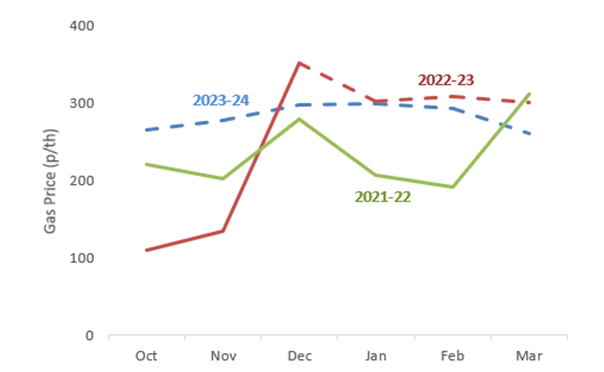

New modelling from Cornwall Insight included in our report - ‘Another winter of discontent?’ - has shown wholesale gas prices this December have more than doubled since November and are significantly higher than this time last year. The report forecasts this trend could continue throughout the winter and beyond (Figures 1 and 2), as the tightness of gas supply against demand across Europe pushes up wholesale prices.

The war in Ukraine and subsequent cuts to Russian gas imports have led to pressures on gas supplies across Europe. While November’s milder weather saw wholesale prices remain relatively low, the return of colder conditions and subsequent higher demand has seen a significant leap in prices. Weather and the response of demand in the remainder of this winter will be key swing variables. But, in all scenarios, gas prices in the UK are projected to continue to be impacted as the country’s heavy reliance on imported gas sees it vulnerable to global rises.

These high prices, relative to pre-2022 levels, are unlikely to be a single winter problem, with high winter gas prices forecast to be maintained in 2023-24 and unlikely to return to pre-2021 ‘normality’ this decade. Sustained high gas prices could impact the governmental cost of energy bill support schemes in the UK in the period they apply, and with this support likely to be reduced, could lead to even higher consumer energy costs next winter.

While gas demand in the UK is due be higher than previous winters, largely due to the UK’s high exports to the continent, National Grid’s forecasts indicate the UK should have sufficient Liquified Natural Gas (LNG) cargos to avoid a shortage of gas supply. However, with the UK getting more than 60% of its natural gas supply from imports, the ever-increasing global competition for LNG supplies, limited new supply, and less availability of Russian pipeline gas in summer 2023 mean there are risks of continued high gas prices and sustained elevated bills for consumers as we prepare for, and then move through, next winter.

Weather conditions and subsequent demand levels will also impact the quantity of gas Europe has stored once people start to turn off their heating around April. Assuming Russian gas supply to Europe remains heavily constrained, storage levels will no doubt be down on previous years, and Europe and the UK will have the task of increasing capacity during the summer of 2023 to prepare for next winter, a summer in which even less Russian pipeline gas is anticipated to be available.

Figure 1: Graph for average monthly wholesale gas prices* for the winters of 2021-22, 2022-23, and 2023-24.

Source: Cornwall Insight

Solid lines represent actual day-ahead prices for past and current months and dashed lines are forecasts for future months.

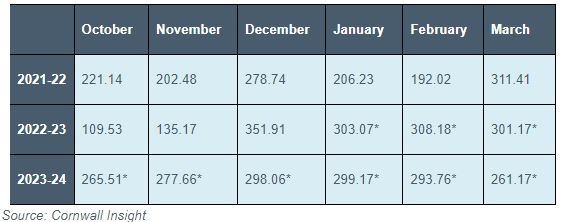

Figure 2: Pence per therm figures for average monthly wholesale gas prices for the winters of 2021-22, 2022-23, and 2023-24.

* Asterisks indicate the data is from Cornwall Insight’s forecasts and not actual day-ahead data

Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight:

“Energy security is often tested over the winter months as low temperatures lead to spikes in demand; however, this winter, despite a mild start, and impressive storage levels entering the colder period, we are in uncharted territory at least in price terms. Cuts to Russian gas across Europe elevated the costs of filling European storage and pushed up Liquified Natural Gas (LNG) prices. The UK’s material dependence on imports means it to is vulnerable to volatile global prices, such as we have been seeing throughout 2022. This winter we are essentially going to experience continued periods in which we are importing the price effects of the cancellation of Russian gas flows, either as a result of high LNG prices from our own terminals, or via our imports from Europe.

“If high prices are largely locked in for this winter, the big issue now is how much gas Europe will have in storage at the end of this winter and what this will mean for the costs of rebuilding inventories to meet next winter’s challenge. Our long-term forecasts indicate that gas prices are likely to remain high up until the end of next winter, without some radical change in the buyer-seller relationship between Europe and Russia. The plausible scenarios are pipeline flows of Russian gas will be even further reduced on summer 2022, and we will also see gas prices remaining above pre-pandemic levels until at least 2030 as the market takes time to adjust to this change in supply and demand dynamics in Europe.

“Ultimately these higher prices will be borne by the end consumer, and while UK government support is currently in place, this cannot go on indefinitely. Without some form of enduring action on tariffs to equitably and progressively share the financial burden of higher cost gas, and investment of resources in accelerating viable routes to more efficient consumption of energy, these costs will eventually end up on the bills of the many struggling households and businesses.”