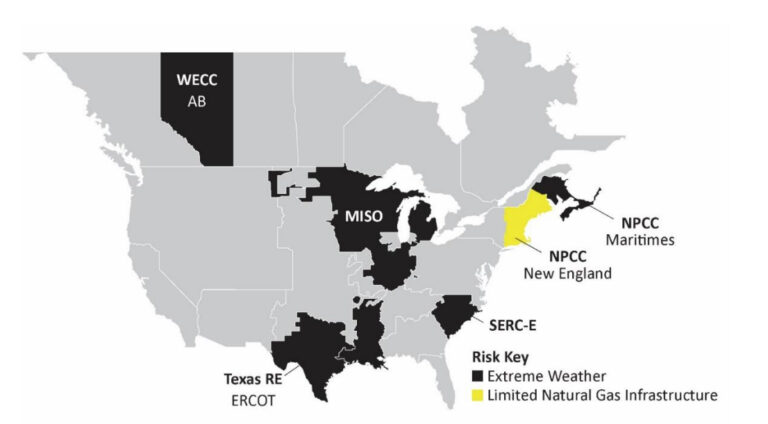

The nation’s designated Electric Reliability Organization (ERO) in its latest Winter Reliability Assessment, issued on Nov. 17, said several regions face risks of insufficient electricity supplies during peak winter conditions owing to higher peak-demand projections and inadequate weatherization. The reliability watchdog also prominently highlighted fuel supply risks for coal, natural gas, and oil, and it underscored risks related to natural gas infrastructure constraints.

According to NERC’s evaluation of the generation resource and transmission system adequacy to meet projected peak demand, several regions may be highly vulnerable to extreme weather this winter and could require load-shedding procedures. These include the Electric Reliability Council of Texas (ERCOT); the Midcontinent Independent System Operator (MISO); SERC-East—a region that includes North Carolina and South Carolina; WECC-Alberta; and the Northeast Power Coordinating Council (NPCC) Maritimes, a region that comprises the Canadian provinces of New Brunswick, Nova Scotia, and Prince Edward Island, and the northern portion of Maine.

NERC’s 2022-2023 Winter Reliability Risk Area Summary. Courtesy: NERC

“In summary, though we found that there are several areas where more severe conditions are likely to lead to an electricity supply shortfall, the good news is that almost all areas are well-prepared for a normally occurring or average winter year,” noted Mark Olson, NERC’s manager of Reliability Assessments, during a press briefing on Thursday.

Several Vulnerable Regions

According to the assessment, ERCOT, a region serving nearly 90% of Texas that was hard hit during Winter Storm Uri in 2021, continues to face the risk of a significant number of generator forced outages in extreme and prolonged cold temperatures. These risks are pronounced especially “where generators and fuel supply infrastructure are not designed or retrofitted for such conditions,” despite winterization checks, the assessment says.

Texas, notably, may also grapple with the closure of two CPS Energy coal-fired units, a combined 1.5 GW, at its J.K. Spruce power plant at the end of the year, if the Environmental Protection Agency denies conditional acceptance of CPS Energy’s coal ash disposal plan to address two ponds at the plant. NERC’s assessment, however, notes that ERCOT otherwise has an anticipated reserve margin of 36.4%, “capacity reserves are sufficient to meet forecasted peak demand to cover the types of weather events regularly experienced.”

In MISO, a region that avoided supply disruptions this summer, reserve margins have diminished by more than 5%. “Nuclear and coal-fired generation retirements total over 4.2 GW since the prior winter. Declining reserves are the result of few resource additions,” the assessment notes.

That could mean a falling reserve margin, said Olson. “It means there’s less generation excess above the peak demands, and so the energy risks in the more severe conditions are more likely when you have that shrinking capacity and shrinking reserve margin,” he explained. “And then under severe winter conditions that can extend deep into the south as we’ve seen in Polar Vortex conditions, you have the risk of southern generation being forced offline in the extreme cold. We’ve seen that in a number of winter events.”

In SERC-East, like ERCOT and the southern part of MISO, extreme cold could result in high generator outages and demand volatility. The region is “at risk this winter for potential energy emergencies and a little bit less generation and resource capacity in the area,” Olson said. “Also, there’s been growth in demand and increasing demand volatility.”

Alberta and the Maritimes, both of which are winter-peaking systems, face a surge in peak electricity demand. “Typically, their winter reserve margins—which is the amount of generation they have relative to those peak demands that they can expect to see—are usually a little bit closer anyway because they are winter peakers,” said Olson. “So. with the additional growth there—we’re seeing those—that leads to a very, very thin margin over what peak demand could be. And so that can lead to energy shortfalls, particularly if you see demands going above those average mature peaks.”

A Convergence of Fuel Supply Risks

Along with regional supply and demand vulnerabilities, this year’s assessment highlights a rare convergence of potential fuel supply risks. While the assessment notes that coal fleet stocks have improved since summer 2022 to “near pre-winter average levels,” it urges reliability coordinators to continue to monitor coal and consumables. It also suggests that while natural gas storage inventories are rebounding from the summer, cold weather production and delivery are ongoing concerns.

The report also highlights specific fuel risks in New England. “Generation in the area can rely more than most other areas on stored fuels due to the constraints on the natural gas supply infrastructure. Liquid fuels—petroleum fuels—are a primary backup fuel for New England,” Olson noted. “However, currently, the stored capacity levels are only at about 40% of what they’re capable of holding, and this is something that the system operator in New England is monitoring.” NERC encourages generators to “fill up those tanks” in the event of a cold snap. However, generators have indicated they are delaying procurement of fuels “until later in the winter for economic reasons,” he said.

Olson noted that the fuel supply concerns warranted a serious warning. “We do look at the individual conditions, and so the fuel situation, particularly when we started writing this report a month ago or longer than that, was shaping up to be a very significant factor and I don’t think we’re out of the woods on fuel,” he said. “It’s a particular focus item with current circumstances around the world on the worldwide energy markets. All things are looking a lot better than they were a few months ago. But nonetheless, this is an area that’s of concern and warrants considerable attention and monitoring as we get into the winter,” he added.

Asked whether the report presented a more dire risk outlook compared to last winter, John Moura, NERC’s director of Reliability Assessment and Performance Analysis, suggested the trends were concerning. “The trend is we’ve seen more areas more at risk,” he said. “We see more retirements of critical generation fuel challenges, and we’re doing everything we can to make sure in the operational phase these resources are in place to maintain reliability. And we’re giving the right situation awareness at the highest levels to ensure reliability even during our most extreme conditions.”