Among the technological visions that seem perpetually futuristic (think commercial nuclear fusion and maglev trains), the hydrogen economy has always been tantalizing. Hydrogen produced from renewable energy or nuclear power, with minimal greenhouse-gas emissions, could be piped or transported pretty much anywhere, using mostly existing infrastructure. It could power trucks, cars, planes, and ships and generate electricity, either in fuel cells or combustion turbines. In short, it could do anything fossil fuels do now, but with substantially reduced climate impact.

Now, after decades of false starts and overly optimistic projections, several factors are giving an unprecedented lift to clean hydrogen. In the United States, sweeping legislation capped a series of moves by the country’s Department of Energy (DOE) over the past year to drive down the cost of low-carbon hydrogen and stimulate demand for the fuel. And in Europe, a looming fossil-fuel crisis has sent officials scrambling to find alternatives to the 155 billion cubic meters of Russian natural gas that EU countries imported in 2021.

“You’re rapidly getting the cost of hydrogen down to where it is very competitive—and in many cases cheaper—than the fossil alternative. So that’s why the community is so excited.”

—Keith Wipke, NREL

“I’ve been working in hydrogen for 20 years, and this is absolutely the most exciting time, the busiest time,” says Keith Wipke, manager of the Fuel Cell and Hydrogen Technologies Program at the National Renewable Energy Laboratory (NREL) in Golden, Colo. “There’s just so much activity.”

The U.S. legislation, known as the Inflation Reduction Act, was signed into law by President Joe Biden on 16 August, after being passed in Congress along party lines earlier in the month. It prescribes new spending of US $437 billion over 10 years, of which some $370 billion is directed toward a sprawling range of renewable-energy, electric-vehicle, and other greenhouse-gas reduction measures. But it was the low-carbon-hydrogen provisions that raised eyebrows, for a couple of reasons. One is that they are more generous than many analysts were expecting. The other is that the hydrogen provisions are technology-neutral, meaning that there is no distinction between hydrogen produced by electrolysis with electricity from, for example, a wind farm or a nuclear power plant.

The bill provides tax credits to producers of low-carbon hydrogen at a rate that depends on how much carbon is emitted during production, among other factors. At the lowest emission rate—0.45 kilograms of carbon dioxide emitted per kilogram of hydrogen produced—producers are eligible for a credit of up to $3 per kilogram of hydrogen, making the cost cheaper, in some instances, than that of ordinary “gray” hydrogen, which is derived from natural gas through a process called steam reforming. Production of gray hydrogen creates from 8 to 12 kilograms of CO2 per kilogrm of hydrogen produced. Costs of gray hydrogen vary but are roughly $2/kg in the United States.

Nearly all of the hydrogen made in the United States, some 10 million tonnes last year, is produced this way. China, the world’s largest producer of hydrogen at upwards of 25 million tonnes a year. In both the United States and China, production of “green” hydrogen, created by electrolysis using a renewable energy source, makes up less than 1 percent of total output.

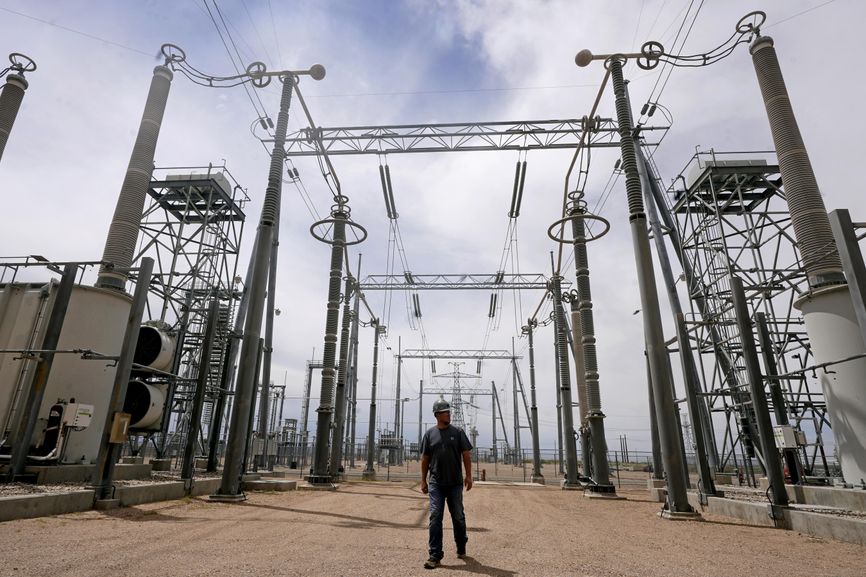

A massive substation at the coal-fired Intermountain Power Plant in Utah links the facility to transmission lines that deliver power to Southern California. A $2.65 billion project, just getting underway, will install facilities there to generate electricity from cleanly produced hydrogen. RICK BOWMER/AP

The DOE has established goals of getting the cost of low-carbon hydrogen, without incentives, down to $2/kg by 2026, and to $1/kg by 2031. Says Wipke, referring to the top $3/kg credit in the Inflation Reduction Act, “if today’s hydrogen is about $5 a kilogram through electrolysis, clean electrolysis, and you’re able to take $3 off of that, and go from $5 down to $2, well, essentially, you have met, with the incentives, our 2026 goal of $2 a kilogram. Now, technically, you’ve done it through incentives, but the impact is the same. You’re rapidly getting the cost of hydrogen down to where it is very competitive—and in many cases cheaper—than the fossil alternative. So that’s why the community is so excited.”

As compelling as the production credit may prove to be, the provisions are just the most recent of a series of government moves aimed at bolstering clean hydrogen. A year ago, for example, the Infrastructure Investment and Jobs Act (IIJA) pledged $8 billion to establish up to eight regional “hydrogen hubs” in the country. These would be facilities where low-carbon hydrogen would be produced, stored, used, and transported elsewhere.

“In the medium- and long-term we see more momentum for hydrogen use. It will come faster because conventional energy such as oil and gas will become scarcer and more expensive.”

—Bernd Heid, McKinsey & Co.

“I think the combination, the one-two punch of the IIJA hydrogen hubs and the IRA's production tax credit, can help build the full value chain,” says Alex Kizer, senior vice president of research and analysis at the Energy Futures Initiative. “And I wouldn't underestimate the other hydrogen-adjacent funding opportunities in the IRA, because hydrogen is going to need manufacturing, it's going to need fueling, it's going to need distribution…. There’s opportunity up and down the hydrogen value chain. That, in addition to the PTC [production tax credit], is what has me most excited.”

In mid-August there were already some 22 prospective hubs being touted around the country, though a formal announcement of a “funding opportunity” from the DOE wasn’t expected until September or October. Around that time, site preparation is expected to begin on a $2.65 billion project in Delta, Utah, where a consortium of companies led by Mitsubishi Power Americas and Magnum Development will install turbines capable of generating 840 megawatts by burning a mix of hydrogen and natural gas. Backed by a half billion dollars in loan guarantees from the DOE, the Intermountain Power Project, as it’s known, will also have solar-photovoltaic generators and a 220-megawatt electrolysis system to produce hydrogen on site, along with facilities to store up to 300 gigawatt-hours of the gas in underground salt domes.

In Europe, too, a hydrogen-hub plan was hurriedly approved by the European Commission in late July. It sets aside €5.4 billion to fund 41 projects to develop technologies ranging from basic R&D to industrial deployment. A small hub near Hamburg, Germany, is already under construction, and a larger hub is being built at the Port of Rotterdam in the Netherlands. “Rotterdam is basically showing the world how to become a hydrogen port,” says Robert Hebner, an IEEE Fellow and director of the Center for Electromechanics at the University of Texas at Austin, where he helps coordinate R&D on hydrogen. “They have signed agreements with companies to operate hydrogen terminals there,” he notes. “They’re working out agreements with Portugal, [under which] Portugal will make hydrogen from wind power and transport it into the Port of Rotterdam. They’ve announced that they’ll use hydrogen-powered trucks to distribute this through Central Europe. They’re thinking holistically about how to get hydrogen to the port and then how to get it redistributed to where it’s needed.”

But any notion that clean-hydrogen production could be ramped up quickly enough to help mitigate the looming loss of Russian natural gas on the continent is quickly dispelled by analysts. According to Bernd Heid, a senior partner in the Cologne office of McKinsey & Co., “hydrogen is not helping Europe in the current energy crisis.” Speaking at the World Economic Forum in Davos, Switzerland, in May, he added, “but in the medium- and long-term we see more momentum for hydrogen use. It will come faster because conventional energy such as oil and gas will become scarcer and more expensive.”

So are we finally witnessing the beginnings of an actual hydrogen economy? “I think, yes, it’s going to happen,” says Hebner. “The Hydrogen Council has over 100 multinational corporations investing billions of dollars a year into making the hydrogen economy real, and they’re making those investments where governments will help them, but this is not government-led. This is industry-led. It’s industries that see a way that they can make money. When I saw that, I said, this one may be real.”