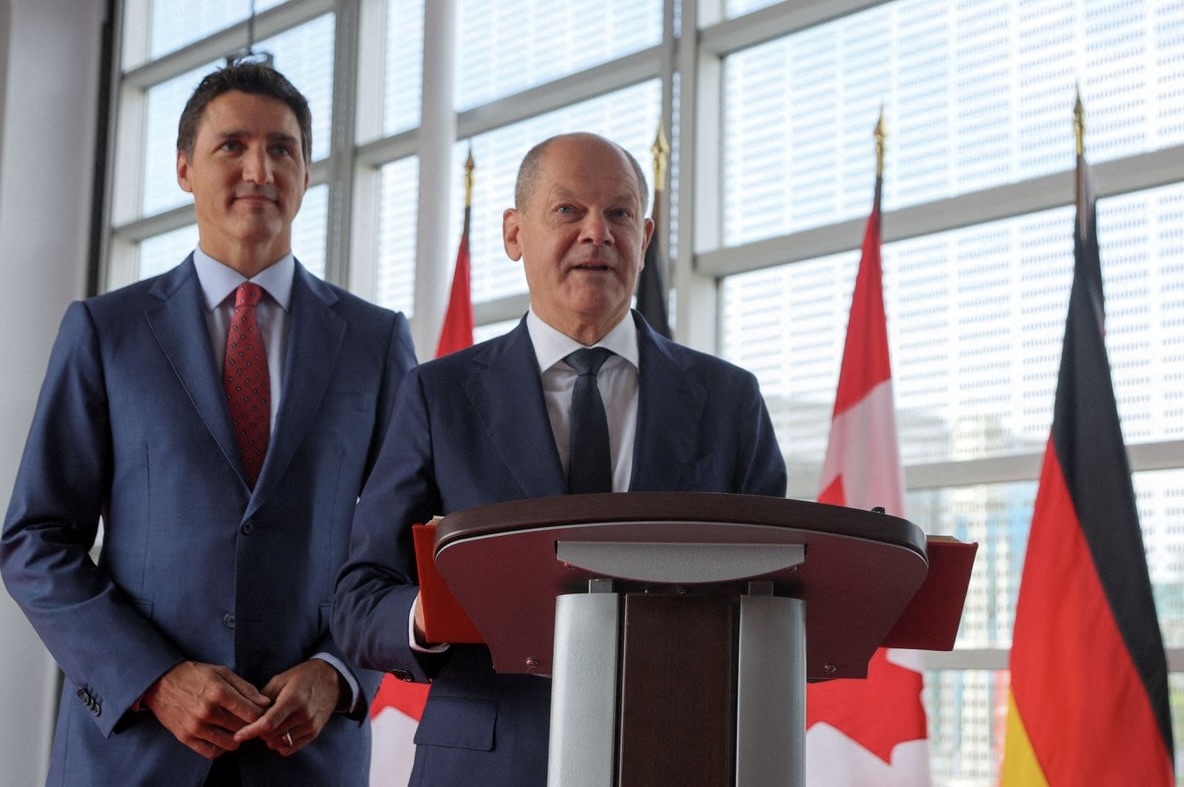

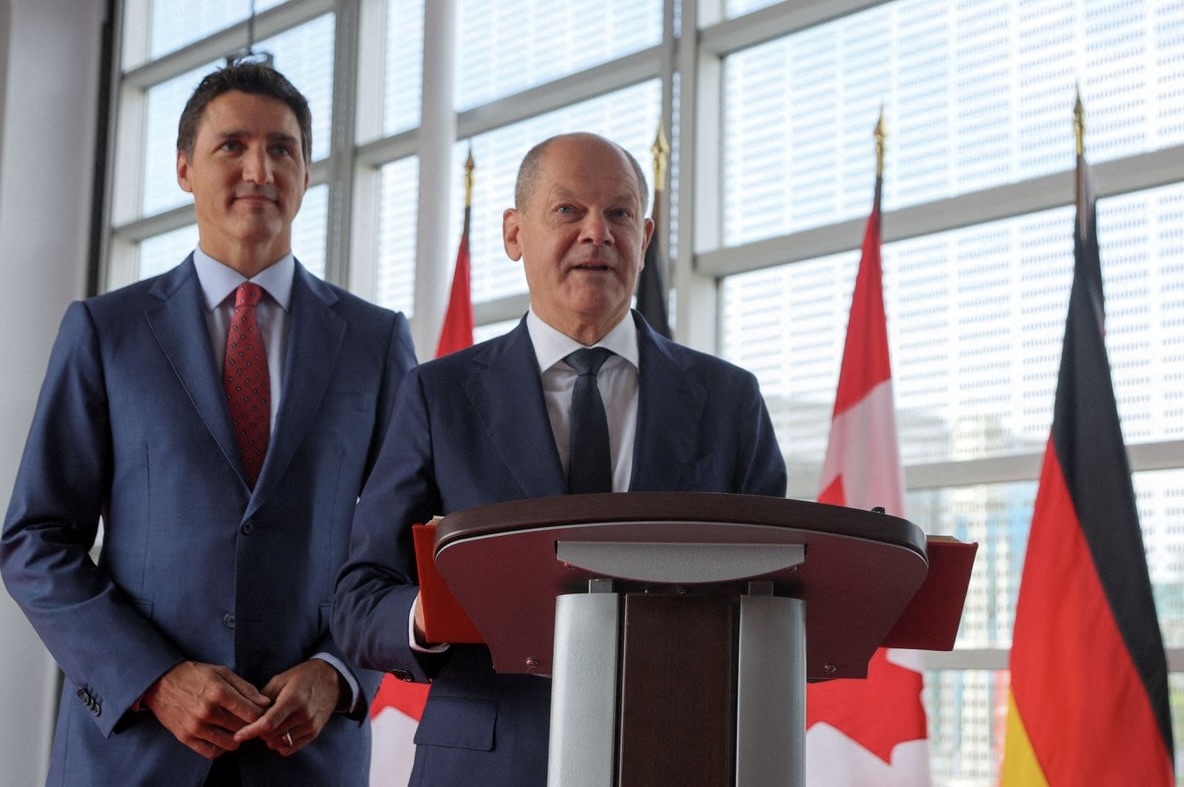

Germany's Chancellor Olaf Scholz speaks alongside Canada's Prime Minister Justin Trudeau as he signs the Golden Book of Canada at the Montreal Science Centre in Montreal, Quebec, Canada August 22, 2022. REUTERS/Christinne Muschi

On Canada's tranquil Atlantic coast, a dozen companies are racing to ship Canada's first green hydrogen to Europe by 2025, aiding the continent's worldwide search to replace Russian natural gas.

Hydrogen is viewed as critical to Europe's efforts to transition to lower-emissions energy sources, and investment has accelerated in countries such as Australia and Chile since Russia cut off Europe's natural gas supply. Eastern Canada, with its strong electricity-generating winds and short shipping distance, is a prime potential source for green hydrogen.

Several companies are moving ahead with regulatory plans and eventually construction, including Brookfield Renewable Partners (BEP.N) and World Energy, but they face big obstacles, such as equipment shortages and local opposition.

Pipeline and utility giant Enbridge Inc (ENB.TO) told Reuters that it too is considering hydrogen development in the region.

Enbridge CEO Al Monaco cautioned that the 2025 target for exports is aggressive.

"Obviously it's very hard to do. But I think East Coast Canada's positioned well," he said.

Most hydrogen output uses natural gas or coal, called gray hydrogen, but companies want to produce green hydrogen without emissions by separating hydrogen from oxygen in water using wind-powered electrolyzers.

Green hydrogen is typically more expensive, but soaring natural gas prices have elevated gray hydrogen production costs above those of green hydrogen, according to an October report.

The world produces just 3.5 million tonnes of clean hydrogen but output may rise to 31 million tonnes annually by 2030, said Minh Khoi Le, head of hydrogen research at consultancy Rystad Energy.

Hydrogen generated hype decades ago, however, without amounting to much.

"I've seen this movie before," said Peter Tertzakian, deputy director of ARC Energy Research Institute. He questioned the efficiency of using wind-generated electricity to produce hydrogen that is then shipped for use as electricity.

Hydrogen may play only a niche role in global energy, he said.

"I would characterize what's going on as lab experiments on an industrial scale."

GERMANY-CANADA HYDROGEN PARTNERSHIP

Germany and Canada signed a non-binding agreement in August to ship clean Canadian hydrogen to Germany by 2025. Their leaders met in the Canadian province of Newfoundland and Labrador, where World Energy is planning a $12-billion project to export ammonia starting in late 2024. Ammonia is one form to transport hydrogen.

A World Energy subsidiary wants to build 164 wind turbines on Newfoundland's Port au Port Peninsula to power a new hydrogen plant. But that project would dramatically change life on the peninsula, where just 4,000 people live, said Marilyn Rowe, a resident who helps lead an opposition group.

"We believe in green energy, but we don’t believe in destroying nature for a profit or supplying Germany," Rowe said.

World Energy will not proceed without a provincial environmental permit for turbines and is considering community input for turbine locations, said CEO Gene Gebolys.

He noted that others in the community support the project for its jobs.

German energy companies E.ON Group (EONGn.DE) and Uniper SE (UN01.DE) signed non-binding agreements with EverWind Fuels, based in the Canadian province of Nova Scotia, for EverWind to ship them a combined 1 million tonnes annually of green ammonia.

EverWind aims to start by shipping 200,000 tonnes in 2025.

The company plans to start building its project at an existing port next year, said Trent Vichie, owner of Everwind and co-founder of U.S. private equity firm Stonepeak Infrastructure Partners.

Vichie has already spent $100 million on the $6-billion project and said he has strong interest from strategic and institutional investors to help pay for the rest.

Citibank and CIBC are advising EverWind.

Supply chains are developing faster than was expected before the war in Ukraine, but green hydrogen is not yet economic at scale, said Teresa Jaschke, spokesperson for E.ON Group. She compared hydrogen with solar modules, now a growing energy source, that were also once considered uneconomic.

"We are certain that hydrogen technologies will also continue to develop enormously," she said.

Global hydrogen development has left manufacturers of turbines and electrolyzers unable to keep up with high demand, however.

In Newfoundland, a subsidiary of Toronto-based Brookfield is planning a C$2-billion ($1.46 billion) wind farm and plant to make 200,000 tonnes of ammonia annually. Scarce equipment may go to first movers, so the pressure is on, said Geoff Wright, Brookfield's senior vice-president of strategic partnerships.

"There's a race to get to the starting line," Wright said.

($1 = 1.3735 Canadian dollars)