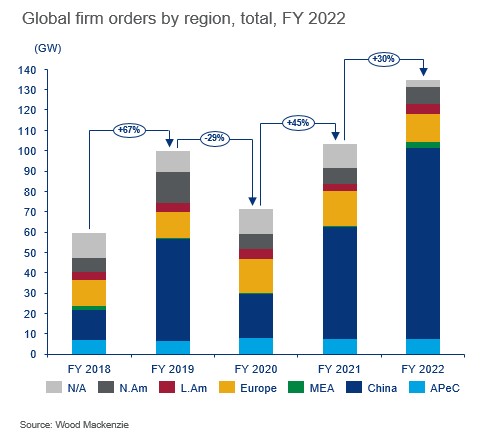

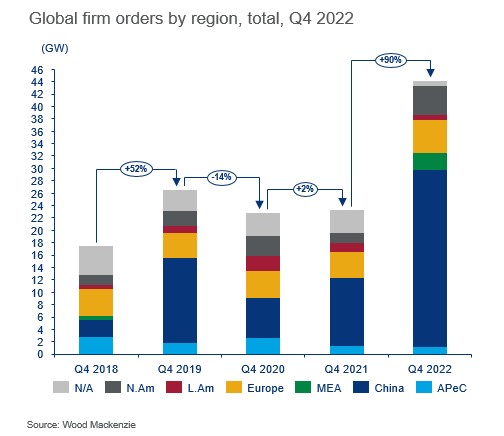

Wind market sees 44 GW in global orders in Q4 2022, 134.6 GW for FY 2022

Global wind turbine order intake hit new highs in 2022, with 44 gigawatts (GW) procured in Q4 and 134.6 GW for the year, both records. Dominated by activity in China, annual investment reached an estimated $74.2 billion, according to new analysis from Wood Mackenzie.

Overall, order intake increased 90% year-over-year (YoY) in Q4 and 30% year-over-year for the fiscal year, with China accounting for 65% of order capacity in Q4 and 70% of all order capacity in 2022. This activity was driven by developers positioning to comply with China’s 14th 5-year plan, which highlights green energy development in the Asian nation.

While China made an outsized impact on global order capacity, order intake outside of China dropped 15% YoY to 41 GW, approximately 9 GW off the four-year average for full-year order capacity from 2018 to 2021.

“We’ve seen incredible activity in China, but its soaring numbers have somewhat masked a slowdown from western OEMs, which have been impacted by supply chain challenges and cost increases. This has negatively impacted both new order intake and installation activity outside of China,” said Luke Lewandowski, Wood Mackenzie Research Director.

North America order intake was relatively flat YoY, up 7%, but the future pipeline looks strong.

“We are already seeing the positive reaction to the Inflation Reduction Act, with H2 orders up 224% over H1 in the US,” said Lewandowski.

Offshore wind hit new records as well in 2022, reaching 19 GW of order intake. However, 80% of the activity was from China.

Chinese OEMs Envision, Mingyang, and Goldwind led the rankings for order intakes in 2022, with more than 17 GW each.