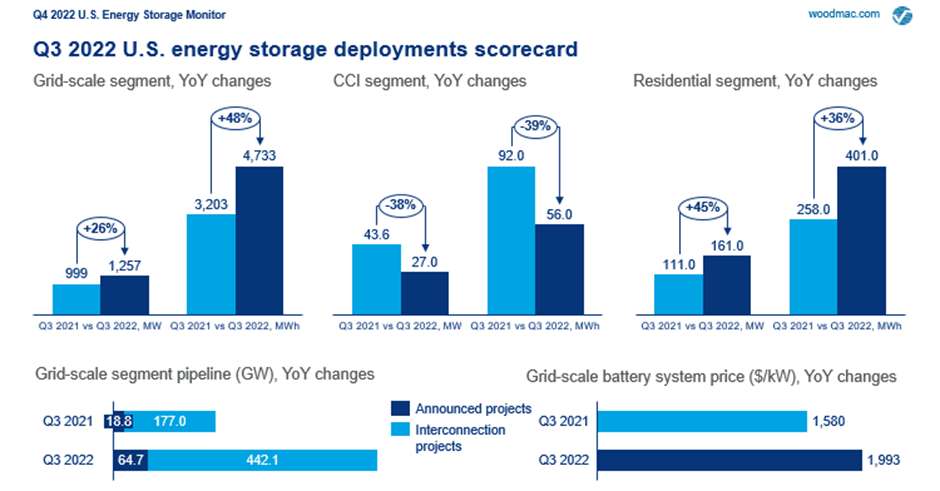

According to a research report released by Wood Mackenzie, the US energy storage market grid-scale segment installed a record 4,733MWh in the third quarter of 2022.

This figure surpasses the previous quarterly high of 4,598MWh in Q1 of 2021, according to the research company’s latest US Energy Storage Monitor. On a single charge, this amount of battery storage could power over 150,000 US homes for a day.

According to the report and the American Clean Power Association (ACP), grid-scale storage deployments relied heavily on California and Texas, which accounted for 96% of total installed capacity over 2022 Q3.

“Demand in the grid-scale and residential storage segments continues to increase, despite rising costs and lingering supply chain challenges,” said Vanessa Witte, senior analyst with Wood Mackenzie’s energy storage team.

“Installed capacity is expected to more than double next year, driven by new grid-scale project announcements and increased residential and non-residential volumes in California due to the introduction of a community solar program and NEM 3.0 (Net Metering 3.0).”

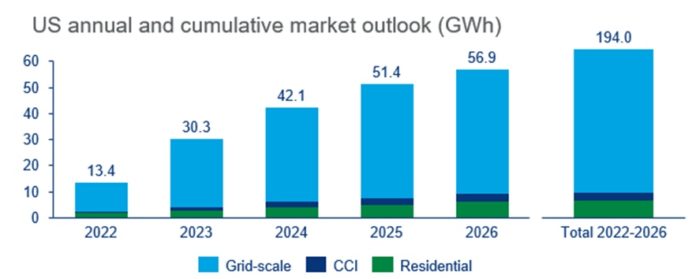

Total forecast volume between 2022-2026 across all segments increased by 109% quarter-over-quarter. In this timeframe the US storage market will install almost 65GW total, with grid-scale installations accounting for 84% of that capacity.

“Demand for energy storage is at an all-time high, driven by sustained higher energy prices, state decarbonisation mandates and Inflation Reduction Act incentives,” said Jason Burwen, vice president of energy storage at the American Clean Power Association.

“California’s reliance on energy storage to meet record peak demand this September shows why it’s absolutely critical that policymakers and grid operators remove barriers to supply to ensure reliability.”

Residential storage had another record quarter, with 400MWh installed, surpassing the previous quarterly record of 375MWh in Q2 2022. Wood Mackenzie projects that this segment will climb to 2.2 GW in 2026.

Community, commercial, and industrial storage deployments underwhelmed for the second quarter in a row, with only 56.6MWh installed in Q3. However, all segments are anticipated to steadily grow over the long-term forecast, bolstered by the strong demand from residential and grid-scale.

Wood Mackenzie’s Witte added that elevated prices and supply chain challenges largely due to a supply deficit combined with heavy demand have pushed several projects past 2022 and into later years of the forecast. However, the pipeline remains strong and active storage requests in the interconnection queue between 2022 and 2028 increased 120% quarter-over-quarter.

Said Witte: “Some developers have considered delaying projects into 2023 to receive tax credits from the Inflation Reduction Act, but this only applies to a very niche segment of projects. In general, supply chain challenges and interconnection queue backlogs will push capacity to later in the forecast, with 2024-2026 seeing increases of 9-13% per year due to this.”