Image by luchschen on 123rf

A first-of-its-kind report analysing global patents suggests that hydrogen technology development is shifting towards low-emissions solutions such as electrolysis.

Hydrogen Patents for a Clean Energy Future: A global trend analysis of innovation along hydrogen value chains is the third joint study produced by the European Patent Office (EPO) and International Energy Agency (IEA).

The report uses global patent data to provide an up-to-date analysis of innovation in hydrogen technologies – from the production of hydrogen to its storage, distribution and transformation through to end-use applications across industries. Patent information is the earliest possible signal of industrial innovation which makes this report a window into how the complex and fast-moving technology landscape is evolving.

It highlights the contribution of start-ups to hydrogen innovation and their reliance on patents to bring new technology to market. At the same time, it flags some of the blind spots where innovation is needed to unlock new applications of green hydrogen.

Reducing reliance on fossil fuels

“Hydrogen from low-emissions sources can play an important role in clean energy transitions with potential to replace fossil fuels in industries where few clean alternatives exist, like long-haul transport and fertiliser production,” explained IEA Executive Director Fatih Birol. “This study shows that innovators are responding to the need for competitive hydrogen supply chains, but also identifies areas – particularly among end-users – where more effort is required. We will continue to help governments spur innovation for secure, resilient and sustainable clean energy technologies.”

In the report foreword, Birol points out that hydrogen produced from low-emissions sources has the potential to reduce reliance on fossil fuels in applications where few alternatives exist. “In the medium- to long-term it represents our best chance to limit exposure to volatile fuel prices in critical sectors like long-haul transport and fertiliser production.

“However, a future of available and affordable low-emission hydrogen is dependent on near-term policies to develop and improve technologies and to establish value chains for investment, equipment and trade,” said Birol.

The IEA chief points out that many countries are stepping up, such as the European Union through the REPowerEU plan and other programmes to mobilise investment to reduce EU gas demand. “In the US, the Inflation Reduction Act will drive capital towards cleaner sources of hydrogen, and we hope, also facilitate competitive international supply chains”.

“Japan’s Green Transformation Programme also contains bold plans for funding advanced technologies,” writes Birol.

In September 2022, 16 countries committed to funding a global portfolio of large-scale demonstration projects this decade to bring technologies like hydrogen-based steel production to market in time to achieve net-zero emissions by 2050.

Hydrogen technology development seeing ramp up in low-emissions innovations

The Hydrogen Patents for a Clean Energy Future report shows that competition to be the leader in hydrogen innovation is intensifying and has the potential to drive commercialisation. The stakes are high: installations of electrolysers reach 380 gigawatts in 2030 in the International Energy Agency’s (IEA) Net Zero Emissions by 2050 Scenario, illustrating the economic opportunity for countries that can translate research excellence into industrial competitiveness.

“However, activity remains concentrated in a small number of regions, limiting the exchange of ideas. Looking ahead, hydrogen innovation must address specific national challenges, for example by helping Africa tap into some of the lowest-cost clean energy on the planet,” said Birol.

The study presents the major trends in hydrogen technologies from 2011 to 2020, measured in terms of international patent families (IPFs), each of which represents a high-value invention for which patent applications have been filed at two or more patent offices worldwide.

The report finds that global patenting in hydrogen is led by the EU and Japan, which account for 28% and 24% respectively of all IPFs filed in this period, with significant growth in the past decade. The leading countries in Europe are Germany (11% of the global total), France (6%), and the Netherlands (3%).

The US, with 20% of all hydrogen-related patents, is the only major innovation centre to see international hydrogen patent applications decline in the past decade.

Hydrogen production technologies accounted for the largest number of hydrogen patents over the 2011-2020 period. While global hydrogen production is currently almost entirely fossil-based, patenting data shows that low-emissions innovations generated more than twice the number of international patents across all segments of the hydrogen value chain than established technologies.

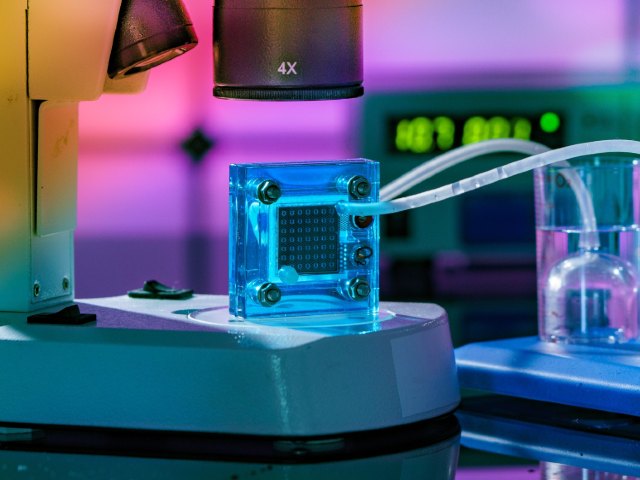

Climate concerns are growing innovation in electrolysis

Technologies motivated by climate concerns accounted for nearly 80% of all patents related to hydrogen production in 2020, with growth driven chiefly by a sharp increase in innovation of electrolysis. The most innovative regions are now competing to host the first industrial roll-out phase. Data suggests Europe is gaining an edge as a location for investment in new electrolyser manufacturing capacity.

Among hydrogen’s many potential end-use applications, the automotive sector has long been the focus for innovation. Patenting in this sector continues to grow, led mainly by Japan. Similar momentum is not yet visible in other end-use applications, despite concerted policy and media attention on hydrogen’s potential to decarbonise long-distance transport, aviation, power generation and heating.

National net zero emissions pledges cannot be achieved without addressing unabated fossil fuel use in these sectors. One bright spot is a recent uptick in patenting for the use of hydrogen to decarbonise steel production. This might be a response to the post-Paris Agreement consensus that the sector needs radical solutions to cut emissions quickly.

Hydrogen technology development is where the money is at

For established hydrogen technology, innovation is dominated by the European chemical industry, whose expertise in this sector has also given it a head start in climate-motivated technologies such as electrolysis and fuel cells. Universities and public research institutes generated 13.5% of all hydrogen-related international patents in 2011-2020, led by French and Korean institutions, with a focus on low-emissions hydrogen production methods such as electrolysis.

The study finds that more than half of the $10 billion of venture capital investment into hydrogen firms in 2011-2020 went to start-ups with patents, despite them making up less than a third of the start-ups in the report’s data set. Holding a patent is a good indicator of whether a start-up will keep attracting finance. More than 80% of late-stage investment in hydrogen start-ups in 2011-2020 went to companies that had already filed a patent application in areas such as electrolysis, fuel cells, or low-emissions methods for producing hydrogen from gas.