Victoria Big Battery. Image supplied

Large-scale batteries in Australia’s National Electricity Market (NEM) earned record high revenue from arbitraging the energy market during 2022.

Calendar 2022 was arguably the most dramatic year in the history of the NEM. The year saw record high wholesale electricity prices due to the global fossil fuel crisis coupled with numerous outages at domestic thermal generators.

The situation became so dire that at one point the Australian Energy Market Operator (AEMO) determined the market was “impossible to manage” resulting in an unprecedented suspension of the energy market from 15 June to 24 June 2022.

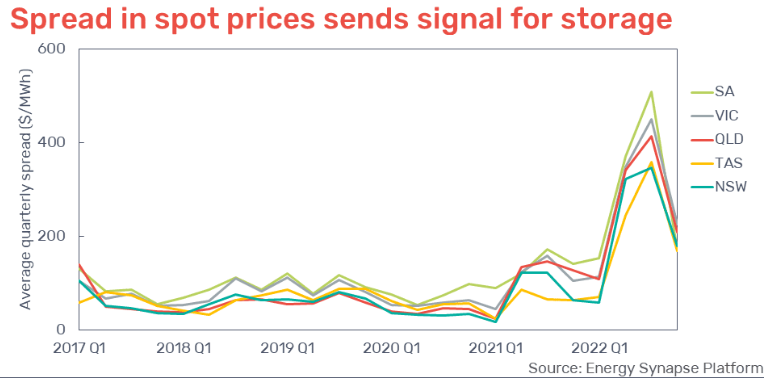

However, high energy prices on their own are not enough for batteries to profit. The greatest potential for energy arbitrage occurs when there is a high spread in pricing.

This increases the difference between the charge (buy) price and discharge (sell) price. Data from the Energy Synapse Platform shows that the spread between the 10th and 90th percentile of wholesale energy prices during 2022 was far above normal levels.

It is this spread in pricing that is responsible for grid-scale batteries earning record high energy arbitrage revenue.

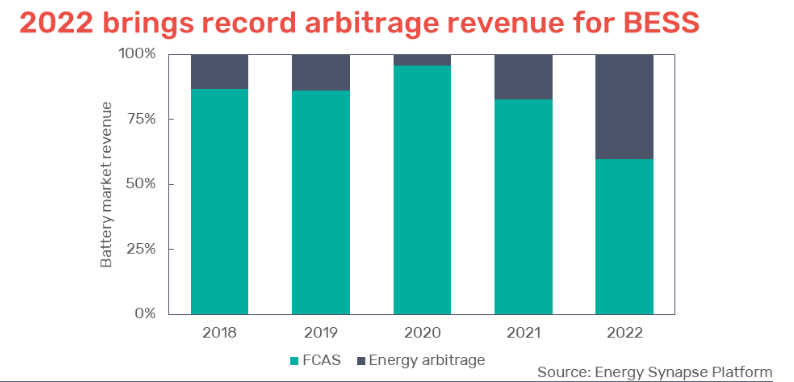

Batteries across the NEM earned the highest energy arbitrage revenue from both a total dollar perspective as well as a percentage of “market revenue”.

As can be seen from the chart below, in previous years, energy arbitrage contributed an average of 12% to total BESS market revenue, with the remainder coming from frequency control ancillary services (FCAS). In 2022, the energy arbitrage share jumped to 40%.

Batteries that have longer storage durations (for example, two hours) were able to capture significantly more arbitrage revenue than batteries with shorter storage durations (e.g. one hour or less).

Despite unprecedented volatility in the energy market, FCAS continued to supply the bulk of total battery market revenue (60%).

The biggest FCAS gains came in November 2022, when South Australia separated from the rest of the NEM for an entire week. The Hornsdale and Dalrymple batteries did particularly well from this event.

FCAS has continued to be a strong revenue stream despite the build-out of new battery systems. See our previous blog on the status of BESS in the NEM.