Congress also expanded the ITC in three crucial ways: 1) Nonprofits with no tax liability can now apply for direct pay reimbursement equal to the value of the tax credit 2) Storage-only projects are now eligible for the ITC. 3) The ITC now includes several ‘bonus credits’, which can significantly increase savings for projects serving low-income and underserved communities. These important changes are outlined in further detail below.

What kind of clean energy technology is eligible?

The ITC formerly could only be applied to energy storage if it was installed with solar or wind power. Now standalone storage projects, in addition to solar only and solar combined with storage projects, are eligible for the ITC. The change to include storage only projects will increase access to storage, including for organizations who have already installed solar and may now want to explore adding resilient battery storage to their facility.

Can nonprofits benefit from the Investment Tax Credit?

Importantly, the ITC can now benefit everyone, not only those that have tax liability. Nonprofits and other tax-exempt entities – like municipalities and Tribal governments – are eligible to receive the ITC in the form of a direct pay reimbursement.

The Treasury Department and Internal Revenue Service (IRS) will release guidance this year about how tax-exempt organizations can apply for reimbursement and when they can expect repayment. At this time, organizations should expect they will need to pay for the cost of the system upfront (optionally with assistance from a low or no interest loan) and receive the direct payment within one to two years.

How much is the ITC worth?

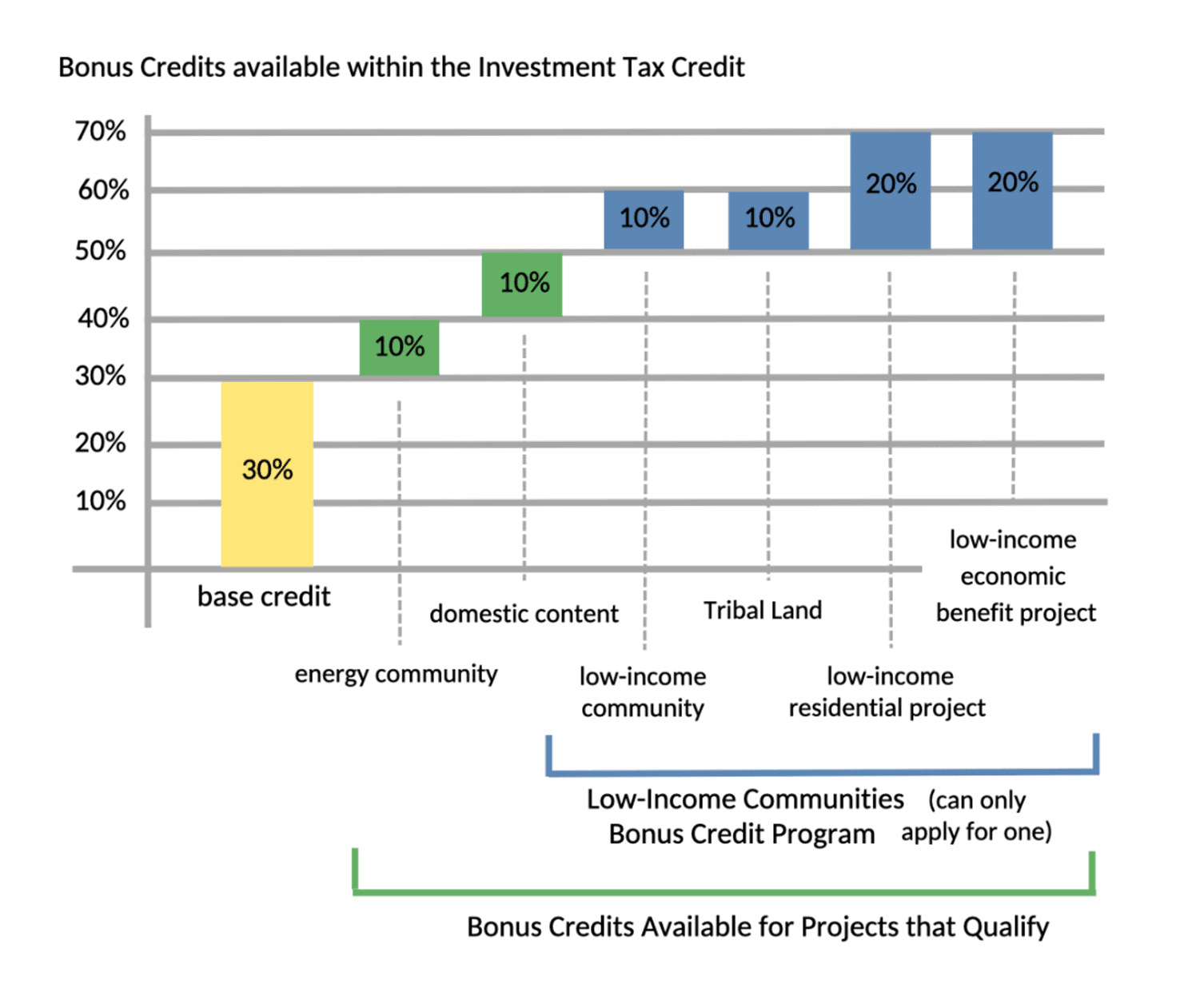

The ITC was also increased to 30% baseline credit for projects installed before 2033. This applies to projects under 5 megawatts capacity or for larger projects that meet manufacturing and workforce requirements. Projects may be eligible for up to six bonus credits that could raise the value of the ITC up to 70% of the cost of the project’s installation.

Bonus Credits

The ITC includes six different bonus credits that projects may apply for. Four of those credits are housed within the Low-Income Communities Bonus Credit Program, which the IRS released preliminary guidance for on February 13, 2023 (available to view here). The IRS is expected to release additional guidance on that program later this year. Currently, projects can only apply for one of the four bonus credits within the Low-Income Communities Bonus Credit Program. This means a project could either receive a 10% or 20% bonus credit, depending on their eligibility.

The four bonus credits within the Low-Income Communities Bonus Credit Program are:

> 10% bonus for projects located in a low-income community

> 10% bonus for projects located on Tribal Land

> 20% bonus for projects when the facility is part of a qualified low-income residential project

> 20% bonus for projects when the facility is part of a qualified low-income economic benefit project

The ITC also includes two additional 10% credits, which are stackable. Projects who are eligible can apply for both bonus credits, in addition to the 30% baseline credit and one of the bonus credits within the Low-Income Communities Bonus Credit Program. The IRS has not released detailed guidance about how these credits will be implemented.

The two stackable bonus credits are:

> 10% bonus for projects located in an “energy community”

> 10% bonus for projects that meet domestic manufacturing requirements

(Read more about all of these six bonus credits in a series of fact sheets that CEG published

The following two sections focus on the guidance released by the IRS about the Low-Income Communities Bonus Credit Program: what we’ve learned and what we still have questions about.

Answers to Frequently Asked Questions about the Low-Income Communities Bonus Credit Program

What kind of clean energy technology is eligible?

The adders within the Low-Income Communities Bonus Credit Program can only be applied to solar or wind projects or projects that pair storage with solar or wind. While standalone storage is eligible for the 30% ITC baseline, it is not eligible for any of these adders (IR-2023-26, Section 2). The maximum net output of the system must be less than 5 megawatts and it must be less than the ‘nameplate capacity of the facility’ (Section 4.08).

When should I apply for these adders?

The Department of Energy (DOE) will accept applications for the Low-Income Communities Bonus Credit Program in the third quarter of 2023. Eligible projects must apply for the adder before the project is installed and ‘placed in service’ (Section 4.05; defined in Section 2.06 of the IRS’ guidance). The application for the two 20% adders will be open for 60-days in Quarter 3 of 2023; the application for the two 10% adders will be available for 60-days later in the year (Section 4.07). The IRS will release more guidance before the application windows begin. Your developer should assist you in applying for these credits.

How likely is it that my project will be approved and receive an adder?

Eligible projects that apply for an adder are not guaranteed to receive the adder. If demand exceeds supply and an eligible project is not approved for an adder, then that project team can decide to reapply the next year (Section 4.06). The Low-Income Communities Bonus Credit Program will approve up to 1.8 gigawatts worth of projects in 2023. The program has reserved 700 megawatts of capacity for projects located in a low-income community (10% credit) and an additional 700 megawatts of capacity for qualified low-income economic benefit projects (20% credit). Projects located on Tribal Land (10% credit) and qualified low-income residential building projects (20% credit) are each allotted another 200 megawatts of capacity in 2023.

The IRS Department may release additional criteria for the adders to prioritize applications for projects owned or developed by community-based organizations and mission-driven entities or that would provide substantial benefits to low-income communities, for example (Section 4.02).

What if I have more questions?

You can reference the most recent guidance released by the IRS (IR-2023-26) or visit the IRS’ website for the Inflation Reduction Act. This post will be updated when the Treasury Department and Department of Energy release more guidance regarding the four adders within the Low-Income Communities Bonus Credit Program. You can also reach out to Anna from Clean Energy Group ([email protected]).

Opportunities for the IRS to Provide Clarity in Future Guidance about the Low-Income Communities Bonus Credit Program

Some questions remain unanswered by the current guidance:

> How soon will applicants receive notice of whether their project is eligible for the adder that they applied for?

> If an eligible project applies for a 20% adder, but their application is not accepted because of capacity restraints, can the project apply for the 10% adder in the same year?

> Projects need to apply to these adders before their project is installed. How do these adders interact with the 30% baseline credit, which historically has been applied only after the installation of the project?

> In both the 20% adder for affordable housing and the 20% adder for qualified low-income economic benefit projects, the financial benefits of the project must be shared equitably with low-income households (Section 3.03 and Section 3.04). What qualifies under this provision? For example, if the financial benefits are restricted to funding improvements for shared community spaces, would that qualify? If the financial benefits are restricted to funding community programming like financial literacy courses, would that qualify?

> How will community solar projects be assessed for eligibility for these adders?