Further, reliability has been continuously challenged by extreme weather events worldwide, such as the deep freeze in Texas; the heatwave in Europe; and flooding following hurricanes, tropical storms, and typhoons all over the globe.

For these reasons, perhaps it isn’t all that surprising that Denmark-based DNV’s latest report, Trilemma and Transition, released on March 1, showed the energy executives are now prioritizing security (reliability) of energy over and above providing clean and affordable energy.

In fact, most executives say the energy system will not resolve the energy trilemma in the next decade. The DNV research analyzed the views of more than 1,300 senior energy professionals, based on a survey conducted during December 2022 and January 2023.

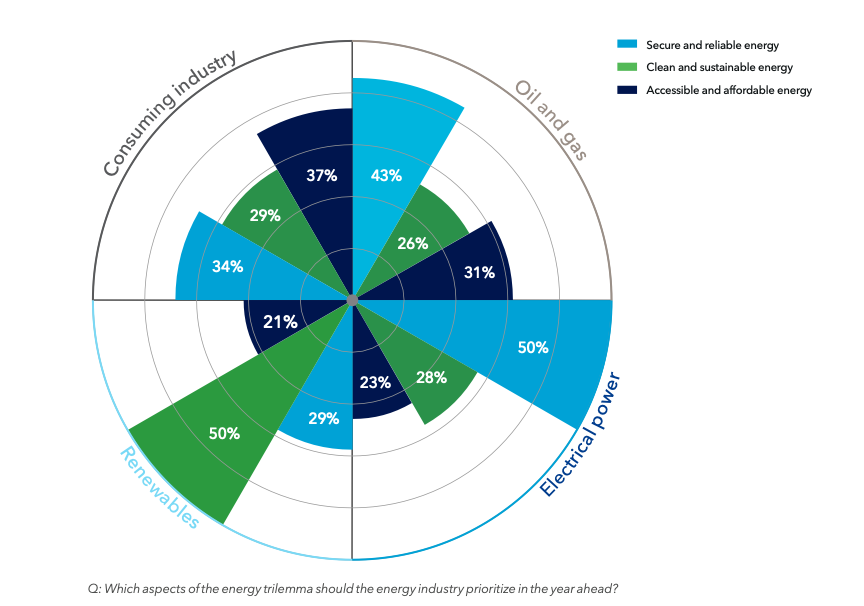

Energy security will take center stage for oil & gas and power sectors in the year ahead, the report said. Renewables players are maintaining their clean energy focus but the priorities of industrial energy consumers are accessible and affordable energy.

Around 39% of energy professionals said they are confident about meeting decarbonization and climate targets. Even so, progress in the energy transition is the greatest driver of confidence among energy professionals for the year ahead, and a majority believe the energy transition is accelerating.

Resolving the energy trilemma – delivering secure, clean, and affordable energy – is viewed by the energy industry as a long-term goal, the report found. Few in the industry (17%) believe the transition will deliver secure, clean, and affordable energy in the next decade, to all parts of the energy system in their country. Many (41%) see this being achieved in 10-20 years, while a smaller percentage (32%) believe this outcome of the energy transition will not be realized until well into the 2040s.

There is general agreement on this outlook across regions, the report said. However, energy professionals in North America are slightly more conservative on the timeline. For the electricity sector, the skills shortage is seen as the number one barrier to growth.

Smart grid and digitalization

The report said that new ideas, technologies and innovations are need to help keep the energy transition in motion. Indeed, 69% of electricity professionals said digitalization is central to their organization’s strategy. Three quarters of the executives surveyed said their organizations will prioritize improving data quality and availability, while 72% also report that advanced use of data is changing the way they work at their organization. “But power industry respondents – and power grid operators in particular – are arguably moving through the most urgent, high impact period of digitalization anywhere in the industry,” the report said.

On the other hand, North American respondents are also the most “digital resistant” according to the report, which says only 44% of respondents across the entire energy sector plan to increase spending on digitalization. This compares to 61% for Europe, 62% for Asia Pacific and 69% for Africa.

The reason for the less than enthusiastic investments in digitalization? Most executives reported that they encounter resistance to change in their organizations.

Supply chain bottlenecks, new transmission needed

“The energy transition has accelerated through both a pandemic and an energy crisis, and this has left markets striving to keep up, across transmission and distribution systems, supply chains, permitting and licensing, financing, infrastructure, and the workforce,” said Ditlev Engel, CEO, Energy Systems at DNV.

“In the year ahead, we may see a slowing in the scale-down of fossil fuels, but potentially also a slowing in the scale-up of clean energy – if barriers aren’t overcome. Governments and policymakers must step up and remove barriers to implementation, and everyone in the energy industry must push forward in the transition.”

DNV’s research finds signs that barriers could slow the pace of the energy transition in the year ahead, but momentum is building to break these barriers as societies increasingly feel the effects of climate and energy crises, and as bottlenecks become more acute in holding back progress.

There is strong agreement in the power sector about an urgent need for greater investment in the grid, while just a fifth in the renewables sector say current transmission capacity planning is sufficient to enable the expansion of renewables.

Three quarters of the energy industry says that supply chain issues are slowing down the transition, while less than half the industry (44%) expects a significant improvement in the availability of goods in 2023.

Oil and gas

A record year of profits for the oil and gas industry has redefined what acceptable profits look like for the sector. In 2022, 52% of oil and gas executives said that their organization would make acceptable profits if the oil price averaged $40 to $50 per barrel. For the year ahead, just 39% feel the same.

Half of respondents from the oil and gas industry (53%) say that their organization will increase investment in gas in 2023, up eight percentage points year-on-year. Some 43% of the oil and gas industry expect to increase investment in oil, up nine percentage points. Oil and gas companies are slowing their shift into areas outside of core hydrocarbons businesses and holding back their focus on decarbonization compared to 2022.

Investments

In 2023, the energy industry as a whole expects to increase investment in clean energy sources and carriers. Half of energy professionals expect their organization to invest in low-carbon hydrogen/ammonia (52%), and similar proportions in wind (49%) and solar (46%). Over a third expect their organization to increase investment in carbon capture and storage. In enabling technologies, six in 10 say their organization is increasing investment in energy efficiency and digitalization, and half the industry is investing in energy storage technologies.