SSEF, an EU-focused fund backed by the EIB and advised by Solas Capital AG, has reached final close with investment commitments of €220 million ($228.4 million). The fund targets energy efficiency and Behind-The-Meter (BTM) renewable energy investments for projects in the public and private sectors.

Image: 123rf

Image: 123rf

Supported by the European Investment Bank (EIB), the Solas Sustainable Energy Fund ICAV (SSEF) delivers a financing solution for energy service companies (ESCOs) across the EU.

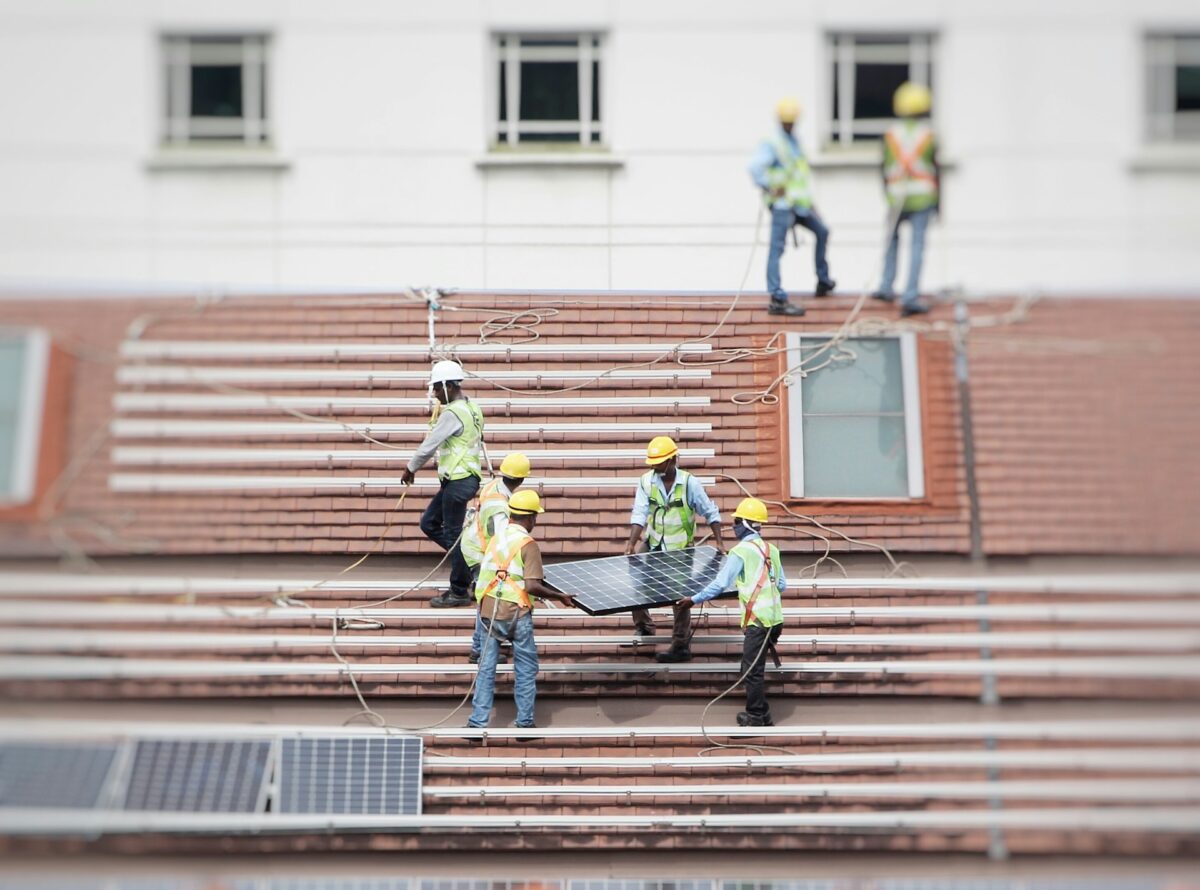

The fund aims to support energy-saving business models focusing on the renovation of existing infrastructure, particularly buildings, by using established and reliable energy efficient technologies such as rooftop solar photovoltaic panels, LED lighting, heat pumps, combined heat and power units and building fabric.

The fund finances projects in both the public and private sectors, including smaller projects within the Small and Medium-sized Enterprise (SME) sector, where companies often find it more difficult to secure finance.

By end of 2022, SSEF expects to have signed financing agreements worth €50 million ($51.9 million) to support energy efficiency projects across the EU.

Pipeline projects will deliver estimated energy savings of 150GWh per year and will reduce greenhouse gas emissions by around 42,000 tonnes CO2e per year.

The fund has recently deployed financing to the following energy service companies:

• An Ireland-based energy service company, supporting a portfolio of LED lighting retrofit projects with an integrated financing solution, allowing their SME and corporate customers to pay a fixed monthly payment for the provision of Lighting-As-A-Service (LaaS). These retrofits significantly reduce energy costs, reduce CO2 emissions and improve lighting quality for customers.

• A German energy service company, supporting a range of energy efficient renovations, including combined heat and power and LED lighting for a European industrial client. These improvements have led to reductions of approximately 3,270 tonnes CO2e per year, helping the industrial client to achieve their goal of becoming carbon neutral by 2050.

Further deployments are planned for the end of 2022, and throughout 2023.

SSEF’s cornerstone investors are institutions from both the public and private sectors, including the EIB, Ireland Strategic Investment Fund (ISIF), and MEAG, the asset manager of the Munich Re Group. The EIB committed a €30 million ($31.1 million) investment at the launch of the fund, backed by the European Fund for Strategic Investments (EFSI), the main pillar of the Investment Plan for Europe.

The fund is also supported by the Private Finance for Energy Efficiency (PF4EE) initiative, a financial instrument funded through the EU LIFE Programme and set up by the EIB and the European Commission.

PF4EE facilitates investment into energy efficiency technology in buildings and, in particular, enables the provision of long-term debt financing for SMEs and public bodies.

European Commissioner for Energy Kadri Simson said: “Investing in energy efficiency is always a good idea, but it makes even more sense when energy prices are high. Initiatives like the Solas Sustainable Energy Fund help to make sure that we have the necessary funding for these investments.

“The more efficient we become, the more we can reduce energy consumption and energy bills, decrease our greenhouse gas emissions and phase out our dependence on Russian fossil fuels.”