well as the legal requirements, committing to and delivering on net zero targets provides a valuable reputational benefit, with the issue of climate change currently highly relevant among consumers and citizens. Meaning the renewable energy generation could make businesses more attractive to customers and investors.”

Reference:

1. From 6 April 2022, over 1,300 of the largest UK-registered companies have been required to disclose climate-related financial information in line with the Task force on Climate-related Financial Disclosures recommendations, and all quoted corporations are mandated to report their annual UK energy use and greenhouse gas emissions. Additionally, individual industry sectors have set their own net zero targets for businesses to commit to.

2. Storage assets that allow discharge at specific times are better suited to the peak avoidance strategy, whereas more inflexible steady demand can benefit from technologies such as solar or wind.