And the offshore wind industry is not just expanding, it’s also changing. Perhaps this is no better demonstrated than in the supply chain. Swelling component sizes, soaring demand and the required re-investment make change in the offshore wind tower market not only merely required, but inevitable.

How will the industry prepare for this change? And what challenges will be encountered along the way?

Swelling component sizes: next generation turbines require bigger, heavier and more complex towers

In this market, size matters: tower tonnage is getting heavier, component size is increasing exponentially and dimensions are expanding.

Driven by continually larger turbine technology, by 2029 most towers will be over nine metres in diameter – a significant increase from the average five to six metres that was required in 2021. Turbines will also need more tower sections, which will result in a four-fold increase in demand for those sections.

The culmination of expanding dimensions and sections adds considerable tonnage. By 2031, the average tower will be nearly three times heavier in comparison to a decade before. That will pose logistical challenges – forcing the supply chain to adapt. We are already seeing new facilities increasingly being positioned with direct access to the sea, reducing logistical headaches from fabrication facilities inland.

Looking beyond 2030, the uptake and globalisation of floating wind farms, which typically require stronger and heavier towers due to wave motion, will further increase both complexity and weights of these components.

Soaring demand: a tightening in market supply as demand accelerates out to 2030

The requirement for heavier towers will have a knock-on impact on demand for steel, as offshore wind towers will need nearly 500% more steel in 2031 compared to 2022 demand levels. As the volume of orders increases, similarly the annual spend on towers will increase five-fold, with the cumulative spend from 2022 to 2031 reaching €15 billion.

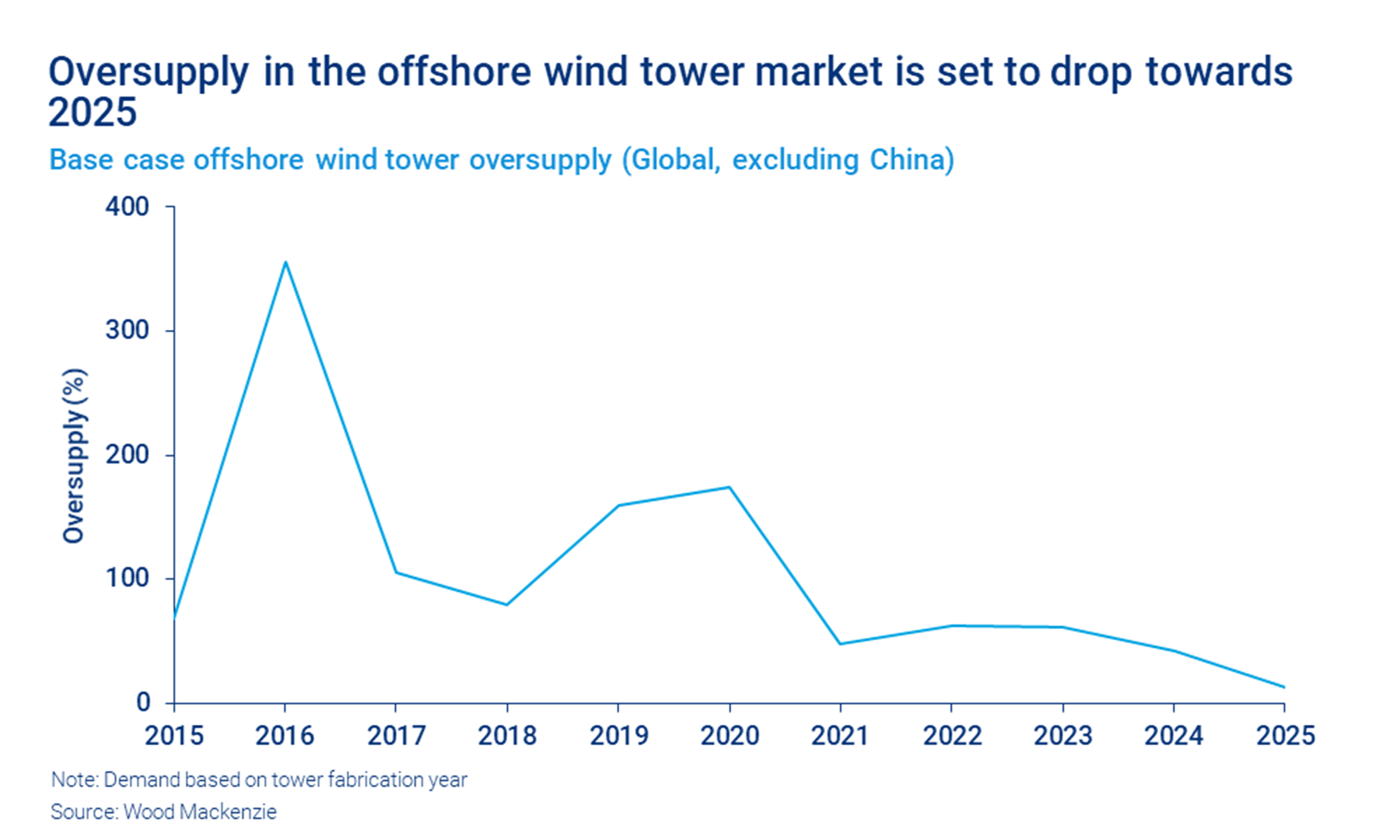

Up until now, offshore developers have had the luxury of significant oversupply in the offshore wind market. With ample supply to cater for fluctuating demand, suppliers’ margins have been squeezed to unsustainably low levels. Aggressive bidding in tenders, combined with higher steel and logistics costs, is also having a detrimental impact as developers' cost pressures are passed onto the supply chain.

Yet this too is set for change, as towards 2025 the growth in demand significantly outpaces the growth in supply. The tightening market will give suppliers increased bargaining power during contract negotiations, and ease pressure on margins.

Market growth demands further investments: how will suppliers adapt, and where will the new production capacity come from?

The surge in demand will be met partially by facility upgrades, which will keep suppliers in the market. However, new facilities will be the key driver in adding manufacturing capacity that is vital to support offshore wind growth.

By 2025, over one third of the market's supply will be reliant on new facilities and upgrades coming into fruition, highlighting how there is little room for facility delays or cancellations. Given that demand continues to soar beyond 2025, we forecast that more than €3 billion will be required in new facility investments by 2028 to cater for the global offshore wind build out (excluding China).

Thus far, the announced new facilities will be built wholly or partly by existing players. Suppliers have a preference to newly built facilities over existing facility upgrades, as they can continue to operate existing yards at full capacity. Additionally, many local or regional governments offer grants to subsidise new facility investments because of the positive impact on job creation.